Analysis of 16 CBIC circulars providing the biggest relief to the taxpayer

Table of Contents

- 1. Analysis of Circular no. 01 dated 27 June 2024 –

- Analysis of Circular no. 02 Dated 27 June 2024

- Analysis of Circular no. 03 dated 27 June 2024-

- Analysis of Circular no. 04 Dated 27 June 2024 –

- Analysis of Circular no. 05 Dated 27 June 2024 –

- Analysis of Circular no. 06 Dated 27 June 2024 –

- Analysis of Circular no. 07 Dated 27 June 2024 –

- Analysis of Circular no. 08 Dated –

- Analysis of Circular no. 09 Dated 27 June 2024 –

- Analysis of Circular no. 10 Dated 27 June 2024 –

- Analysis of Circular no.11 Dated 27 June 2024 –

- Analysis of Circular no.12 Dated 27 June 2024 –

- Analysis of Circular no.13 Dated 27 June 2024 –

- Analysis of Circular no.14 Dated 27 June 2024 –

- Analysis of Circular no.15 Dated 27 June 2024 –

- Analysis of Circular no.16 Dated 27 June 2024 –

1. Analysis of Circular no. 01 dated 27 June 2024 –

Reduction of Government Litigation – fixing monetary limits for filing appeals or applications by the Department before GSTAT, High Courts and Supreme Court

The Circular No. 207/1/2024, issued by the Ministry of Finance on June 26, 2024, focuses on reducing government litigation by setting monetary thresholds for filing appeals or applications in tax disputes under the Central Goods and Services Tax (CGST) Act. The monetary limits are:

GST Appellate Tribunal (GSTAT): ₹20,00,000

High Court: ₹1,00,00,000

Supreme Court: ₹2,00,00,000

These limits aim to prevent appeals in cases with amounts below these thresholds, promoting judicial efficiency. Exceptions include cases involving constitutional validity or significant recurring issues. The circular emphasizes prudent litigation and clarity for taxpayers, while still allowing appeals in important matters regardless of the monetary limits.

Download Original PDF-

Analysis of Circular no. 02 Dated 27 June 2024

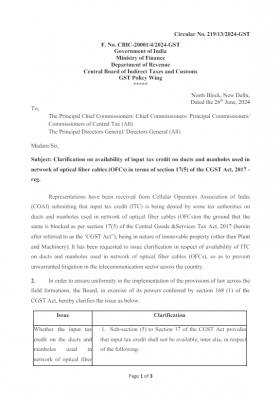

Clarifications on various issues pertaining to special procedure for the manufacturers of the specified commodities

Summary of Circular No. 208/2/2024-GST

Clarifications on Special Procedure for Manufacturers

Background:

Special procedures for certain manufacturers notified via Notification No. 04/2024-CT dated 05.01.2024.

Issues and Clarifications:

Implementation:

Suitable trade notices to be issued.

Any difficulties in implementation should be reported to the Board.

Download Original PDF-

Analysis of Circular no. 03 dated 27 June 2024-

Clarification on the provisions of clause (ca) of Section 10(1) of the Integrated Goods and Service Tax Act, 2017 relating to place of supply

Key Points:

Nature: Clarification (Retrospective application).

Issue Addressed: Place of supply for goods sold to unregistered persons, particularly via e-commerce, where billing and delivery addresses differ.

Key Clarification:

For supplies to unregistered persons, the place of supply is the delivery address on the invoice.

If the billing and delivery addresses differ, the delivery address is used for determining the place of supply.

Suppliers can record the delivery address as the recipient’s address for accurate place of supply determination.

Example:

If Mr. A (unregistered) from State X orders a mobile phone to be delivered to State Y, the place of supply is State Y (delivery address).

Action Required:

Trade notices should be issued to publicize this clarification.

Any difficulties in implementation should be reported to the Board

Download Original PDF –

Analysis of Circular no. 04 Dated 27 June 2024 –

Clarification on valuation of supply of import of services by a related person where recipient is eligible to full input tax credit.

Subject: Clarification on valuation of supply of import of services by a related person where the recipient is eligible for full input tax credit (ITC).

Key Points:

Nature: Clarification regarding valuation (Retrospective application).

Issue Addressed: Valuation of services imported from related persons outside India when the recipient in India is eligible for full ITC.

Key Clarifications:

Provision: As per Rule 28(1) of CGST Rules, for supplies between related persons, the value declared in the invoice is deemed as the open market value if the recipient is eligible for full ITC.

Taxability: Services provided by foreign affiliates to domestic entities should be valued at the declared invoice value. If no invoice is issued, the value is deemed as Nil and considered as open market value.

