Section 137 of CGST Act : Offences by Companies (Updated till on July 2024)

Section 137 of CGST Act : Offences by Companies

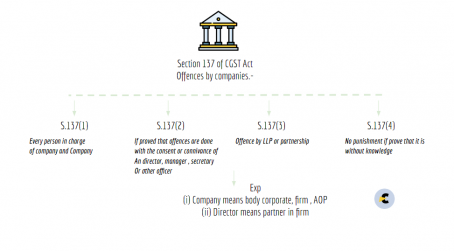

Summary Chart of Section 137 :

(1) Where an offence committed by a person under this Act is a company, every person who, at the time the offence was committed was in charge of, and was responsible to, the company for the conduct of business of the company, as well as the company, shall be deemed to be guilty of the offence and shall be liable to be proceeded against and punished accordingly.

(2) Notwithstanding anything contained in sub-section (1), where an offence under this Act has been committed by a company and it is proved that the offence has been committed with the consent or connivance of, or is attributable to any negligence on the part of, any director, manager, secretary or other officer of the company, such director, manager, secretary or other officer shall also be deemed to be guilty of that offence and shall be liable to be proceeded against and punished accordingly.

(3) Where an offence under this Act has been committed by a taxable person being a partnership firm or a Limited Liability Partnership or a Hindu Undivided Family or a trust, the partner or karta or managing trustee shall be deemed to be guilty of that offence and shall be liable to be proceeded against and punished accordingly and the provisions of sub-section (2) shall, mutatis mutandis , apply to such persons.

(4) Nothing contained in this section shall render any such person liable to any punishment provided in this Act, if he proves that the offence was committed without his knowledge or that he had exercised all due diligence to prevent the commission of such offence.

Explanation. -For the purposes of this section,-

(i) “company” means a body corporate and includes a firm or other association of individuals; and

(ii) “director”, in relation to a firm, means a partner in the firm.

(As given in CGST Act)

Prem

Prem

designer

Adilabad, India

gst taxation