Section 174 of CGST Act : Repeal and saving (Updated till July 2024)

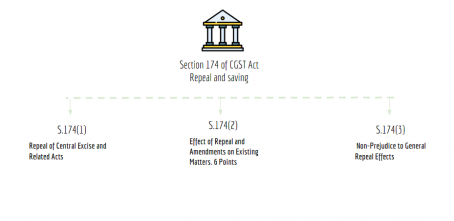

Section 174 Summary Chart :

Section 174 of CGST Act : Repeal and saving

(1) Save as otherwise provided in this Act, on and from the date of commencement of this Act, the Central Excise Act, 1944 (1 of 1944) (except as respects goods included in entry 84 of the Union List of the Seventh Schedule to the Constitution), the Medicinal and Toilet Preparations (Excise Duties) Act, 1955 (16 of 1955), the Additional Duties of Excise (Goods of Special Importance) Act, 1957 (58 of 1957), the Additional Duties of Excise (Textiles and Textile Articles) Act, 1978 (40 of 1978), and the Central Excise Tariff Act, 1985 (5 of 1986) (hereafter referred to as the repealed Acts) are hereby repealed.

(2) The repeal of the said Acts and the amendment of the Finance Act, 1994 (32 of 1994) (hereafter referred to as “such amendment” or “amended Act” , as the case may be) to the extent mentioned in the sub-section (1) or section 173 shall not-

(a) revive anything not in force or existing at the time of such amendment or repeal; or

(b) affect the previous operation of the amended Act or repealed Acts and orders

(c) affect any right, privilege, obligation, or liability acquired, accrued or incurred under the amended Act or repealed Acts or orders under such repealed or amended Acts:

Provided that any tax exemption granted as an incentive against investment through a notification shall not continue as privilege if the said notification is rescinded on or after the appointed day; or

(d) affect any duty, tax, surcharge, fine, penalty, interest as are due or may become due or any forfeiture or punishment incurred or inflicted in respect of any offence or violation committed against the provisions of the amended Act or repealed Acts; or

(e) affect any investigation, inquiry, verification (including scrutiny and audit), assessment proceedings, adjudication and any other legal proceedings or recovery of arrears or remedy in respect of any such duty, tax, surcharge, penalty, fine, interest, right, privilege, obligation, liability, forfeiture or punishment, as aforesaid, and any such investigation, inquiry, verification (including scrutiny and audit), assessment proceedings, adjudication and other legal proceedings or recovery of arrears or remedy may be instituted, continued or enforced, and any such tax, surcharge, penalty, fine, interest, forfeiture or punishment may be levied or imposed as if these Acts had not been so amended or repealed;

(f) affect any proceedings including that relating to an appeal, review or reference, instituted before on, or after the appointed day under the said amended Act or repealed Acts and such proceedings shall be continued under the said amended Act or repealed Acts as if this Act had not come into force and the said Acts had not been amended or repealed.

(3) The mention of the particular matters referred to in sub-sections (1) and (2) shall not be held to prejudice or affect the general application of section 6 of the General Clauses Act, 1897 (10 of 1897) with regard to the effect of repeal.

Prem

Prem

designer

Adilabad, India

gst taxation