Reverse Charge Mechanism: Registered persons in India must pay tax on a reverse charge basis for such imports and issue self-invoices.

Action Required: Issue suitable trade notices to publicize the contents. Report any implementation difficulties to the Board.

Download Original PDF –

Analysis of Circular no. 05 Dated 27 June 2024 –

Clarification on time limit under Section 16(4) of CGST Act, 2017 in respect of RCM supplies received from unregistered persons.

Subject: Clarification on the time limit under Section 16(4) of the CGST Act, 2017, for RCM supplies received from unregistered persons.

Clarification Nature: Retrospective application.

Core Issue: Determining the relevant financial year for availing ITC for RCM supplies from unregistered persons.

Key Clarification:

The financial year for ITC is when the recipient issues the invoice under RCM, not when the supply was received.

Tax must be paid by the recipient on a reverse charge basis.

Legal Basis:

Section 16(2)(a) of CGST Act: ITC requires a tax invoice.

Section 31(3)(f) of CGST Act: Recipients must issue invoices for unregistered supplies.

Implications:

Delayed issuance leads to interest and potential penalties.

Download Original PDF –

Analysis of Circular no. 06 Dated 27 June 2024 –

Clarification on mechanism for providing evidence of compliance of conditions of Section 15(3)(b)(ii) of the CGST Act, 2017 by the suppliers

Subject: Mechanism for providing evidence of compliance with Section 15(3)(b)(ii) of the CGST Act, 2017, by suppliers.

Key Points:

Nature: Retrospective application.

Core Issue: Verifying reversal of ITC for discounts offered through tax credit notes after the supply has been effected.

Clarifications:

Section 15(3)(b)(ii): Discounts post-supply are excluded from taxable value if ITC is reversed by the recipient.

Verification Mechanism: Suppliers to obtain a certificate from the recipient’s CA/CMA certifying ITC reversal.

Details in Certificate: Credit notes, invoice numbers, ITC reversal amount, and relevant GST documents.

Small Amounts: For tax amounts ≤ ₹5,00,000 per financial year, an undertaking from the recipient is sufficient.

Use of Certificates: Treated as admissible evidence during scrutiny, audit, or investigations.

Action Required: Issue trade notices to publicize the contents and report any implementation difficulties to the Board.

Download Original PDF –

Analysis of Circular no. 07 Dated 27 June 2024 –

Seeking clarity on taxability of re-imbursement of securities/shares as SOP/ESPP/RSU provided by a company to its employees.

Subject: Clarification on the taxability of ESOP/ESPP/RSU provided by a company to its employees through its overseas holding company.

Key Points:

Nature: Retrospective clarification.

Core Issue: Taxability of Employee Stock Options (ESOP), Employee Stock Purchase Plans (ESPP), and Restricted Stock Units (RSU) provided by foreign holding companies to employees of Indian subsidiaries.

Key Clarifications:

Securities/shares provided under ESOP/ESPP/RSU are considered neither goods nor services and are thus not liable to GST.

Reimbursement of the cost of such securities/shares by the Indian subsidiary to the foreign holding company is not considered an import of services and is not liable to GST.

If the foreign holding company charges any additional fee, markup, or commission, it is treated as consideration for the supply of services, and GST is leviable on this amount on a reverse charge basis.

Action Required: Issue trade notices to publicize the contents of this circular and report any implementation difficulties to the Board.

Download Original PDF –

Analysis of Circular no. 08 Dated –

Clarification on the requirement of reversal of input tax credit in respect of the portion of the premium for life insurance policies which is not included in taxable value

Subject: Clarification on Reversal of Input Tax Credit for Life Insurance Premiums

Key Points:

Nature: Retrospective application.

Core Issue: Whether insurance premiums not included in taxable value as per Rule 32(4) of CGST Rules are considered exempt/non-taxable supplies requiring ITC reversal.

Clarification:

Life insurance policies with investment components still fall under taxable life insurance business.

The portion of premium not included in taxable value is neither nil rated, wholly exempt, nor non-taxable.

No requirement to reverse ITC for premiums not included in taxable value under Rule 32(4).

Action Required: Issue trade notices to publicize contents and report any implementation difficulties to the Board.

Download Original PDF –

Analysis of Circular no. 09 Dated 27 June 2024 –

Clarification on taxability of wreck and salvage values in motor insurance claims.

Subject: Taxability of salvage/wreck value in motor vehicle insurance claims.

Key Points:

Clarification Nature: Retrospective application.

Issue Addressed: GST liability on salvage/wreck value in motor vehicle insurance claims.

