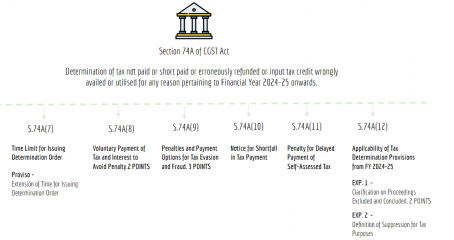

Section 74A of CGST Act : Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised for any reason pertaining to Financial Year 2024-25 onwards

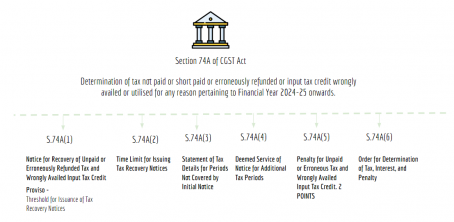

Summary Chart of Section 74A :

Section 74A of CGST Act : Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised for any reason pertaining to Financial Year 2024-25 onwards.

(1) Where it appears to the proper officer that any tax has not been paid or short paid or erroneously refunded, or where input tax credit has been wrongly availed or utilised, he shall serve notice on the person chargeable with tax which has not been so paid or which has been so short paid or to whom the refund has erroneously been made, or who has wrongly availed or utilised input tax credit, requiring him to show cause as to why he should not pay the amount specified in the notice along with interest payable thereon under section 50 and a penalty leviable under the provisions of this Act or the rules made thereunder:

Provided that no notice shall be issued, if the tax which has not been paid or short paid or erroneously refunded or where input tax credit has been wrongly availed or utilised in a financial year is less than one thousand rupees.

(2) The proper officer shall issue the notice under sub section (1) within forty-two months from the due date for furnishing of annual return for the financial year to which the tax not paid or short paid or input tax credit wrongly availed or utilised relates to or within forty-two months from the date of erroneous refund.

(3) Where a notice has been issued for any period under sub-section (1), the proper officer may serve a statement, containing the details of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised for such periods other than those covered under sub section (1), on the person chargeable with tax.

(4) The service of such statement shall be deemed to be service of notice on such person under sub-section (1), subject to the condition that the grounds relied upon for such tax periods other than those covered under sub-section (1) are the same as are mentioned in the earlier notice.

(5) The penalty in case where any tax which has not been paid or short paid or erroneously refunded, or where input tax credit has been wrongly availed or utilised,––

(i) for any reason, other than the reason of fraud or any wilful-misstatement or suppression of facts to evade tax, shall be equivalent to ten per cent. of tax due from such person or ten thousand rupees, whichever is higher;

(ii) for the reason of fraud or any wilful-misstatement or suppression of facts to evade tax shall be equivalent to the tax due from such person.

(6) The proper officer shall, after considering the representation, if any, made by the person chargeable with tax, determine the amount of tax, interest and penalty due from such person and issue an order.

(7) The proper officer shall issue the order under sub section (6) within twelve months from the date of issuance of notice specified in sub-section (2):

Provided that where the proper officer is not able to issue the order within the specified period, the Commissioner, or an officer authorised by the Commissioner senior in rank to the proper officer but not below the rank of Joint Commissioner of Central Tax, may, having regard to the reasons for delay in issuance of the order under sub-section (6), to be recorded in writing, before the expiry of the specified period, extend the said period further by a maximum of six months.

(8) The person chargeable with tax where any tax has not been paid or short paid or erroneously refunded, or where input tax credit has been wrongly availed or utilised for any reason, other than the reason of fraud or any wilful misstatement or suppression of facts to evade tax, may, ––

(i) before service of notice under sub-section (1), pay the amount of tax along with interest payable under section 50 of such tax on the basis of his own ascertainment of such tax or the tax as ascertained by the proper officer and inform the proper officer in writing of such payment, and the proper officer, on receipt of such information shall not serve any notice under sub-section (1) or the statement under sub-section (3), as the case may be, in respect of the tax so paid or any penalty payable under the provisions of this Act or the rules made thereunder;

(ii) pay the said tax along with interest payable under section 50 within sixty days of issue of show cause notice, and on doing so, no penalty shall be payable and all proceedings in respect of the said notice shall be deemed to be concluded.

(9) The person chargeable with tax, where any tax has not been paid or short paid or erroneously refunded or where input tax credit has been wrongly availed or utilised by reason of fraud, or any wilful-misstatement or suppression of facts to evade tax, may,––

(i) before service of notice under sub-section (1), pay the amount of tax along with interest payable under section 50 and a penalty equivalent to fifteen per cent. of such tax on the basis of his own ascertainment of such tax or the tax as ascertained by the proper officer and inform the proper officer in writing of such payment, and the proper officer, on receipt of such information, shall not serve any notice under sub-section (1), in respect of the tax so paid or any penalty payable under the provisions of this Act or the rules made thereunder;

(ii) pay the said tax along with interest payable under section 50 and a penalty equivalent to twenty-five per cent. of such tax within sixty days of issue of the notice,and on doing so, all proceedings in respect of the said notice shall be deemed to be concluded;

(iii) pay the tax along with interest payable thereon under section 50 and a penalty equivalent to fifty per cent. of such tax within sixty days of communication of the order, and on doing so, all proceedings in respect of the said notice shall be deemed to be concluded.

(10) Where the proper officer is of the opinion that the amount paid under clause (i) of sub-section (8) or clause (i) of sub-section (9) falls short of the amount actually payable, he shall proceed to issue the notice as provided for in sub section (1) in respect of such amount which falls short of the amount actually payable.

(11) Notwithstanding anything contained in clause (i) or clause (ii) of sub-section (8), penalty under clause (i) of sub section (5) shall be payable where any amount of self assessed tax or any amount collected as tax has not been paid within a period of thirty days from the due date of payment of such tax.

(12) The provisions of this section shall be applicable for determination of tax pertaining to the Financial Year 2024 25 onwards.

Explanation 1.––For the purposes of this section,––

(i) the expression “all proceedings in respect of the said notice” shall not include proceedings under section 132;

(ii) where the notice under the same proceedings is issued to the main person liable to pay tax and some other persons, and such proceedings against the main person have been concluded under this section, the proceedings against all the persons liable to pay penalty under sections 122 and 125 are deemed to be concluded.

Explanation 2.––For the purposes of this Act, the expression “suppression” shall mean non-declaration of facts or information which a taxable person is required to declare in the return, statement, report or any other document furnished under this Act or the rules made thereunder, or failure to furnish any information on being asked for, in writing, by the proper officer.

Prem

Prem

designer

Adilabad, India

gst taxation