landmark judgment on jurisdiction of GST authorities – TVL Vardhan Infrastructure

Table of Contents

Issue in jurisdiction in GST

Since the starting of GST the issue of proceedings by the authorities not assigned the TP is disputed. In many cases the courts are observing the relevant facts. In GST the cross empowerment is allowed but the same is not supported by any notification by CBIC.

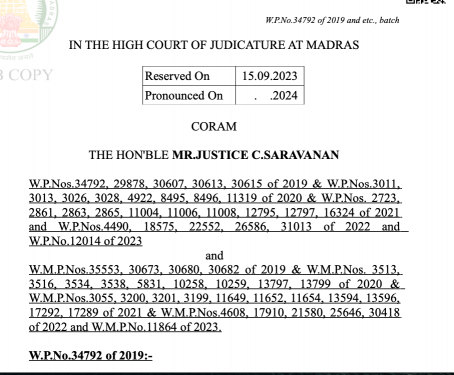

Multiple writ petitions were clutched here in this judgment. You can read its copy below.

many questions have been sparked by this judgment.

You can watch this video for detailed discussion.

Also read 7 judgments on cross empowerment and jurisdiction of taxpayer

In a recent development the honourable high court of Madras has given a landmark judgment. The jurisdiction of various GST authorities for doing the proceedings against a taxpayer is a disputed issue.

There are various orders staying the SCN’s issued against the taxpayers. But now a detailed judgment is pronounced by the high court of Madras. In this judgment the proceedings initiated by the authority to whom the Taxpayer was assigned are set aside.

The court has said that GST law has given the right for cross empowerment but as there is no notification in this regard issued by the CBIC. The proceedings by other authority is not valid.

This is the case of Tvl Vardhan Infrastructre, Vs. The Special Secretary, Head of the GST Council Secretariat,

Observation of court-

1- “The manner in which the provisions have been designed are to ensure that there is no cross interference by the counterparts. Only exception provided is under Section 6 of the respective GST enactement. Therefore, in absence of a notification for cross-empowerment, the action taken by the respondents are without jurisdiction. Officers under the State or Central Tax Administration as the case may be cannot usurp the power of investigation or adjudication of an assesse who is not assigned to them.”

2- “Therefore, the proceedings initiated by the respondents so far against the respective petitioners by the Authorities other than the Authority to whom they have been assigned to are to be held as without jurisdiction. Therefore, the impugned proceedings warrants interference.”

3- Same power ought to have been exercised by the respective counterparts of the respondents, namely the Central Authority/State Authority as the case may be, to whom the respective petitioners have been assigned, proceedings should be initiated against each of the petitioners by the Authority to whom they have been assigned for the purported loss of Revenue under the respective GST Enactments.

4- The time between the initiation of the proceedings impugned in these writ petitions and time during the pendency of the present writ petitions till the date of receipt of this order shall stand excluded for the purpose of computation of limitation.

Read/download the copy of judgment here – Tvl Vardhan infrastructure

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.