Clarifications:

Total Loss/Constructive Total Loss:

If the insurance claim is settled by deducting the salvage value, the salvage remains the property of the insured, and no GST is payable by the insurance company.

If the claim is settled on the full Insured Declared Value (IDV) without deducting salvage value, the salvage becomes the property of the insurance company, and GST is payable on its disposal.

Partial Loss Situation: The same principles apply regarding the ownership and GST liability of the salvage value.

Action Required: Suitable trade notices should be issued to publicize the contents and report any implementation difficulties to the Board.

Download Original PDF –

Analysis of Circular no. 10 Dated 27 June 2024 –

Clarification in respect of GST liability and input tax credit (ITC) availability in cases involving Warranty/ Extended Warranty, in furtherance to Circular No. 195/07/2023-GST dated 17.07.2023

Subject: Clarification on GST liability and ITC availability for warranty and extended warranty cases.

Key Points:

Nature: Retrospective clarification.

Issue Addressed: GST liability and ITC reversal for warranty/extended warranty replacements.

Clarifications:

Replacement of Goods/Parts under Warranty: Applies to both parts and whole goods replaced under warranty.

Distributor Replacements: If distributors replace goods/parts from their stock and are replenished by the manufacturer without additional cost, no GST is payable on the replenishment, and no ITC reversal is required.

Extended Warranty:

At the Time of Original Supply: If provided by a different supplier, it’s treated as a separate supply and taxed as services.

After Original Supply: Always treated as a separate supply of services.

Action Required: Issue trade notices to publicize the contents and report any implementation difficulties to the Board.

Download Original PDF –

Analysis of Circular no.11 Dated 27 June 2024 –

Entitlement of ITC by the insurance companies on the expenses incurred for repair of motor vehicles in case of reimbursement mode of insurance claim settlement.

Subject: Entitlement of ITC by insurance companies on repair expenses in reimbursement mode of claim settlement.

Key Points:

Clarification Nature: Retrospective application.

Issue Addressed: Availability of ITC for insurance companies on motor vehicle repair expenses under reimbursement mode.

Clarifications:

Reimbursement Mode:

Insurance companies can avail ITC on repair expenses reimbursed to policyholders.

Garages issue invoices in the name of insurance companies.

Section 17(5) and Section 16 of the CGST Act support ITC entitlement for insurers.

Separate Invoices:

If garages issue separate invoices for approved claim costs and excess amounts, ITC is available only for the approved claim cost.

Invoices Not in Insurer’s Name:

ITC is not available if repair invoices are not in the insurer’s name.

Action Required: Suitable trade notices should be issued to publicize the contents, and any implementation difficulties should be reported to the Board.

Download Original PDF –

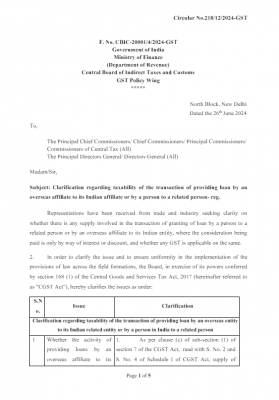

Analysis of Circular no.12 Dated 27 June 2024 –

Clarification regarding taxability of the transaction of providing loan by an overseas affiliate to its Indian affiliate or by a person to a related person.

Subject: Clarification regarding taxability of the transaction of providing loans by an overseas affiliate to its Indian affiliate or by a person to a related person.

Key Points:

Nature: Retrospective clarification.

Core Issue: Whether providing loans by an overseas affiliate to an Indian affiliate or by a person to a related person, without consideration in the form of processing fees, administrative charges, or loan granting charges, but only by way of interest or discount, constitutes a taxable supply under GST.

Clarifications:

Supply Definition: Services of granting loans/credit/advances between related persons, even without consideration, are considered a supply under GST as per Section 7(1)(c) of the CGST Act and Schedule I.

Exemption: Services by way of extending loans or advances where consideration is represented only by way of interest or discount are exempt under GST as per Notification No. 12/2017-Central Tax (Rate).

Processing/Service Fees: If processing or service fees are charged, these are taxable and liable to GST.

No Consideration: If no additional fee is charged beyond interest or discount, no GST is applicable on the loan.

Action Required: Issue suitable trade notices to publicize the contents of this circular and report any implementation difficulties to the Board.

