Annual amount paid for land leased by MIDC is premium/Salami and not interest- CESTAT

Table of Contents

Amount paid monthly will be considered as rent?

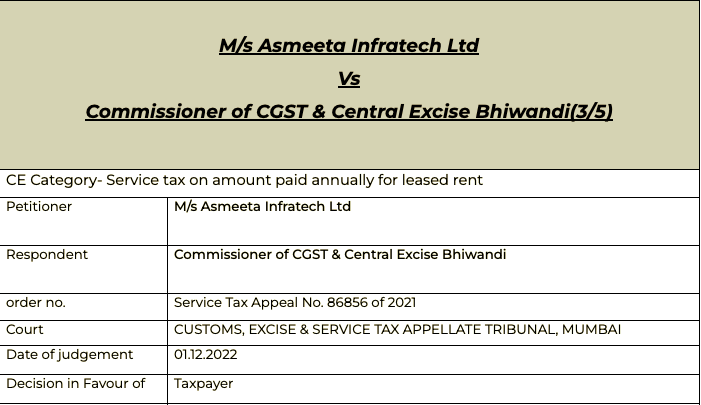

In a recent ruling the CESTAT held that the amount paid annually for leased land is not rent. The amount is premium/salami. It is not taxable under the service tax.

The case argued by advocate Bharat Raichandani. In this case the tribunal held that the amount paid is not interest.

Citation

Greater Noida Industrial Development Authority Vs. CCE & ST, Noida – 2015

Gujarat Power Corporation Ltd. Vs. CCE & ST vide Final Order No. A/11392/2022 dated 18.11.2022

M/s Luxmi Township Ltd. Vs. Commissioner of CGST & CS, Siliguri vide Final Order No. 77349/2023 dated 18.10.2023

Case- Asmeeta Infratech Ltd Vs Commissioner of CGST & Central Excise

Pleading

To drop the order which confirmed the order for the levy of tax , interest and penalty on amount paid monthly.

Facts

The appellant in this case, is engaged in the business of

development of an Integrated Textile Park (ITP), launched by the Ministry of Textiles in the Government of India. ITP was set up with the objective of establishment of Integrated Hi-Tech Textile parks with infrastructures and manufacturing facilities, based on Public- Private Partnership (PPP) model. The said scheme was launched for facilitating textile unit/s to meet international environment and social standards by providing various subsidies. For carrying out the objective of this scheme, the appellant had applied for allotment of land, which was allotted by the Maharashtra Industrial Development Corporation (MIDC).

Paragraph 3.5 of the said agreement has provided that the lessee shall pay the annual lease rent of Re.1/- to the lessor. In addition to such lease rental, the said lessee had also paid one time premium to the appellant, which is generally considered as ‘Salami’. The department had interpreted that such premium amount received by the appellant should be treated as consideration for provision of taxable service under the category of ‘renting of immovable property’, defined under Section 66E ibid.

learned AR appearing for the Revenue reiterates the findings recorded in the impugned order and further submitted that since the premium amount was received by the appellant on periodical basis, the same should be considered as rent and since such rental amount is in context with immovable property, the provisions of taxable service under the category of renting of immovable property is squarely applicable for payment of Service Tax on the amount of premium received by the appellant.

Observation

A lease is a transaction, which has to be supported by consideration. The consideration may be either premium or rent or both. The consideration which is paid periodically is called rent. As regards premium, the Apex Court in the case of Commissioner of Income Tax, Assam and Manipur v. Panbari Tea Co. Ltd. reported in (1965) 3 SCR 811 has made a distinction between premium and rent observing that when the interest of the lessor is parted with for a price, the price paid is premium or salami, but the periodical payments for continuous enjoyment are in the nature of rent, the former is a Capital Income and the latter is the revenue receipt. Thus, the premium is the price paid for obtaining the lease of an immovable property. While rent, on the other hand, is the payment made for use and occupation of the immovable property leased. Since taxing event under Section 65(105)(zzzz) read with Section 65(90a) is renting of immovable property, Service Tax would be leviable only on the element of rent i.e. the payments made for continuous enjoyment under lease which are in the nature of the rent irrespective of whether this rent is collected periodically or in advance in lump sum. Service Tax under Section 65(105)(zzzz) read with Section 65(90a) cannot be charged on the “premium” or ‘salami’ paid by the lessee to the lessor for transfer of interest in the property from the lessor to the lessee as this amount is not for continued enjoyment of the property leased. Since the levy of Service Tax is on renting of immovable property, not on transfer of interest in property from

lessor to lessee, Service Tax would be chargeable only on the rent whether it is charged periodically or at a time in advance. In these appeals, in the show cause notice dated 19-3-2012 issued by the Addl. Director, DGCEI, New Delhi, Service Tax has been demanded only on the lease rent and not on the premium amount while in the subsequent show cause notice dated 17-10-2012 issued by the Commissioner of Central Excise and Service Tax, Noida, the amount of premium has also been included in the lease rent for the purpose of charging of Service Tax for which no valid reasons have been given. Therefore, the Order-in-Original dated 30-4-2013 confirming the Service Tax demand on the premium amount is not correct and to this extent, the Service Tax demand would not be sustainable.”

In view of the settled position of law, we do not find any merits in the impugned order, insofar as it has confirmed the adjudged demands on the appellant. Therefore, by setting aside the impugned order, the appeal is allowed in favour of the appellant.

Read/download copy of the judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.