Removal of Directors Disqualification scheme

Removal of Directors Disqualification scheme

Procedures for Removal of Directors Disqualification

*(A) Defaulting Company is Active and Directors are disqualified

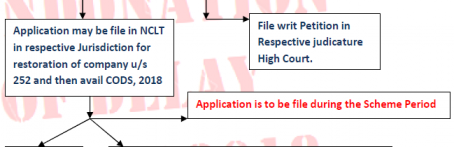

*(B) Defaulting Company is struck off and Directors are disqualified

Key Notes:-

DIN of directors associated with the defaulting companies:

- That have not filled there overdue documents and e-Cods 2018 and

- Overdue documents filled which are not taken on record on the MCA -21 registry and are thereby still found to be disqualify on the conclusion of the scheme in terms of section 164 (2)(a) r/w 167(1)(a) of the companies ACT 2013 shall be liable to be deactivated again on the expiry of the scheme period.

- All SRN entered in the E-form shall be valid and approved and shall be

associated with the CIN further the same should not be marked as defective. - System shall not allowed the filling of form e-cods 2018 in case another e-cods

2018 is filled and pending for payment of fees. - Fee for e-cods 2018 Rs 30k.

- After filling overdue documents they are required to seek condonation of delay by filling form e-CODS 2018.

DISCLAIMER:

The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. IN NO EVENT SHALL I SHALL BE LIABLE FOR ANY DIRECT, INDIRECT, SPECIAL OR INCIDENTAL DAMAGE RESULTING FROM, ARISING OUT OF OR IN CONNECTION WITH THE USE OF THE INFORMATION. This is only a knowledge sharing initiative and author do not intend to solicit any business or profession.

Advocate Jeetam Saini

Advocate Jeetam Saini

Jaipur, India