Related Posts

Tax Benefits of Owning Multiple Rental Properties

Sep 09, 2024

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

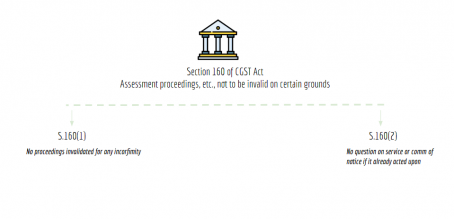

(1) No assessment, re-assessment, adjudication, review, revision, appeal, rectification, notice, summons or other proceedings done, accepted, made, issued, initiated, or purported to have been done, accepted, made, issued, initiated in pursuance of any of the provisions of this Act shall be invalid or deemed to be invalid merely by reason of any mistake, defect or omission therein, if such assessment, re-assessment, adjudication, review, revision, appeal, rectification, notice, summons or other proceedings are in substance and effect in conformity with or according to the intents, purposes and requirements of this Act or any existing law.

(2) The service of any notice, order or communication shall not be called in question, if the notice, order or communication, as the case may be, has already been acted upon by the person to whom it is issued or where such service has not been called in question at or in the earlier proceedings commenced, continued or finalised pursuant to such notice, order or communication.

Prem

Prem

designer

Adilabad, India

gst taxation

Sep 09, 2024

Recieve the most important tips and updates

Absolutely Free! Unsubscribe anytime.

We adhere 100% to the no-spam policy.