Rectification of return allowed by Bombay high court

In this case rectification was allowed by the court. We have very strong jurisprudence related to the rectification in bona fide cases.

Table of Contents

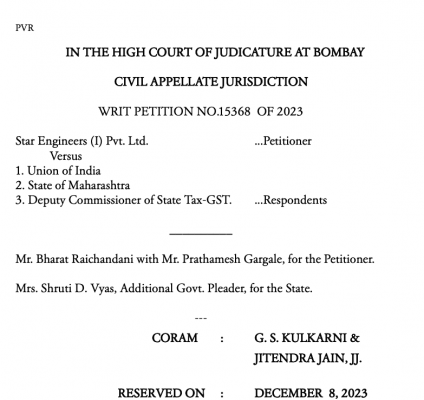

Case Details-

Start Engineers Pvt Ltd

Versus

Union of India

Category – CE Rectification of returns 1

Ranking *****

Facts-

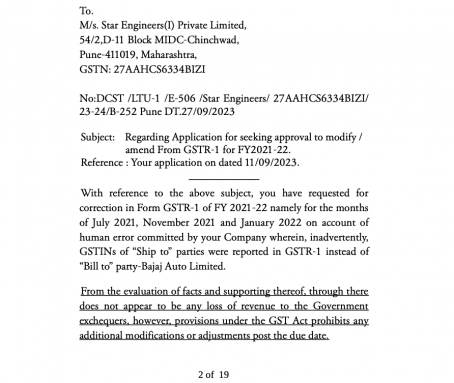

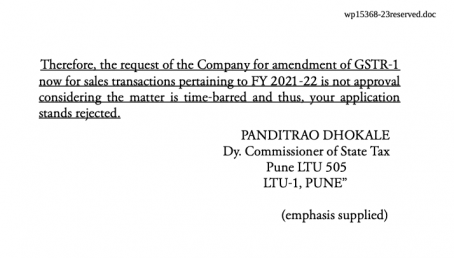

An application of the petitioner for seeking approval to modify / amend FORM GSTR-1 for financial year 2021-2022 dated 11 September 2023, the petitioner has been informed that such a request for amendment of Form GSTR-1 cannot be approved considering that the matter is time barred and accordingly, the petitioner’s application would stand rejected.

The aforesaid request was rejected with a reply given below.

Observation-

The honourable court allowed the rectification. In this case there was no loss of revenue thus the amendment was allowed.

You can read a whole article on other cases where the rectification was allowed by the honourable court.

Read a copy of judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.