Interim Relief Granted Against GST Notification No. 56/2023

Here’s a summary of the key points:

1. Notification in Question :

– The petition challenges Notification No. 56/2023 dated 28.12.2023, issued by CBIC.

– The notification extends the time limits for passing orders under Section 73(9) of the CGST Act, 2017 for the financial years 2018-2019 and 2019-2020.

2. Petitioner’s Arguments :

– The notification is alleged to be invalid because it was issued without the mandatory recommendation from the GST Council, as required under Section 168A of the CGST Act.

– The petitioner argues that the notification extends the period beyond what is permissible and claims that lack of manpower, as mentioned in the GST Council minutes, does not constitute “force majeure.”

3. Responses from the Government :

– Respondents argue that the notification was issued based on a recommendation from the GST Implementation Committee and that the GST Council’s ratification is pending.

– The State GST authorities follow the central notifications, including the contested one.

4. Court’s Interim Order :

– The Court issued a notice for the next hearing on 21.08.2024.

– The Court granted interim protection to the petitioner, preventing any coercive actions based on the disputed assessment order until the next hearing.

– The Court has directed the respondents to file their affidavits by 19.08.2024 and noted the need for a detailed examination of the notification’s legality and the applicability of force majeure.

In essence, the Court is considering whether the notification was issued in compliance with legal requirements and has temporarily restrained actions based on it while further proceedings continue.

5. Case Details :

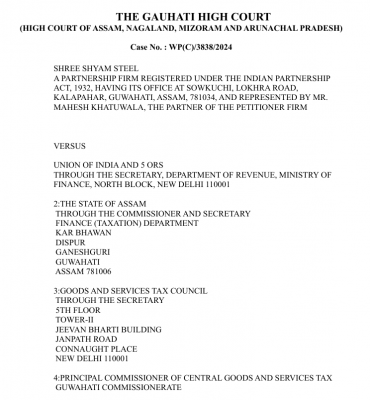

– Petitioner : Shree Shyam Steel, represented by Mr. Mahesh Khatuwala.

– Respondents : Union of India, State of Assam, Goods and Services Tax Council, Principal Commissioners of Central and State Goods and Services Tax, and Assistant Commissioner of GST and Central Excise.

Author can be reached at 9953077844, shaifaly.ca@gmail.com

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.