Amendments to CGST Act 2017 as brought in by Finance Bill 2020

Table of Contents

- Amendments to CGST Act 2017 as brought in by Finance Bill 2020

- 1. Insertion in Section 2(114) of CGST Act 2017: Definition of Union Territory

- Effect of amendment:

- 2. Section 10(2) of CGST Act 2017- Restriction for composition dealer

- Effect of Amendment:

- 3. Amendment in Section 16(4) of the CGST Act 2017- Time limit for availing credit based on debit notes

- Effect of Amendment:

- 4. Amendment in Section 29(1) of the CGST Act- Cancellation of registration

- Download the copy:

- Effect of Amendment:

Amendments to CGST Act 2017 as brought in by Finance Bill 2020

All the amendments mentioned below are effective from the date to be notified.

1. Insertion in Section 2(114) of CGST Act 2017: Definition of Union Territory

“Union territory” means the territory of—

a. the Andaman and Nicobar Islands;

b. Lakshadweep;

c. Dadra & Nagar Haveli and Daman & Diu

d. Ladakh

e. Chandigarh; and

f. Other territories.

Effect of amendment:

The definition of Union Territory now includes ‘Ladakh’ as a separate Union Territory in the CGST Act 2017. ‘Dadra and Nagar Haveli and Daman and Diu’ have been combined in the definition of Union Territory.

Similar changes have been notified in section 1(2) and section 2(8) of the UT GST Act 2017.

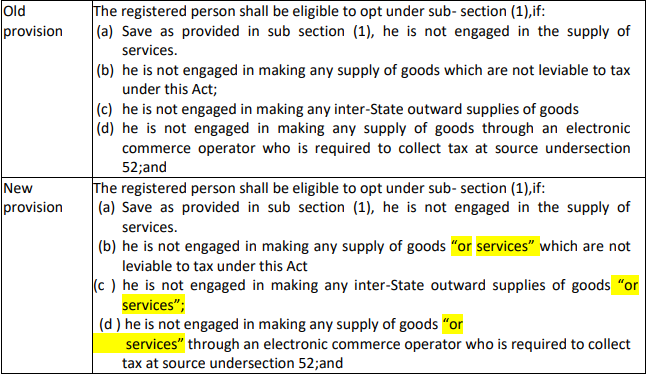

2. Section 10(2) of CGST Act 2017- Restriction for composition dealer

Effect of Amendment:

section 10(2) amended to provide that dealer in goods will not be entitled to composition scheme, if he undertakes the following supplies:

(i) Services not leviable to GST

(ii) Inter-state supply of services

(iii) Supply of services through electronic commerce operator

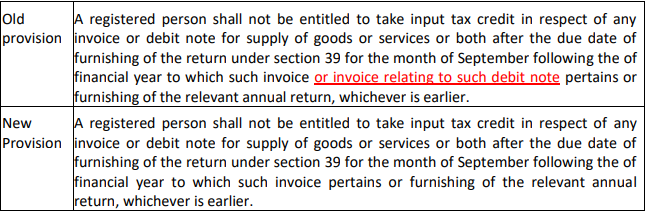

3. Amendment in Section 16(4) of the CGST Act 2017- Time limit for availing credit based on debit notes

Effect of Amendment:

Section 16(4) of the CGST Act 2017 restricts the ITC beyond the due date of filing return for the month of September of the corresponding financial year. In this restriction credit pertaining to a debit note is linked with the date of invoice against which debit note is issued. Now it is proposed to delink the debit note with the date of invoice to avail ITC. Now the last date of taking the input tax credit will be the due date of the September return of the subsequent financial year to which the debit note pertains and it will not be linked with date of Invoice.

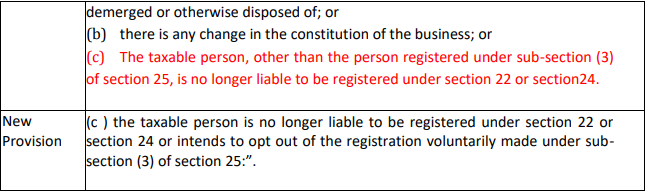

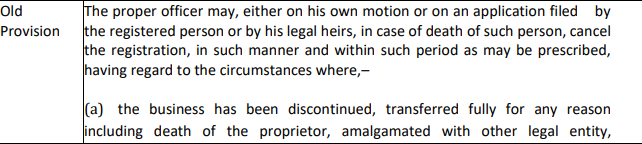

4. Amendment in Section 29(1) of the CGST Act- Cancellation of registration

Download the copy:

Effect of Amendment:

Section 29(1) of the CGST Act provides the power to cancel the registration either on its own motion or application by the registered person. Clause c of section 29(1) excludes the person registered under section 25(3) i.e. voluntary registration. The provision of clause c of section 29(1) has now been modified to allow those cases wherein a person had obtained their registration voluntarily.

CA Rajender Arora

CA Rajender Arora