Important amendments in GST via 15/2021 in refund, registration and forms

Introduction-

CBIC has issued a notification no. 15/2021. It amended the provisions related to refund, registration, and forms in GST. Let us have a look at those provisions. You can also download the PPT attached to the post.Following is a small list of main amendments in CGST Rules.

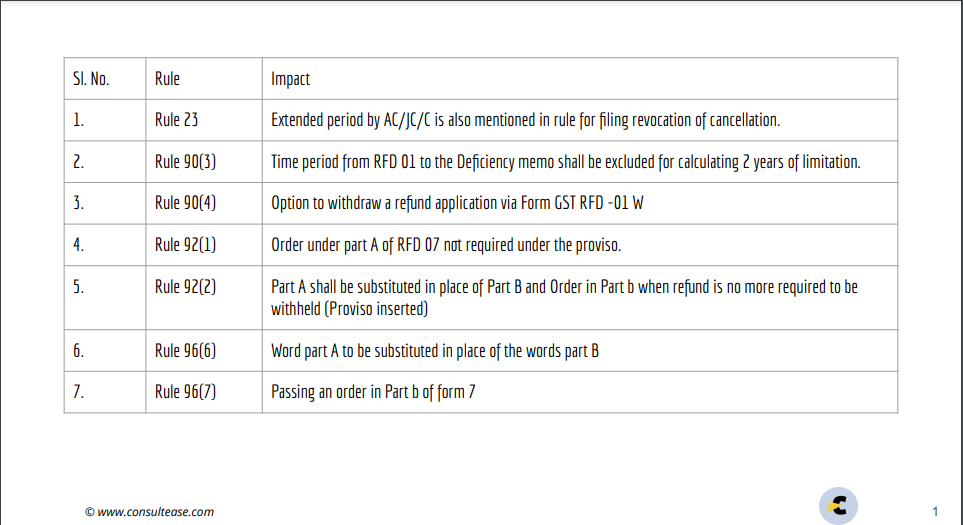

| Sl. No. | Rule | Impact |

| 1. | Rule 23 | Extended period by AC/JC/C is also mentioned in rule for filing revocation of cancellation. |

| 2. | Rule 90(3) | Time period from RFD 01 to the Deficiency memo shall be excluded for calculating 2 years of limitation. |

| 3. | Rule 90(4) | Option to withdraw a refund application via Form GST RFD -01 W |

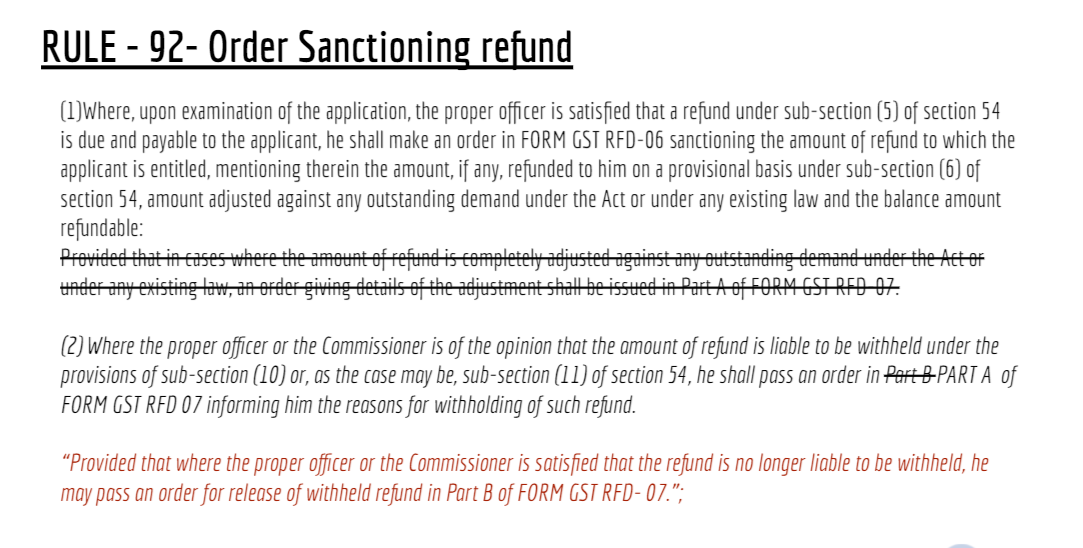

| 4. | Rule 92(1) | Order under part A of RFD 07 not required under the proviso. |

| 5. | Rule 92(2) | Part A shall be substituted in place of Part B and Order in Part b when refund is no more required to be withheld (Proviso inserted) |

| 6. | Rule 96(6) | Word part A to be substituted in place of the words part B |

| 7. | Rule 96(7) | Passing an order in Part b of form 7 |

| 8. | Form Reg 21 | Extension of date for revocation by AC/DC/C is mentioned in form |

