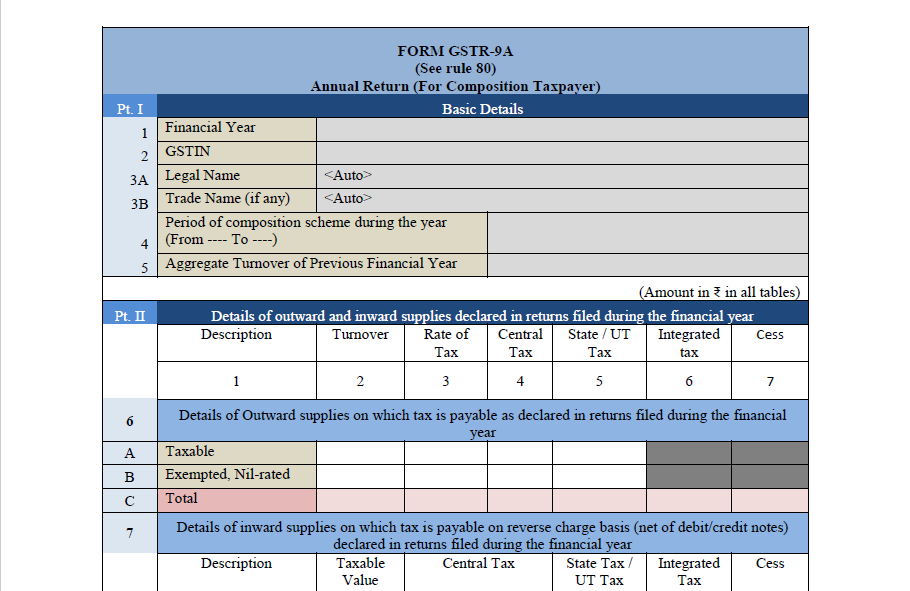

Format for Annual Return for Composition Dealer

Annual Return for Composition Dealer

The GST was applied from 1st July 2017 and the first financial year under the GST regime has finished. But the annual return is not issued till 4th September 2018. On 4th September 2018 CBEC has issued Notification No. 39/2018 by amending the CGST Rules. Which should be called Central Goods and Services Tax (Eighth Amendment) Rules, 2018.

There is two form issued for the Annual return one is for normal taxpayers and another one is for the composition dealer. In the above-mentioned notification, there are some major additions to the rules. But the most important and needed addition to the rules is the Form GSTR-9 for the Annual return under GST regime. This change is also one of the most awaited changes for which everyone related to the GST is waiting for. Whether the person is the taxpayer, consultant or GST Practitioners. Because the due date for filing the annual return is the end Dec 2018 for the Financial Year 2017-18. Also, there is no valid format for filing the annual return under GST Regime. All the taxpayers and practitioners are confused regarding the filing of the annual return.

Some people even think that the annual return will also be postponed, due to non-availability of the proper format. The people will feel ease after the release of proper format for filing the GST Annual return.

Download the Format of the Form GSTR-9 GST Annual Return for Composition Dealer by clicking the below image:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.