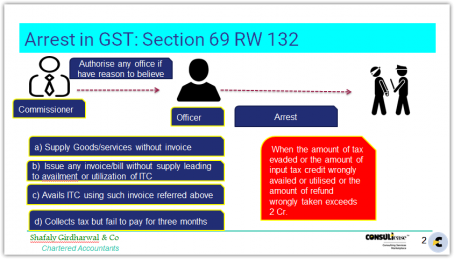

provisions for arrest by a GST officer

Section 69 provide for arrest by a GST officer authorised by commissioner:

GST provisions provide for arrest by a GST officer for any of following offence. Arrest by GST officer can be done when amount of tax evaded is more than 2 Cr.

- supplies any goods or services or both without issue of any invoice, in violation of the provisions of this Act or the rules made thereunder, with the intention to evade tax;

GST provisions for invoice are below:

- For Goods: Invoice shall be raised before or at the time of movement of goods. We can say that no goods can move for delivery without an invoice.

- For services: Invoice can be raised within 30 days from the rendering of services

Here it is also important to note that there should be intention to evade tax. Fraudulent intention should also be there.

- issues any invoice or bill without supply of goods or services or both in violation of the provisions of this Act, or the rules made thereunder leading to wrongful availment or utilisation of input tax credit or refund of tax;

This is reverse of first case above. In this case where the invoice is raised but supply is not made. It also requires that the recipient has availed or utilised the credit related to that invoice. Unless credit is taken it will not be an offence liable for prosecution.

- avails input tax credit using such invoice or bill referred to in clause (b);

The provision of sub sec (b) is from supplier side. This part of law covers the recipient side of transaction. Recipient of credit on such invoice is also liable for arrest.

- collects any amount as tax but fails to pay the same to the Government beyond a period of three months from the date on which such payment becomes due

This provision covers the default of supplier to collect tax but not making a payment to proper govt. A time limit of three months is given in this case.

These are the basic provisions for arrest of a taxpayer for abovementioned offences. We need to take care to comply the provisions of GST related to invoice and ITC.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.