All you need to know about ITR 4 of FY 19-20

Table of Contents

- What is the ITR 4 Sugam Form?

- Who can File the ITR 4 Sugam Form?

- Who can’t File the ITR 4 Form for AY 2020-21?

- What are the Major Changes Made in ITR 4 Sugam Form for AY 2020-21?

- Due Date for Filing ITR 4 Sugam Form for AY 2020-21

- Guide to File Income Tax Return (ITR) 4 Sugam Online:

- PART A: General Information

- Part B: Gross Total Income

- Part C: Deductions and Taxable Total Income

- Part D: Tax Computations and Tax Status

- Computation of Presumptive Income From Goods Carriages Under Section 44AE

- Information Regarding Turnover/gross Receipt Reported for GST

- Particulars of Cash and Bank Transactions Relating to Presumptive Business

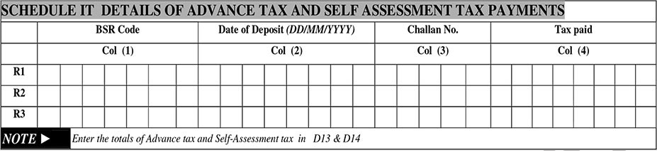

- Schedule IT: Details of Advance Tax and Self Assessment Tax Payments

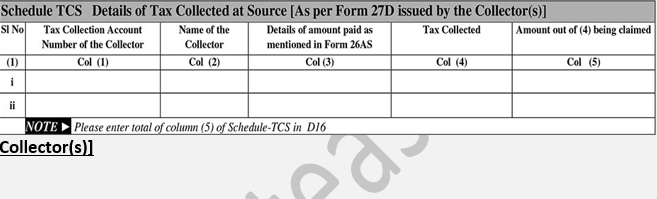

- Schedule TCS: Details of Tax Collected at Source [As per Form 27D issued by the Collector(s)]

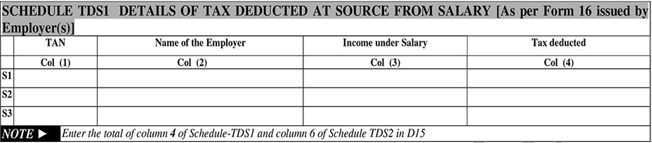

- Schedule TDS1: Details of Tax Deducted at Source From Salary [as Per Form 16 Issued by Employer(S)]

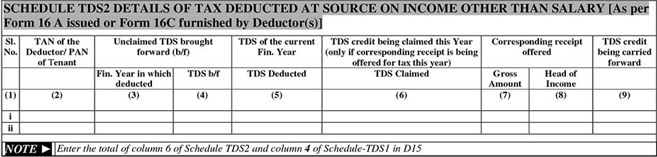

- Schedule TDS2: Details of Tax Deducted at Source on Income Other Than Salary

- Download the copy:

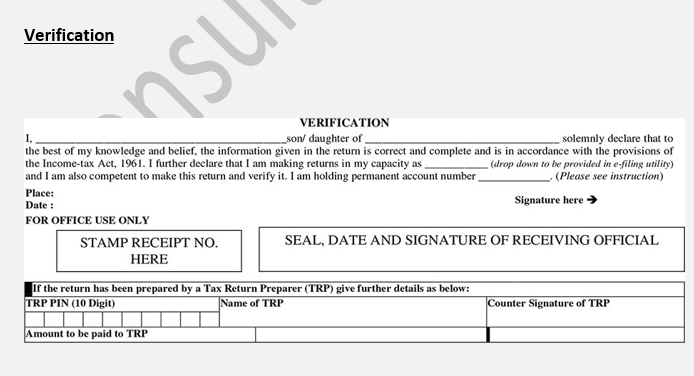

- Verification

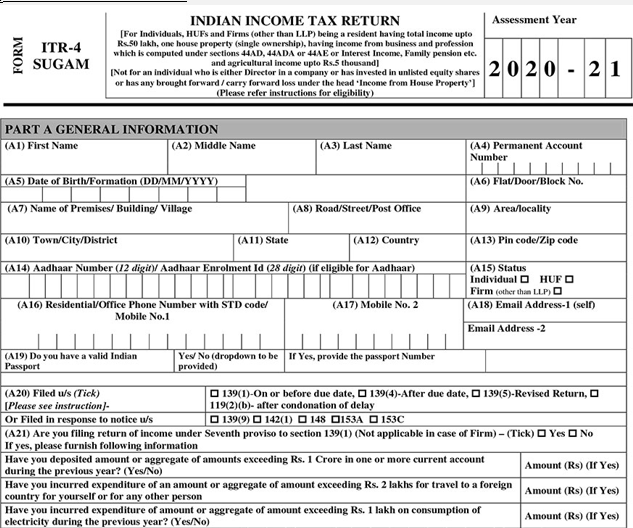

What is the ITR 4 Sugam Form?

