16 FAQ’s on 43B(h) applicable from 1.04.2024

Q-1 What is 43B(h)

Ans- 43B(h) refers to a section of the Indian Income Tax Act, introduced in the Finance Act of 2023. It aims to ensure timely payments to Micro and Small Enterprises (MSMEs).

In this provision the delayed payment will be disallowed as expenditure in income tax. It means you will have to pay the tax on that amount. Also an interest of three times of interest rate is also payable.

Q-2 When it is applicable?

- Effective Date: April 1, 2024 (assessment year 2024-2025 and subsequent years). But for this assessment year the previous year will start from 1st April 2023 to 31st March 2024. Thus the transactions done in that period are also covered by this provision.

- Impact: This means the rule regarding timely payments to Micro and small enterprises. The disallowance of tax deductions for delayed payments applies to transactions happening from April 1, 2023 onwards.

Q-3 On which buyers it is applicable?

Section 43B(h) is applicable to any buyer who purchases goods or services from a registered MSME (Micro and Small ) under the MSMED Act, 2006.

There’s no requirement for the buyer to be registered under the MSMED Act. The focus is on ensuring timely payments to MSMEs, regardless of the buyer’s size or registration status.

Here’s a breakdown of who this applies to:

- Large companies: They are bound by this section if they purchase from MSME vendors. Delaying payments beyond the stipulated timeframe can lead to disallowance of tax deductions for those expenses.

- Medium and small businesses: Even if they are not classified as MSMEs themselves, they are still subject to this rule if they buy from medium and small suppliers. Late payments could result in tax implications.

- Individuals: If an individual makes a significant purchase from an MSME and the payment terms exceed the allowed timeframe, they might not be able to claim tax deductions on that expense.

- Partnerships- These are also covered.

e.g. An individual doing a normal business will also fall in it. Even though he is not liable for any GST registration or TDS deduction. But here he will also be covered.

Q-4 On which class of sellers it is applicable?

Section 43B(h) is specifically applicable to sellers registered as Micro and Small (MSMEs) under the MSMED Act, 2006.

Here’s why it only applies to MSMEs:

- The core objective of this section is to support MSMEs by ensuring timely payments and improving their cash flow.

- MSMEs are often more vulnerable to financial strain due to late payments compared to larger businesses.

- The MSMED Act defines specific criteria for classifying businesses as micro, small, and medium based on investment in plant & machinery and turnover.

It’s important to note that this section doesn’t offer any specific benefits to sellers who are not registered MSMEs. However, it can still indirectly benefit them by encouraging a more prompt payment culture in general.

But it is not applicable of traders as they were initially not covered in it. They were included for the limited benefits.

Here are some additional points to consider:

- Retail and Wholesale Trade MSMEs: There might be some specific exclusions within the MSME category. For instance, some sources suggest retail and wholesale trade MSMEs might be excluded from Section 43B(h)’s benefits. It’s advisable to consult a tax professional for the latest updates on such specific exclusions.

- Udyam Registration: An MSME should be registered on the Udyam portal to be considered for the benefits under Section 43B(h).

Overall, Section 43B(h) is a significant step towards ensuring timely payments for MSMEs, promoting a healthier financial ecosystem for these businesses.

Q-5 What are the exceptions of it?

There are a few exceptions to Section 43B(h) where a buyer might not face disallowance of tax deductions for delayed payments to MSMEs:

-

Written Agreement: If there’s a written agreement between the buyer and the MSME seller that specifies a payment timeline of up to 45 days after the invoice date, the deduction can still be claimed in the year of accrual (the year the expense is incurred) even if the payment is made later. However, the agreement needs to be a valid document outlining the payment terms clearly.

-

Presumptive Taxation Scheme: Businesses opting for the presumptive taxation scheme under sections 44AD, 44ADA, or 44AE of the Income Tax Act are not subject to Section 43B(h). Their tax liability is calculated based on a predetermined percentage of their estimated income, regardless of actual expenses or payment timelines.

-

Capital Expenditure: Payments related to capital expenditure incurred on assets (land, machinery, etc.) from an MSME are not covered by Section 43B(h). These are treated differently for tax purposes.

