Animal feed and feed supplements constitute one class of products (Pdf Attach)

Table of Contents

Cases Covered

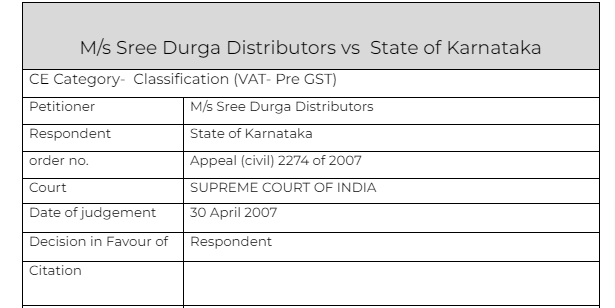

M/s Sree Durga Distributors vs State of Karnataka

Facts of the cases :

According to the appellant, dog feed and cat feed are the products which would fall in the category of animal feed under Entry 5. According to the appellant, Entry 5 deals with animal feed, feed supplements, namely, processed commodity sold as poultry feed, cattle feed, pig feed, fish feed, fish feed, fish meal, prawn feed, shrimp feed, feed supplements and mineral mixtures. According to the appellant, the words; poultry feed, cattle feed, and pig feed etc. are the specific instances of food supplements. According to the appellant, the word ’namely’ after the words ’feed supplements’ in Entry 5 shows that the Legislature intended the words ’feed supplements’ to be confined to poultry feed, cattle feed, pig feed, fish feed, fish meal, prawn feed and shrimp feed. In other words, according to the appellant, animal feed and feed supplements are two expressions in Entry 5 which should be read disjunctively and not conjunctively.

Observations & Judgement of the court :

The above quoted Entry 5 shows that animal feed and feed supplements is one category. It is after the expression “animal feed and feed supplements” that the Legislature has inserted the comma, therefore, animal feed and feed supplements constitute one class of products, they do not constitute two separate classes. Further, the expression “animal feed and feed supplements” is not only followed by the comma, it is followed by the word ’namely’, which indicates that the items mentioned after the word ’namely’ like poultry feed, cattle feed, pig feed, fish feed etc. are specific instances of animal feed and feed supplements, which would fall in Entry 5. That list is exhaustive

Read & Download the Full M/s Sree Durga Distributors vs State of Karnataka

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.