ITR stands for Income Tax Return and ITR 4 Sugam Form is for the taxpayers who are filing return under the presumptive income scheme in Section 44AD, Section 44ADA and Section 44AE of the Income Tax (IT) Act. If the turnover of the aforementioned business becomes more than Rs 2 crores then the taxpayer can’t file ITR-4

Who can File the ITR 4 Sugam Form?

ITR 4 Sugam form can be filed by the individuals / HUFs / partnership firm(other than LLP) being a resident if:-

- Total income does not exceed Rs. 50 lakh.

- Assessee having business and profession income under section 44AD,44AE or ADA or having interest income, family pension, etc.

- Having agricultural income up to Rs 5,000/-

- Have a single House property.

It must be noted that the freelancers involved in the above-mentioned profession can also choose this scheme only if their gross receipts are not more than Rs 50 lakhs.

Who can’t File the ITR 4 Form for AY 2020-21?

A person whose income from salary or house property or other sources is more than Rs 50 lakh cannot file ITR 4 Form for AY 2020-21. A person who is a director in a company or has invested in the unlisted equity shares or has any brought forward/ carry forward loss under house property income cannot file the ITR 4 for AY 2020-21.

What are the Major Changes Made in ITR 4 Sugam Form for AY 2020-21?

- In Part A, ‘Nature of employment’ section has been deleted.

- In Part A, passport details field has been added.

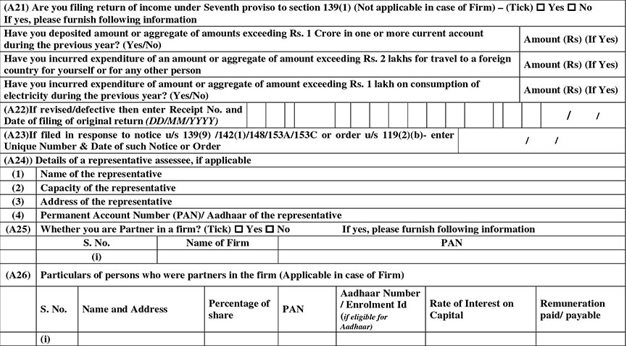

- In part A “Are you filing return of income under the Seventh proviso to section 139(1) (Not applicable in case of Firm) – (Tick) Yes/ No. If yes, please furnish following information Have you deposited amount or aggregate of amounts exceeding Rs. 1 Crore in one or more current account during the previous year? (Yes/No) Amount (Rs) (If Yes) Have you incurred expenditure of an amount or aggregate of the amount exceeding Rs. 2 lakhs for travel to a foreign country for yourself or for any other person Amount (Rs) (If Yes) Have you incurred expenditure of amount or aggregate of an amount exceeding Rs. 1 lakh on the consumption of electricity during the previous year? (Yes/No) Amount (Rs) (If Yes) has been added

- In part A “whether you are a partner or not in a firm” has been inserted.

- In Part A Details of partner in the firm (applicable in case of firm) has been inserted.

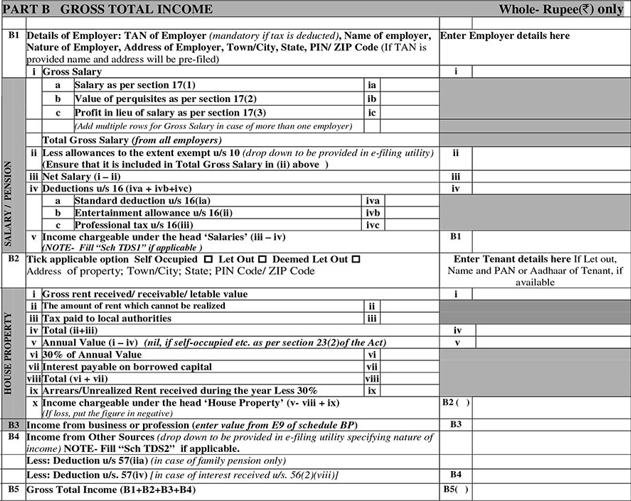

- Under salary head details of employer is required to be filed in part B.

- Under house property field of “Amount of rent which cannot be realized” has been added.

- In other sources head” Deduction u/s. 57(iv) [in case of interest received u/s. 56(2)(viii)]” has been added.

- In schedule BP” Changes in the table of Gross Turnover or Gross Receipts relatable to presumptive income u/s. 44AE has been inserted.”