- Charitable trusts- In the case of charitable trust there is an exemption.

Here are some additional points to consider:

- Retail and Wholesale Trade MSMEs: As mentioned earlier, there might be some ambiguity regarding the applicability of Section 43B(h) to retail and wholesale trade MSMEs. It’s best to consult a tax advisor for clarification on the latest stance.

- Udyam Registration: The MSME seller should be registered on the Udyam portal for the buyer to claim the deduction benefits under Section 43B(h).

It’s always advisable to consult a tax professional for specific guidance related to your situation and ensure adherence to the latest regulations. Send your queries at info@consultease.com

Q-6 What will be its impact on Buyer?

Section 43B(h) can have a two-sided impact on buyers, depending on their current payment practices:

Positive Impacts:

-

Improved Payment Discipline: This section incentivizes buyers to adopt a more disciplined approach to payments, ensuring timely settlements with MSME vendors. This can foster stronger relationships with suppliers and potentially lead to better pricing or terms in the future.

-

Reduced Disputes and Late Payment Penalties: By adhering to the stipulated timelines, buyers can avoid potential disputes with MSMEs over delayed payments. Additionally, they can steer clear of any late payment penalties that might be levied by the MSMEs themselves.

-

Transparency and Compliance: Section 43B(h) encourages transparency in financial dealings. Buyers are motivated to maintain clear records of purchases and payments made to MSME vendors.

Negative Impacts:

-

Increased Working Capital Requirement: For buyers who traditionally had longer payment cycles with MSME vendors, Section 43B(h) might necessitate adjustments to their cash flow management. They might need to arrange for additional working capital to ensure timely payments within the stipulated timeframe.

-

Potential Price Negotiations: MSMEs, aware of the tax implications for buyers delaying payments, might become more assertive in negotiating shorter payment terms or higher prices to compensate for potential delays.

-

Administrative Burden: Buyers, especially those dealing with a large number of MSME vendors, might need to implement new processes or systems to track invoices, due dates, and ensure adherence to the payment timelines.

Overall Impact:

In the long run, Section 43B(h) is expected to have a positive impact on the overall business ecosystem. It promotes a more responsible payment culture, benefits MSMEs by improving their cash flow, and fosters stronger relationships between buyers and sellers.

Here are some additional factors to consider:

- Buyer Size and Industry: The impact might vary depending on the buyer’s size and industry. Large companies with established cash flow management might adapt more easily compared to smaller businesses.

- Existing Payment Practices: Buyers with a history of prompt payments might not face significant challenges. However, those with traditionally longer payment cycles might need to make adjustments.

It’s important for buyers to carefully assess their current payment practices and implement necessary changes to comply with Section 43B(h). Consulting with a financial advisor can be helpful in navigating the potential impact and devising strategies for smooth adaptation.

Q-7 What will be its impact on seller?

Here’s a breakdown of the impact of Section 43B(h) on sellers, specifically MSMEs (Micro, Small and Medium Enterprises):

Positive Impacts:

-

Improved Cash Flow: This is the most significant benefit. Section 43B(h) disincentivizes buyers from delaying payments to MSMEs. This ensures a more predictable and timely inflow of funds, which is crucial for MSMEs to manage their working capital effectively.

-

Stronger Bargaining Power: With the tax implications at stake for buyers who delay payments, MSMEs gain leverage when negotiating payment terms with their customers. They can push for shorter payment cycles and potentially secure more favorable terms in contracts.

-

Reduced Disputes and Bad Debts: Timely payments minimize the chances of disputes arising from delayed invoices. This also reduces the risk of bad debts for MSMEs, where they might struggle to recover payments from buyers.

-

Increased Transparency: This section encourages more transparent financial practices. Buyers are motivated to maintain clear records and make timely payments, leading to better communication and a more trusting business relationship between buyer and seller (MSME).

Potential Challenges:

-

Scrutiny of MSME Registration: Buyers might become more diligent in verifying if sellers are legitimately registered MSMEs under the MSMED Act. This could involve requesting registration documents or checking the Udyam portal. While not necessarily a negative aspect, MSMEs need to ensure their registration is up-to-date.

