CGST (Fourteenth Amendment) Rules, 2017

CGST (Fourteenth Amendment) Rules, 2017:

2. In the Central Goods and Services Tax Rules, 2017, –

(i) in rule 17, after sub-rule (1), the following sub-rule shall be inserted, namely:-

“(1A) The Unique Identity Number granted under sub-rule (1) to a person under clause (a) of sub-section (9) of section 25 shall be applicable to the territory of India.”;

(ii) in rule 19, after sub-rule (1), the following sub-rule shall be inserted, namely:-

“(1A). Notwithstanding anything contained in sub-rule (1), any particular of the application for registration shall not stand amended with effect from a date earlier than the date of submission of the application in FORM GST REG-14 on the common portal except with the order of the Commissioner for reasons to be recorded in writing and subject to such conditions as the Commissioner may, in the said order, specify.”; (iii) with effect from 23rd October, 2017, in rule 89, for sub-rule (4), the following shall be substituted, namely:-

“(4) In the case of zero-rated supply of goods or services or both without payment of tax under bond or letter of undertaking in accordance with the provisions of subsection (3) of section 16 of the Integrated Goods and Services Tax Act, 2017 (13 of 2017), refund of input tax credit shall be granted as per the following formula – Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-rated supply of services) x Net ITC ÷Adjusted Total Turnover Where, – (A) “Refund amount” means the maximum refund that is admissible; (B) “Net ITC” means input tax credit availed on inputs and input services during the relevant period other than the input tax credit availed for which refund is claimed under sub-rules (4A) or (4B) or both; (C) “Turnover of zero-rated supply of goods” means the value of zero-rated supply of goods made during the relevant period without payment of tax under bond or letter of undertaking, other than the turnover of supplies in respect of which refund is claimed under sub-rules (4A) or (4B) or both; (D) “Turnover of zero-rated supply of services” means the value of zero-rated supply of services made without payment of tax under bond or letter of undertaking, calculated in the following manner, namely:- Zero-rated supply of services is the aggregate of the payments received during the relevant period for zero-rated supply of services and zero-rated supply of services where supply has been completed for which payment had been received in advance in any period prior to the relevant period reduced by advances received for zero-rated supply of services for which the supply of services has not been completed during the relevant period; (E) “Adjusted Total turnover” means the turnover in a State or a Union territory, as defined under clause (112) of section 2, excluding –

(a) the value of exempt supplies other than zero-rated supplies and

(b) the turnover of supplies in respect of which refund is claimed under subrules (4A) or (4B) or both, if any, during the relevant period; (F) “Relevant period” means the period for which the claim has been filed. (4A) In the case of supplies received on which the supplier has availed the benefit of notification No. 48/2017-Central Tax dated 18th October, 2017, refund of input tax credit, availed in respect of other inputs or input services used in making zero-rated supply of goods or services or both, shall be granted. (4B) In the case of supplies received on which the supplier has availed the benefit of notification No. 40/2017-Central Tax (Rate) dated 23rd October, 2017 or notification No. 41/2017-Integrated Tax (Rate) dated 23rd October, 2017, or both, refund of input tax credit, availed in respect of inputs received under the said notifications for export of goods and the input tax credit availed in respect of other inputs or input services to the extent used in making such export of goods, shall be granted.”;

(iv) in rule 95 – (a) for sub-rule (1), the following sub-rule shall be substituted, namely:-

“(1) Any person eligible to claim refund of tax paid by him on his inward supplies as per notification issued under section 55 shall apply for refund in FORM GST RFD-10 once in every quarter, electronically on the common portal or otherwise, either directly or through a Facilitation Centre notified by the Commissioner, along with a statement of the inward supplies of goods or services or both in FORM GSTR-11.”;

(b) in sub-rule (3), in clause (a), the words “and the price of the supply covered under a single tax invoice exceeds five thousand rupees, excluding tax paid, if any” shall be omitted;

(v) with effect from 23rd October, 2017, in rule 96 – (a) in the heading, after the words “paid on goods”, the words “or services” shall be inserted; (b) after sub-rule (8), the following sub-rule shall be inserted, namely:-

“(9) The persons claiming refund of integrated tax paid on export of goods or services should not have received supplies on which the supplier has availed the benefit of notification No. 48/2017-Central Tax dated 18th October, 2017 or notification No. 40/2017-Central Tax (Rate) dated 23rd October, 2017 or notification No. 41/2017- Integrated Tax (Rate) dated 23rd October, 2017.”;

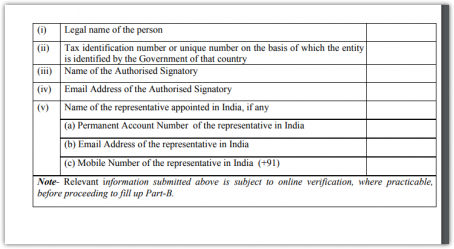

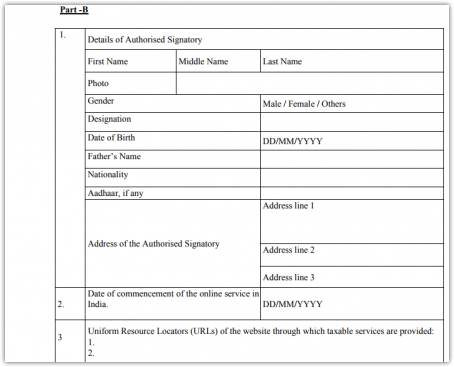

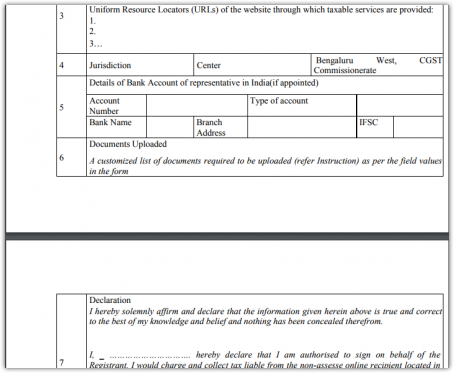

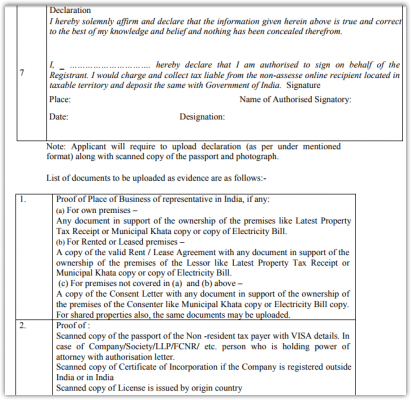

(vi) for FORM GST REG-10, the following form shall be substituted, namely:- “Form GST REG-10 [See rule 14(1)] Application for registration of person supplying online information and data base access or retrieval services from a place outside India to a person in India, other than a registered person.

Part –A

Instructions – 1. If authorised signatory is not based in India, authentication through digital signature certificate shall not be mandatory for such persons. The authentication will be done through Electronic Verification Code (EVC). 2. Appointed representative in India shall have the meaning as specified under section 14 of Integrated Goods and Services Tax Act, 2017.”; (vii) in FORM GST REG-13, a. in PART-B, at serial no. 4, the words, “Address of the entity in State” shall be substituted with the words, “Address of the entity in respect of which the centralized UIN is sought”; b. in the Instructions, the words, “Every person required to obtain a unique identity number shall submit the application electronically” shall be substituted with the words, “Every person required to obtain a unique identity number shall submit the application electronically or otherwise.”; (viii) for FORM GSTR-11, the following form shall be substituted, namely:

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.