Duplicate proceedings for same period not allowed

Comment

Duplicate proceedings for same period not allowed The proceedings were already in process. A summon was issued to the taxpayer. Court held that dual proceedings for the same period are not possible. The order was stayed by the court.

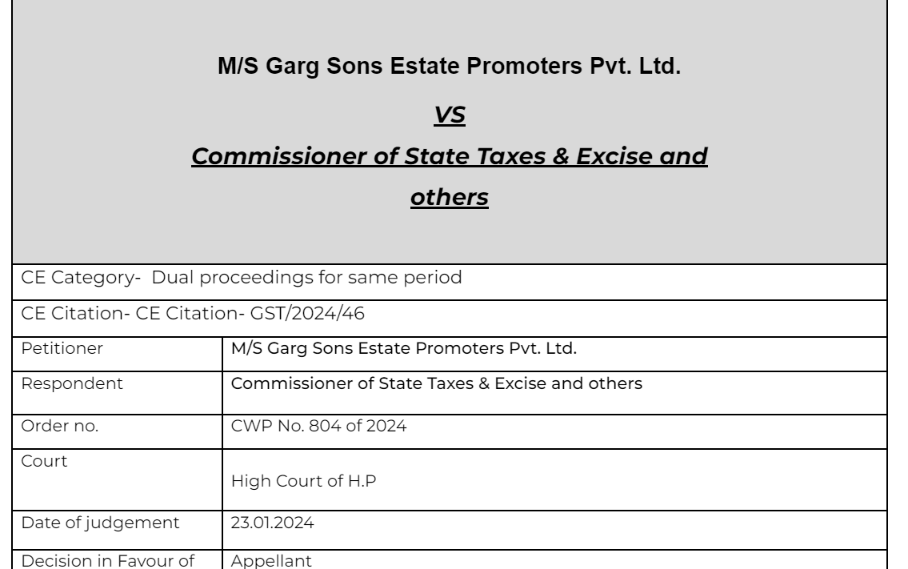

Details of the case

Pleading

To quash the order passed by the authority.

Facts

Vide Annexure P-2 dated 03.07.2021 respondent No.2 had issued summons under Section 70 of the HPGST/CGST Act., 2017. The period in question pertains to 01.01.2021 to 30.06.2021. The proceedings in question pertain to supplies received by the petitioner from one M/S R.J. Trading.

Subsequent thereto vide impugned Annexure P-10, dated 20.05.2023 tax liability of GST (CGST + HGST) under Section 74 (9) of the HPGST/CGST Act, 2017 alongwith interest and penalty was imposed on the present petitioner.

At this juncture, learned counsel for the petitioner has drawn the attention of this Court to Annexure P-3, i.e. summons issued under Section 70 of the Central Goods and Excise Taxation Act., 2017, issued by the Central Authorities on 12.08.2021. The period in question pertains to 01.07.2017 to 30.06.2021

Observation

Based on the documents placed on record, a prima facie case exists in favour of the petitioner. Balance of convenience also lies in favour of the petitioner. Grave irreparable loss, which cannot be compensated in terms of money shall be occasioned to the petitioner, if in case the respondents are not restrained from giving effect to Annexure P-10, i.e. order dated 20.05.2023. In view of the aforesaid, the impugned order dated 20.05.2023, is stayed till further order. The application stands disposed of.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.