-

Focus on Shorter Payment Cycles: Buyers might prioritize working with MSMEs who offer shorter payment cycles to comply with Section 43B(h) more easily. MSMEs that traditionally offered longer credit terms might need to adapt their approach.

Overall Impact:

Section 43B(h) is a positive development for MSMEs. It empowers them to receive timely payments, improves their financial health, and strengthens their position in the marketplace. However, some MSMEs might need to adjust their credit terms or ensure proper registration to fully benefit from this provision.

Here are some additional points to consider:

- Industry and Customer Base: The impact might vary depending on the MSME’s industry and customer base. MSMEs dealing with large corporations might see a more significant improvement in payment cycles compared to those working with smaller businesses.

- Adaptability and Communication: MSMEs that can adapt their credit terms strategically and communicate effectively with their customers can leverage Section 43B(h) to their advantage.

By understanding the potential impact and implementing necessary adjustments, MSMEs can position themselves to benefit significantly from this regulation.

Q-8 When the payment is required to be made under 43B(h)?

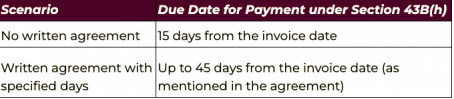

According to Section 43B(h) of the Income Tax Act, the payment to an MSME vendor is required to be made within the following timeframe:

-

Standard Due Date: 15 days from the date of the invoice issued by the MSME.

-

Extended Due Date with Written Agreement: If there’s a valid written agreement between the buyer and the MSME seller, the payment can be made within up to 45 days from the invoice date. The specific number of days within this limit will be mentioned in the written agreement.

In essence,

Example:

Let’s consider an invoice issued by an MSME on March 15, 2024.

- Standard Due Date (without written agreement): March 30, 2024 (15 days from invoice date)

- Due Date with Written Agreement (30 days): April 14, 2024 (30 days from invoice date, as specified in the agreement)

Important to Note:

- The buyer can still claim the deduction for the expense in the year of accrual (the year the invoice is raised) even if the payment is made later, as long as it’s made before filing the income tax return for that relevant year. However, this might not be ideal from a cash flow perspective.

- For the buyer to claim the deduction benefits under Section 43B(h), the MSME seller should be registered on the Udyam portal.

It’s always advisable to consult a tax professional for specific guidance related to your situation and ensure adherence to the latest regulations.

Q-9 When expanse will be allowed in future?

The expanse will be available when the payment is actually made.

Q-10 Is it applicable on foreign companies also?

Section 43B(h) of the Income Tax Act is primarily applicable to domestic buyers in India who make purchases from registered MSMEs (Micro, Small and Medium Enterprises) under the MSMED Act, 2006.

There’s no clear mention of its direct application to foreign companies operating in India. However, here’s a breakdown of possibilities:

-

Foreign Subsidiary in India: If a foreign company has a subsidiary registered and operating in India, that subsidiary would likely be subject to Section 43B(h) when making purchases from MSMEs. The subsidiary would be considered a domestic buyer within the Indian tax framework.

-

Foreign Company with Branch Office: Foreign companies with a branch office in India might also be subject to Section 43B(h) for transactions with MSMEs. The branch office could be seen as a permanent establishment in India, bringing its purchases under the purview of Indian tax regulations.

For a more definitive answer regarding a specific foreign company’s situation, it’s crucial to consult a tax professional with expertise in foreign company taxation in India. They can analyze the company’s specific structure, operations, and tax residency status to determine the applicability of Section 43B(h).

Here are some additional factors to consider:

-

Double Taxation Avoidance Agreements (DTAAs): India has DTAAs with many countries. These agreements might influence how foreign company transactions with MSMEs are treated for tax purposes. A tax professional can examine the relevant DTAA to determine any potential exemptions or modifications.

-

Permanent Establishment (PE): The concept of PE plays a crucial role in determining tax liability for foreign companies in India. If a foreign company’s operations in India constitute a PE, it might be subject to Section 43B(h) for transactions with MSMEs. Understanding the PE definition and its implications is essential.