Download Original PDF –

Analysis of Circular no.13 Dated 27 June 2024 –

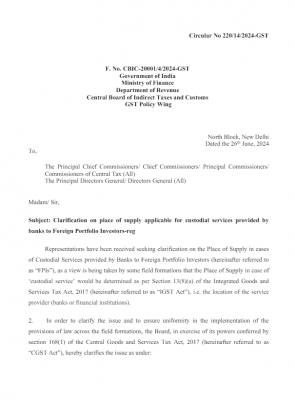

Clarification on availability of input tax credit on ducts and manholes used in network of optical fiber cables (OFCs) in terms of section 17(5) of the CGST Act, 2017

Subject: Clarification on availability of input tax credit (ITC) on ducts and manholes used in the network of optical fiber cables (OFCs).

Key Points:

Issue:

ITC denial on ducts and manholes used in OFC networks as they were considered immovable property, not plant and machinery.

Clarification:

Ducts and manholes are essential components of the OFC network and are classified as “plant and machinery”.

These components are not excluded from the definition of “plant and machinery” under Section 17 of the CGST Act.

Therefore, ITC on ducts and manholes used in OFC networks is not restricted.

Action Required:

Issue trade notices to publicize this clarification.

Report any implementation difficulties to the Board.

This clarification ensures uniformity and prevents unwarranted litigation in the telecommunication sector.

Download Original PDF –

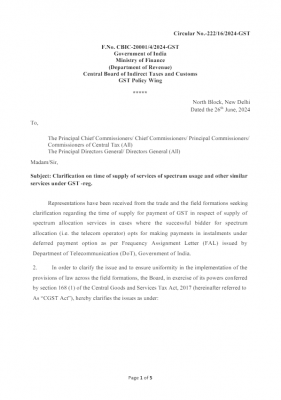

Analysis of Circular no.14 Dated 27 June 2024 –

Clarification on place of supply applicable for custodial services provided by banks to Foreign Portfolio Investors

Subject: Clarification on place of supply for custodial services provided by banks to Foreign Portfolio Investors (FPIs).

Key Points:

Issue:

Determination of place of supply for custodial services provided by banks to FPIs.

Clarification:

Custodial services are not considered services provided to ‘account holders’ under Section 13(8)(a) of the IGST Act.

Place of supply for custodial services to FPIs is determined under the default provision, Section 13(2) of the IGST Act.

This aligns with similar provisions under the Service Tax regime.

Action Required:

Issue trade notices to publicize this clarification.

Report any implementation difficulties to the Board.

Its not 219/13, Pls be carefull with number of circular

Download Original PDF –

Analysis of Circular no.15 Dated 27 June 2024 –

Time of supply on Annuity Payments under HAM Projects

Subject: Clarification on time of supply for construction and maintenance services of National Highway Projects under the Hybrid Annuity Model (HAM).

Key Points:

Issue: Time of supply for services in HAM contracts.

Clarification:

HAM contracts are considered continuous supply of services.

Time of supply is the earlier of invoice issuance or payment receipt if the invoice is issued on or before the specified date or event completion.

If invoices are not timely, the time of supply is the earlier of service provision or payment receipt.

Interest Component: Included in taxable value.

Action Required: Issue trade notices and report any implementation difficulties to the Board.

Download Original PDF –

Analysis of Circular no.16 Dated 27 June 2024 –

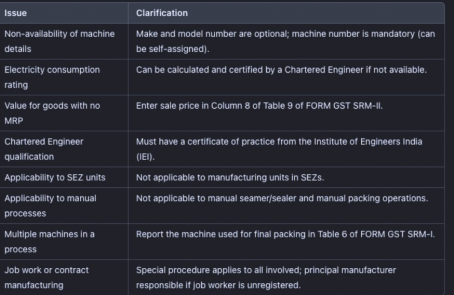

Time of supply in respect of supply of allotment of Spectrum to Telecom companies in cases where an option is given to the Telecom Companies for payment of licence fee and Spectrum usage charges in instalments in addition to an option of upfront payment.

Subject: Clarification on time of supply of services for spectrum usage and other similar services under GST.

Key Points:

Issue:

Determining the time of supply for GST payment on spectrum allocation services when the telecom operator opts for deferred payments.

Clarifications:

Spectrum allocation services are considered a continuous supply of services as defined under Section 2(33) of the CGST Act.

Time of supply for services on a reverse charge basis is determined under Section 13(3) of the CGST Act.

GST is payable on each installment as per the specified payment schedule in the Frequency Assignment Letter (FAL).

If the full upfront payment is made, GST is due at the time of payment or when it becomes due, whichever is earlier.

Deferred payments will attract GST as per the installment schedule, with interest applicable for delayed payments beyond 60 days from the invoice date.

Action Required:

Issue trade notices to publicize this clarification.

Report any implementation difficulties to the Board.

Download Original PDF –

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.