Section 171 of CGST Act : Anti-profiteering measure (Updated till on July 2024)

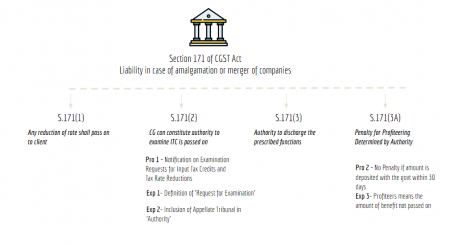

Section 171 Summary Chart :

Section 171 of CGST Act : Anti-profiteering measure

(1) Any reduction in rate of tax on any supply of goods or services or the benefit of input tax credit shall be passed on to the recipient by way of commensurate reduction in prices.

(2) The Central Government may, on recommendations of the Council, by notification, constitute an Authority, or empower an existing Authority constituted under any law for the time being in force, to examine whether input tax credits availed by any registered person or the reduction in the tax rate have actually resulted in a commensurate reduction in the price of the goods or services or both supplied by him.

Provided that the Government may by notification, on the recommendations of the Council, specify the date from which the said Authority shall not accept any request for examination as to whether input tax credits availed by any registered person or the reduction in the tax rate have actually resulted in a commensurate reduction in the price of the goods or services or both supplied by him.

Explanation 1––For the purposes of this sub-section, “request for examination” shall mean the written application filed by an applicant requesting for examination as to whether input tax credits availed by any registered person or the reduction in the tax rate have actually resulted in a commensurate reduction in the price of the goods or services or both supplied by him.’

Explanation 2––For the purposes of this section, the expression “Authority” shall include the “Appellate Tribunal”.

(3) The Authority referred to in sub-section (2) shall exercise such powers and discharge such functions as may be prescribed.

1[(3A) Where the Authority referred to in sub-section (2), after holding examination as required under the said sub-section comes to the conclusion that any registered person has profiteered under sub-section (1), such person shall be liable to pay penalty equivalent to ten per cent. of the amount so profiteered:

Provided that no penalty shall be leviable if the profiteered amount is deposited within thirty days of the date of passing of the order by the Authority.

Explanation.-For the purposes of this section, the expression “profiteered” shall mean the amount determined on account of not passing the benefit of reduction in rate of tax on supply of goods or services or both or the benefit of input tax credit to the recipient by way of commensurate reduction in the price of the goods or services or both]

- Inserted vide sec 112 of The Finance (No. 2) Act, 2019 (No. 23 of 2019), notified through Notification No. 1/2020 – CT dated 01.01.2020 – Brought into force w.e.f. 01.01.2020.

Prem

Prem

designer

Adilabad, India

gst taxation