Overall:

While there’s no blanket application of Section 43B(h) to all foreign companies, the structure and operations of a foreign company in India can influence its applicability. Consulting a tax professional specializing in foreign company taxation in India is highly recommended to obtain a clear understanding of the rules and potential implications for your specific situation.

Q-11 Is it applicable on Service providers?

Yes, Section 43B(h) of the Income Tax Act is applicable to service providers if they are registered MSMEs (Micro, Small and Medium Enterprises) under the MSMED Act, 2006.

The provision focuses on ensuring timely payments to MSMEs, regardless of whether they are providing goods or services.

Here’s a breakdown:

-

Focus on MSME Status: The key factor is the seller’s registration as an MSME. If a service provider is duly registered under the MSMED Act, they are entitled to the benefits of Section 43B(h), which incentivizes buyers to make timely payments.

-

Broad Definition of Services: The MSMED Act doesn’t exclude professional services from the definition of a business that can qualify as an MSME. This means service providers like CA firms, consultants, marketing agencies, etc., can be registered MSMEs.

Here are some additional points to consider:

-

Previous Ambiguity: There might have been some confusion in the past regarding the applicability of Section 43B(h) to specific service sectors like retail and wholesale trade. However, clarifications suggest that registered MSME service providers in these sectors can also benefit from the provision.

-

Udyam Registration: For an MSME service provider to claim the benefits of Section 43B(h), they should be registered on the Udyam portal.

Overall:

Section 43B(h) plays a significant role in promoting timely payments for service providers who are registered MSMEs. This fosters a more supportive environment for these businesses and helps them improve their cash flow.

Q-12 Is it applicable on traders?

The applicability of Section 43B(h) to traders, specifically retail and wholesale traders, is a bit complex and there have been some conflicting interpretations. Here’s a breakdown of the current understanding:

General Applicability:

In principle, Section 43B(h) applies to any buyer making purchases from a registered MSME (Micro, Small and Medium Enterprise) under the MSMED Act, 2006. This would suggest that it should be applicable to traders as well, if they are buying from MSME vendors.

Exclusion for Retail and Wholesale Traders:

However, there have been clarifications issued by the Indian government that exclude retail and wholesale traders registered under the MSMED Act from some of the benefits associated with the MSME category. This exclusion might extend to Section 43B(h) as well.

Source of Exclusion:

-

Office Memorandum (July 2021): An Office Memorandum issued by the government in July 2021 allowed retail and wholesale traders to register on the Udyam portal, but with limitations. It specified that benefits like priority sector lending would be restricted for these traders.

-

Focus of MSMED Act: The MSMED Act primarily focuses on promoting the growth and development of manufacturing and service-based MSMEs. Retail and wholesale trade activities might not be considered a priority under this objective.

Current Understanding:

Based on the above information, it’s likely that retail and wholesale traders registered as MSMEs wouldn’t be covered by Section 43B(h). This means that a buyer delaying payment to such a trader wouldn’t face the risk of disallowance of tax deductions.

Recommendation:

For a definitive answer regarding the applicability of Section 43B(h) to your specific situation involving a trader (even if registered as an MSME), it’s highly advisable to consult a tax professional. They can access the latest government clarifications and provide the most accurate guidance based on the nature of your business and the type of trader you’re dealing with.

Here are some additional points to consider:

- The government’s stance on this issue might evolve over time. Staying updated with official notifications is crucial.

- Even if Section 43B(h) doesn’t apply, there might be other tax implications for delayed payments. A tax professional can advise on these aspects as well.

By seeking professional advice, you can ensure compliance with the latest regulations and avoid any potential complications with tax authorities.

Q-13 In case the MSME is not registered , Will it be applicable?

No, Section 43B(h) will not be applicable if the seller (MSME) is not registered under the MSMED Act, 2006. This provision is specifically designed to incentivize timely payments to registered MSMEs.

Here’s why registration is crucial:

-

Objective of 43B(h): The primary aim of Section 43B(h) is to support the growth and financial well-being of MSMEs. By ensuring timely payments, it helps them manage cash flow effectively. This benefit is only extended to registered MSMEs as they are recognized and categorized under the MSMED Act.