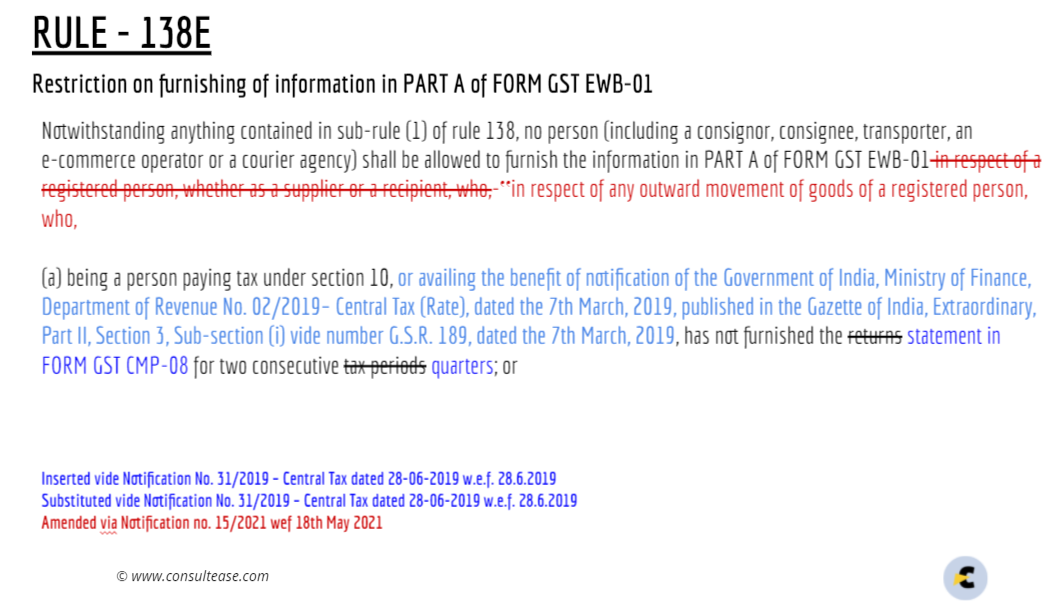

| 9. | Rule 138(E) | Outward movements of a defaulting supplier are covered |

| 10. | New Form RFD 07 | Amended form is prescribed |

| 11. | New Form RFD 01-W | New form is prescribed for withdrawal of refunds |

Related Topic:

Sectionwise Analysis – GST Amendments (Finance Bill 2021)

Rule 23- Revocation of registration cancellation

In this rule time extended by the JC/AC/C is also included to apply for revocation of registration. When a registration is cancelled in GST, the TP has the right to apply for the revocation of cancellation. The time limit can be extended under section 30 of CGST Act.

Related Topic:

