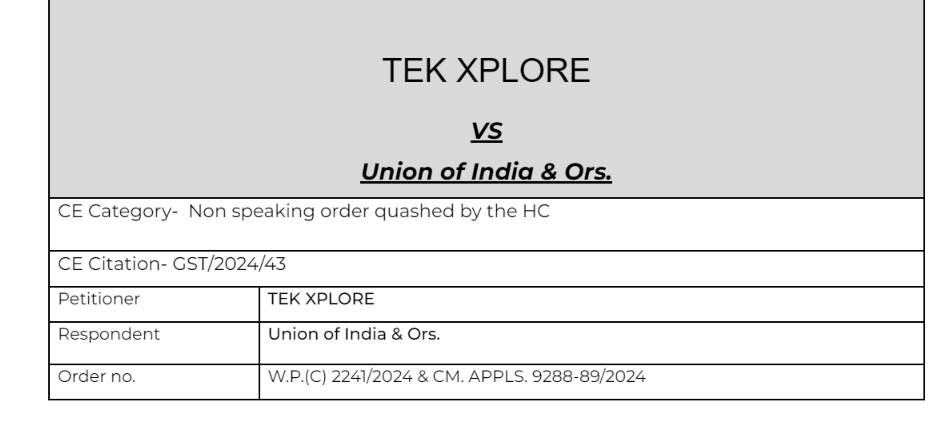

Non speaking GST order quashed by Delhi high court

Table of Contents

Comment

The order was issued before hearing the appellant. The order is cryptic and it is template based and doesn’t mention the reason for the demand raised.

Details of the case

Pleading

1. Petitioner impugns order dated 24.12.2023, whereby Show Cause Notice dated 24.09.2023, has been set aside and demand created against the petitioner.

Facts

He submits that the Show Cause Notice raises a demand under Section 16 (2)(c) and 17 (5) of the Goods and Services Tax Act, 2017. He submits that demand could not have been raised against the petitioner and further that a duplicate demand has been raised under both the provisions. He further submits that that the impugned order is cryptic order merely using a template and does not give any reason. He prays that an opportunity be granted to the petitioner to file a reply to the Show Cause Notice and the Show Cause Notice be adjudicated afresh.

Observation

4. Perusal of the order shows that the order is a cryptic order without giving any details. After narrating the recitals, it merely records ‘in view of above, there is no option but to proceed with the demands mentioned in the Show Cause Notice’. 5. The impugned order is accordingly set aside. Petitioner is given an opportunity to file a reply to the Show Cause Notice within one week from today. On such a reply being filed, the proper officer shall adjudicate the Show Cause Notice afresh within a period of four weeks after giving an opportunity of personal hearing to the petitioner to the petitioner. The proper officer shall pass a detailed speaking order.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.