-

Focus on Recognition: The MSME registration process verifies the legitimacy and qualifies the business as a micro, small, or medium enterprise. This recognition is essential for claiming the benefits associated with Section 43B(h).

Impact on unregistered sellers:

If an MSME seller is not registered under the MSMED Act, they wouldn’t be entitled to the benefits of Section 43B(h) in case of delayed payments from a buyer. This means:

-

No leverage for timely payments: The buyer wouldn’t face the risk of disallowance of tax deductions for delayed payments to the unregistered seller.

-

Potential disputes: Unregistered sellers might have to rely on other means, like contractual agreements with specific payment terms, to ensure timely settlements from buyers.

Benefits of registration:

Even if Section 43B(h) might not be directly applicable in this scenario, there are several advantages to MSME registration:

-

Access to government schemes: Registered MSMEs can avail various government benefits like subsidies, loans at concessional rates, and participation in preferential procurement programs.

-

Enhanced credibility: Registration lends legitimacy and credibility to the business, potentially attracting new customers and investors.

Q-14 If the MSME don’t deposit the cheque, Will it be applicable?

The applicability of Section 43B(h) doesn’t depend on whether the MSME deposits the cheque or not. Here’s why:

-

Focus on Payment: This section focuses on ensuring timely payments are made by the buyer to the MSME vendor. As long as the buyer issues the cheque within the stipulated timeframe (15 days or as per written agreement), they have fulfilled their obligation under Section 43B(h).

-

MSME’s Responsibility: The responsibility of depositing the cheque lies with the MSME seller. Any delays or issues with encashing the cheque wouldn’t affect the buyer’s compliance with Section 43B(h).

However, there are some practical considerations:

-

Late encashment by MSME: A significantly delayed encashment by the MSME could raise questions about the legitimacy of the transaction. This might be relevant in case of audits or disputes.

-

Stoppage of payment by MSME: If the MSME deliberately stops payment on the cheque after receiving it, it could be interpreted as an attempt to manipulate the system and claim benefits under Section 43B(h) even if the actual payment wasn’t received.

Recommendation:

For both buyers and MSMEs, it’s advisable to maintain clear records of transactions, including cheque issuance dates and encashment confirmations. This can help avoid any misunderstandings or complications in the future.

Here are some additional points to consider:

-

Digital Payments: While cheques are still used, digital payments are becoming increasingly common. Section 43B(h) would still be applicable as long as the buyer can demonstrate the timely transfer of funds through electronic means.

-

Dispute Resolution: If a dispute arises regarding the payment or encashment of the cheque, both parties might need to involve legal or tax professionals to resolve the issue.

By following best practices and maintaining transparent communication, both buyers and MSMEs can ensure smooth compliance with Section 43B(h).

Q-15 Is it applicable for proprietor also?

- Section 43B(h) applies to business transactions. Since a proprietorship is a form of business ownership, purchases made for the business would be considered within the scope of this section.

Q-16 What is benefit of it for MSME?

There are several benefits of Section 43B(h) for MSMEs (Micro, Small and Medium Enterprises):

-

Improved Cash Flow: This is the most significant benefit. Timely payments from larger companies ensure a smoother cash flow for MSMEs. This helps them avoid financial strain, meet operational costs, and invest in growth opportunities.

-

Stronger Bargaining Power: With the tax benefit at stake for larger companies delaying payments, MSMEs gain an edge when negotiating payment terms with their buyers. They can push for shorter payment cycles and fairer terms in contracts.

-

Reduced Disputes: Delayed payments are a major cause of disputes between MSMEs and large companies. Section 43B(h) incentivizes timely settlements, minimizing the chances of disagreements and the need for legal recourse.

-

Increased Transparency: This provision encourages more transparent financial practices in business dealings. Both MSMEs and larger companies are motivated to adhere to clear payment timelines.

-

Supportive Ecosystem: By ensuring timely payments to MSMEs, this section fosters a more supportive ecosystem for these businesses. This can lead to increased investment, growth, and job creation within the MSME sector.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.