Adfert Technologies Pvt. Ltd: Tran 1 allowed

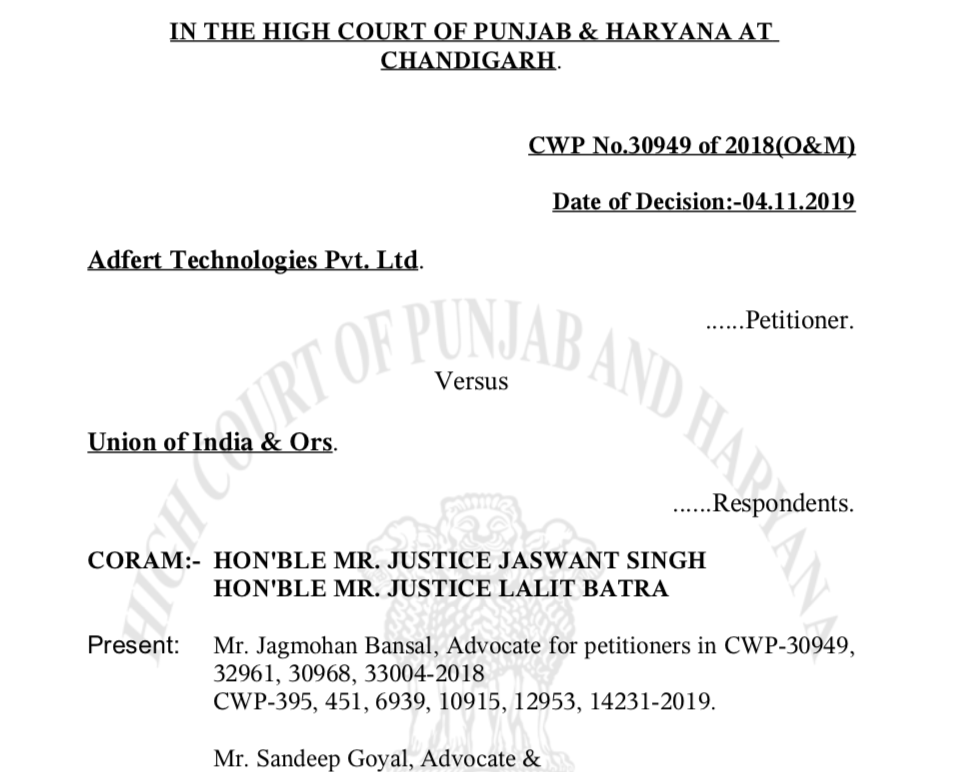

Adfert Technologies Pvt. Ltd. GST Case on Tran 1:

In the case of Adfert Technologies Pvt. Ltd the manual filing of TRAN 1 was allowed. There are other rulings of Delhi and Gujrat High court allowing the filing of Tran 1 manually. In this case, also the trend is maintained and the taxpayer is allowed to file Tran 1. Later on in the case of Hans raj also Tran 1 filing was allowed.

The verdict of the honorable high court was.

We fully agree with the findings of Hon’ble Gujrat and Delhi High Court noticed hereinabove and find no reason to take any contrary view. We are not in agreement with the cited judgment by the Revenue of Hon’ble Gujrat High Court in Willowood Chemicals case (Supra) as the Gujrat High Court itself in subsequent judgments and Delhi High Court in a number of judgments (as noticed hereinabove) have permitted petitioners (therein) to file TRAN-I Forms even after 27.12.2017. We also find that the Sub Rule (1A) added/inserted to Rule 117 w.e.f. 10.09.2018 has not been noticed in the said cited judgment by the Revenue, which goes to the roots of findings recorded by the Hon’ble Gujrat High Court. Thus all the petitions deserve to succeed and are hereby allowed.

Download the copy of Order:

You can download the copy of the order below.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.