ITC cant be rejected only because it was not claimed in GSTR 3B-HC

Table of Contents

Comment-

This is one of the controversial judgments in GST. As we all know that many of us are deprived of our valid input tax credit because it was not claimed in GTSR 3b.

This is the normal understanding that it should be claimed in GSTR 3b. But here the TP filed NIL GSTR 3b as his ITC was more than liability every month.

He forgot to claim ITC also. But it was reflected in GSTR- 2A and it was also mentioned in GSTR 9. As we all know GSTR 9 is not the return to claim ITC and it is time barred and hit by section 16(4) if it is not reflected in GSTR 3b by the limitation date. That date varies for different years. Earlier it was September and now it’s November.

In this judgment the order disallowing ITC was quashed and the petitioner was asked to supply the evidence for ITC within two weeks.

Very important for all cases where ITC was missed in GSTR 3b.

Case details-

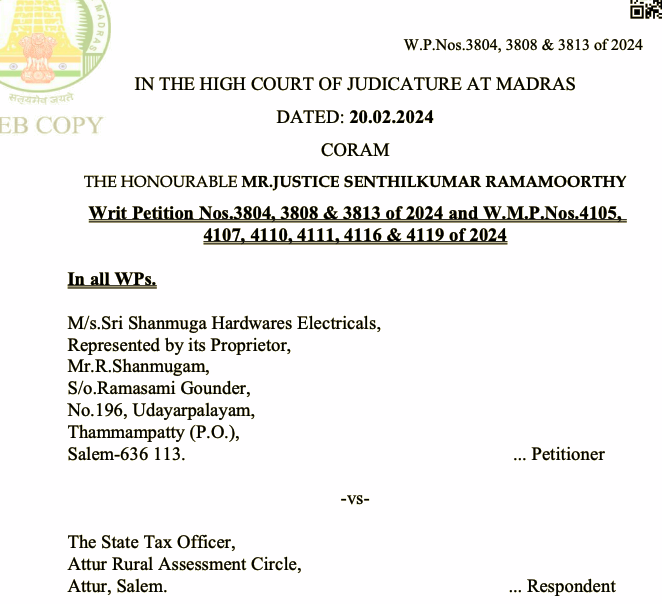

| Petitioner | M/s.Sri Shanmuga Hardwares Electricals, |

| Respondent | The State Tax Officer |

| order no. | Writ Petition Nos.3804, 3808 & 3813 of 2024 and W.M.P.Nos.4105, 4107, 4110, 4111, 4116 & 4119 of 2024 |

| Court | Madras High court |

| Date of judgement | 20th February, 2024 |

| Decision in Favour of | Taxpayer |

Pleading-

To quash the order issued against the TP. The ITC claim was rejected as it was not shown in GSTR 3b

Facts

- Nil returns were erroneously and inadvertently filed in the GSTR-3B returns,

- In each of the above mentioned assessment periods and that this is duly reflected in the GSTR-2A returns

- The ITC claim was rejected solely on the ground that the petitioner had not claimed ITC in the GSTR-3B returns.

- The registered person asserts that he is eligible for ITC by referring to GSTR-2A and GSTR-9 returns

Observation

For reasons set out above, the orders impugned herein are quashed and these matters are remanded for reconsideration

The petitioner is permitted to place all documents pertaining to its ITC claims before the assessing officer within a maximum period of two weeks

Download the copy of judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.