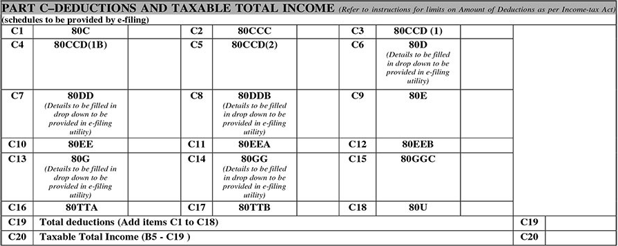

- The column of Deduction u/s 80CCGhas been deleted now.

- The column of Deduction u/s 80EEA, 80EEB has been inserted.

- Schedule 80G has been deleted.

- The financial particulars of the business have been deleted.

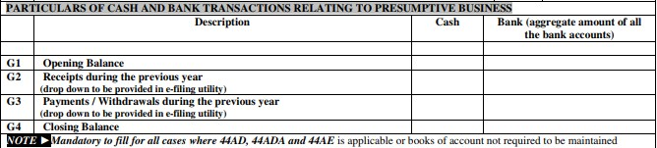

- PARTICULARS OF CASH AND BANK TRANSACTIONS RELATING TO PRESUMPTIVE BUSINESS

Due Date for Filing ITR 4 Sugam Form for AY 2020-21

- All the non-audit cases have to file ITR 4 on or before 31st July of each year mandatorily.

Guide to File Income Tax Return (ITR) 4 Sugam Online:

PART A: General Information

Part B: Gross Total Income

Part C: Deductions and Taxable Total Income

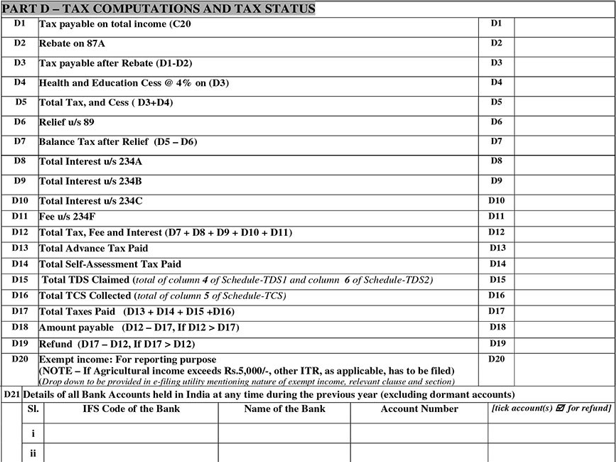

Part D: Tax Computations and Tax Status

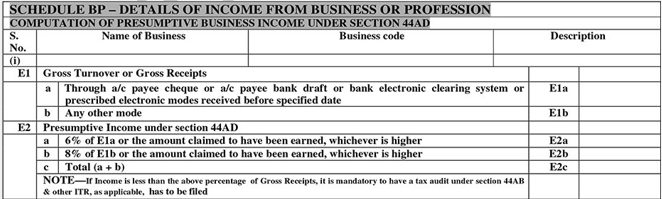

Schedule BP: Details of Income From Business or Profession Computation of Presumptive Business Income Under Section 44AD

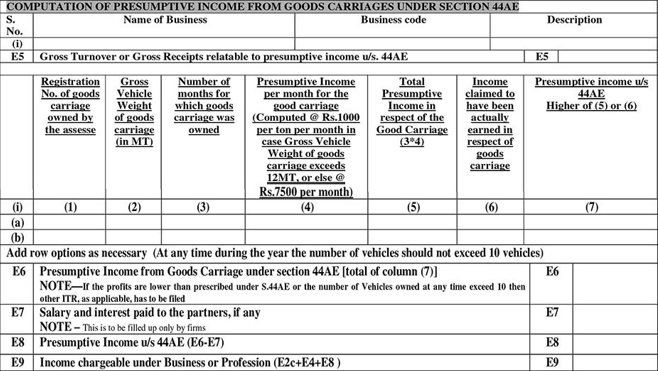

Computation of Presumptive Income From Goods Carriages Under Section 44AE

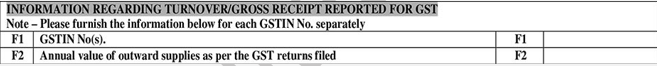

Information Regarding Turnover/gross Receipt Reported for GST

Particulars of Cash and Bank Transactions Relating to Presumptive Business

Schedule IT: Details of Advance Tax and Self Assessment Tax Payments

Schedule TCS: Details of Tax Collected at Source [As per Form 27D issued by the Collector(s)]

Schedule TDS1: Details of Tax Deducted at Source From Salary [as Per Form 16 Issued by Employer(S)]

Schedule TDS2: Details of Tax Deducted at Source on Income Other Than Salary

[as Per Form 16 an Issued or Form 16c Furnished by Deductor(S)]

Download the copy:

Verification