AA can’t remind back the case to adjudicating authority- HC

Table of Contents

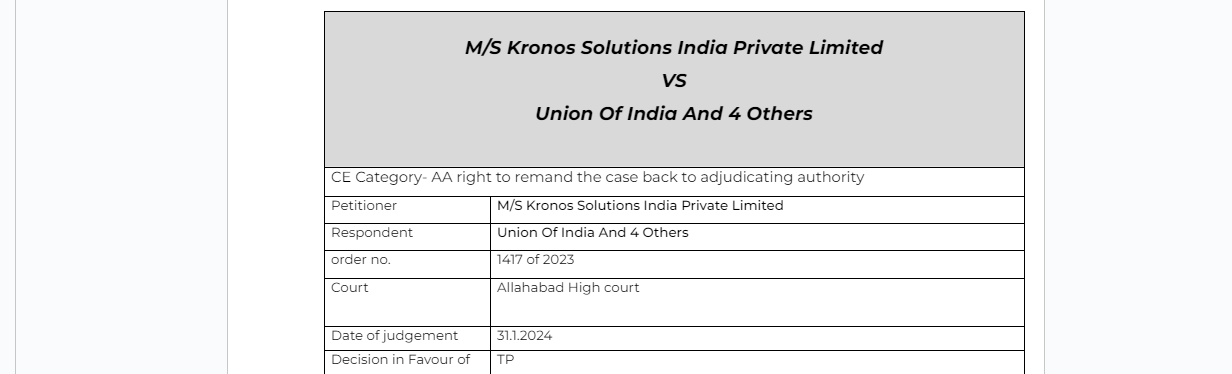

Details of the case

Pleading

The present petition has been filed to assail the order dated 21.2.2023 passed by the Joint Director (CGST) (Appeals), Noida. “The operative portion of the order reads as below:- “10. In view of my above discussion & findings I, hereby partially allow the instant appeal having no.102/GST/APPL-NOIDA/NO1/2020-21 dated 12.01.2021 filed by M/s Kronos Solutions India Private Limited, Floor 4,5 & 6, Plot No.5, Block-B, Tower-4, Okaya Centre, Sector 62, Noida – 201301 and remand back the matter to the original adjudicating authority for de novo adjudication after giving natural justice and chance to be heard to the appellant. The appellant is also directed to use the opportunity as and when called for the hearing.”

Facts

Solitary submission advanced by the learned counsel for the petitioner is, the above order at least operative portion has been passed in defiance to the provisions of Section 107(11) of CGST Act, 2017. For ready reference, that provision of law. On the other hand, learned counsel for the Revenue has raised a preliminary objection as to maintainability of the writ petition. He would submit, the impugned order is appealable under Section 112 of the Act. Therefore, no interference may be made.

Observation

Undeniably, the appeal authority may either confirm or modify or annul the order under appeal. In face of statutory prescription allowing for only three above described options to the appeal authority, no inherent power may remain be exercised by the appeal authority to set aside the order under appeal and remand the proceedings to the original authority. Any doubt in that regard has been clarified by the legislature itself by stating that the appeal authority shall not refer the matter back to the adjudicating authority. 8. Accordingly, no other issue is required to be adjudicated at this stage. Once the appeal authority is seen to have failed to exercise its jurisdiction in accordance with law, such an order may never be sustained. It is accordingly set aside and the matter is remanded to the appeal authority to pass a fresh order after hearing the parties afresh.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.