Government notifies the draft of Drone Rules, 2021

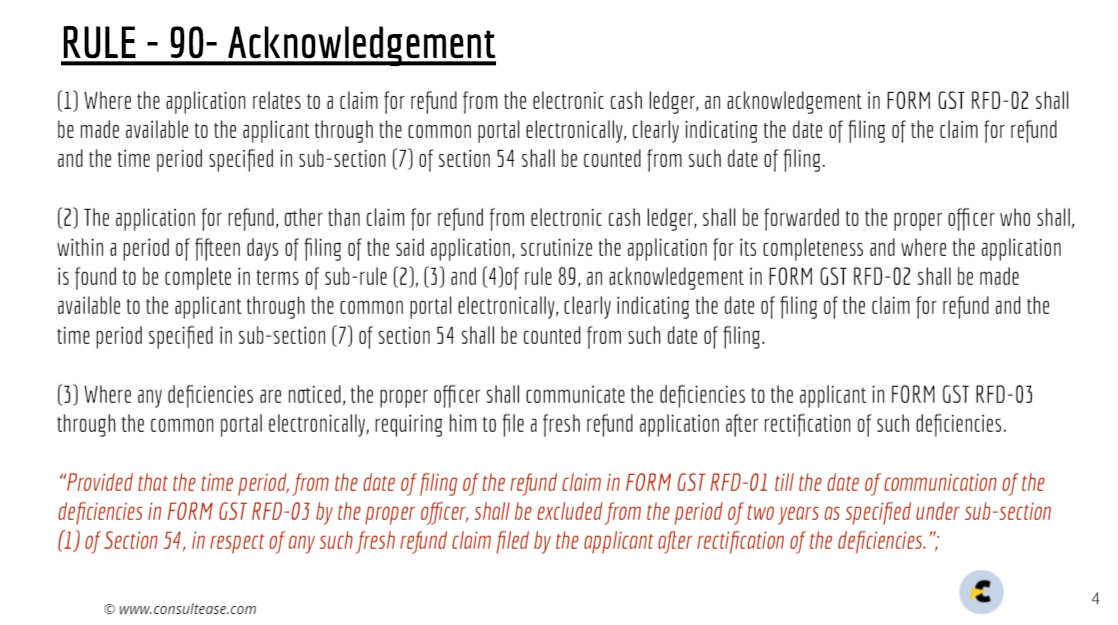

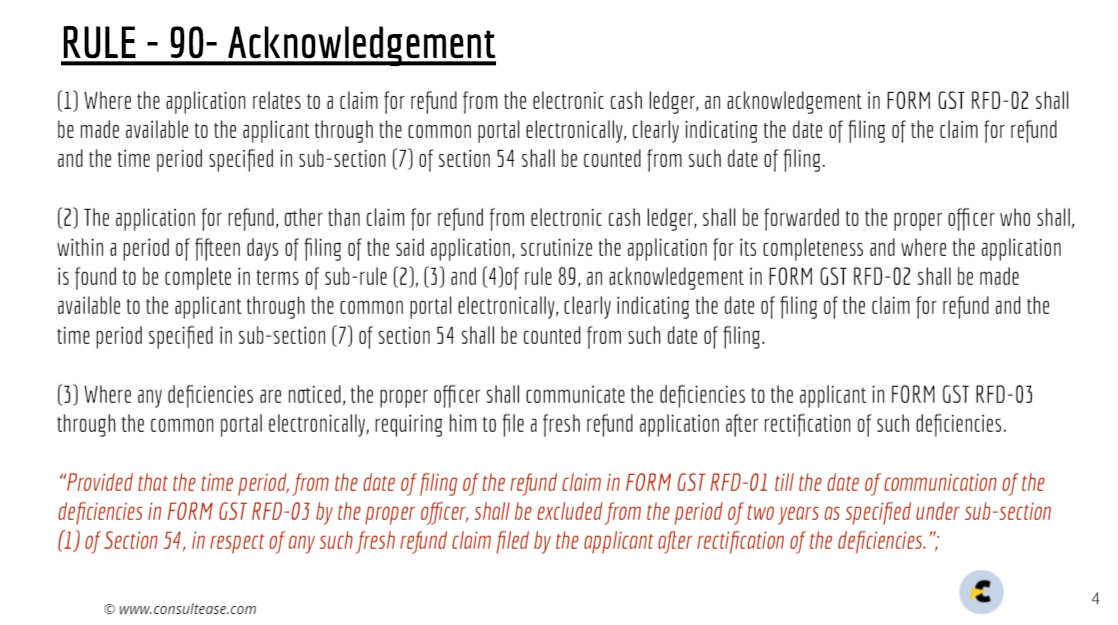

Rule 90(3) of CGST Rules- Limitaion period of refund

Period between RFD 01 and issuance of deficiency memo will not be counted for the limitation period of 2 years.

Related Topic:

306th Issue of Tax Connect

See the highlited proviso to see the exact text of amendment.

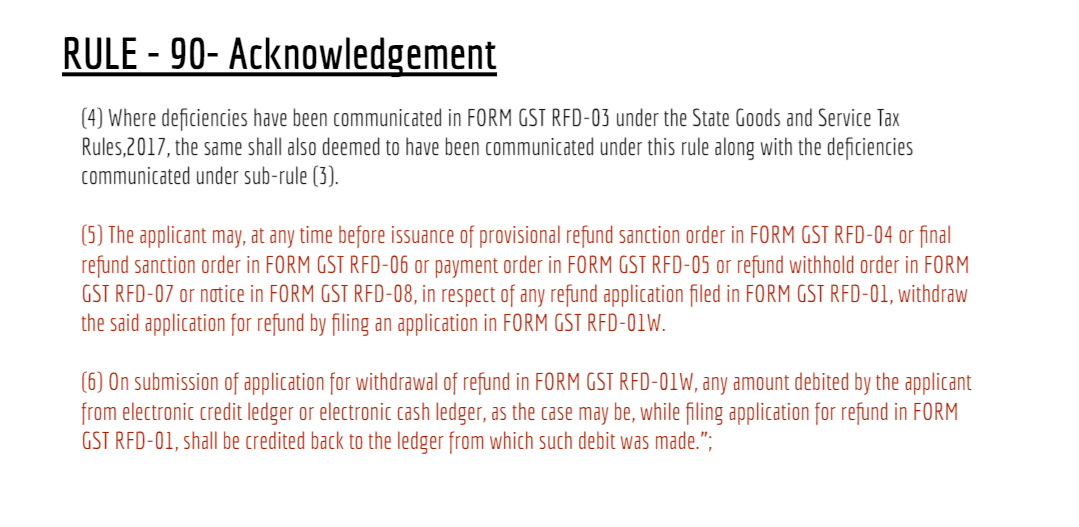

Rule 90(4) – WIthdrawal of refund

A new form is introduced for withdrawal of refund. The form is named as RFD-01W. Also on withdrawal of refund the amoun debited from the ledger will be recredited to the ledger.

Rule 92- Order in new form RFD 07

The old proviso is removed and form RFD 07 is amended. Relevant changes are also made the rules.

Related Topic:

Download List of GST Forms

Rule 138E- E way bill

Now only outward movements by a defaulting person will be restricted for E way bill. Earlier he was not eligible to make E way bill even for the inward movements. Now the rule is amended to include the outward movement only. In this rule there is a restriction on Eway bill if the TP defaults in the filing of returns. This applies to both normal taxpayer and composition taxpayer.

Changes in form REG 21, RFD 07, and new form RFD 01W introduced.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.