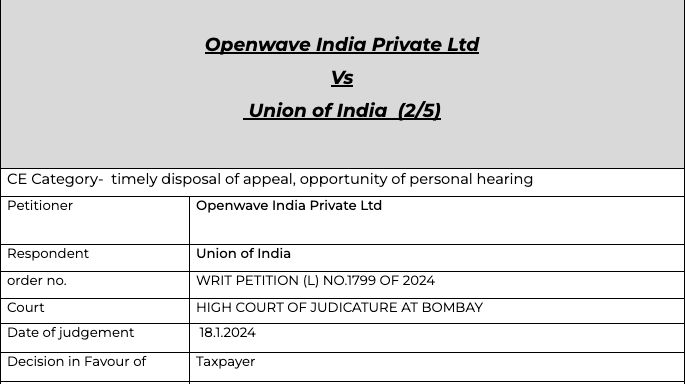

Appeal should be disposed off in a time bound manner

Table of Contents

Appeal shall be disposed off in time bound manner and the opportunity of personal hearing shall be provided.

The opportunity of personal hearing shall be provided. The appeal shall be disposed off in time bound manner even if there is no such limit under the law.

In this case the court asked the authorities to give the time for personal hearing. The taxpayer filed in appeal in 2019 and was following up since then. there was no response from the appellate authority.

(Author can be reached at shaifaly.ca@gmail.com)

Here the court asked the appellate authority to dispose off the appeal within 6 weeks.

Pleading

a) This Hon’ble Court be pleased to issue a writ of mandamus or a writ in the nature of certiorari or any other writ, order or direction under Article 226 of the Constitution of India directing the Respondent No.4 i.e. Joint Commissioner of State Tax Appeals to provide a fair and reasonable opportunity of personal hearing in appeal filed against Order-in-Original No.PUN-VAT-E-802/B-377, B-338, B-339, B-340 dated 31.12.2018, appeal filed against Order-in-Original No.DC-E802/B-1031 AND DCE-802-1032 dated 18.12.2019, appeal filed against Order-in-Original No.ZD270421019620U DCST/E-802/GST-RFD06 and ZD270421019641Q DCST/E802/GST-RFD06 dated 29.04.2022, appeal filed against Order-inOriginal No.ZD270521006281X DCST/E-802/GST-RFD06 dated 10.05.202

b) This Hon’ble Court be plesaed to issue a writ of mandamus or a writ in the nature of certiorari or any other writ, order or direction under Article 226 of the Constitution of India directing the Respondent no.4 to expeditiously pass a reasoned order the appeals filed against Orderin-Original No.PUN-VAT-E-802/B-337, B-338, B-339, B-340 dated 31.12.2018, appeal filed against Order-in-Original No.DC-E-802/B1031 AND DCE-802-1032 dated

18.12.2019, appeal filed against Order-in-Original No.ZD270421019620U DCST/E-802/GSTRFD06 and ZD270421019641Q DCST/E-802/GST-RFD06 dated 29.04.2022, appeal filed against Order-in-Original No.ZD270521006281X DCST/E-802/GST-RFD06 dated 10.05.2021.”

Fact

The Petitioner had entered into a Service Agreement dated 1st April 2020 with Openwave Mobility Inc. For the period prior to April 2020, the Petitioner was providing services to Openwave Mobility Inc. under an Agreement dated 4th June 2012. In terms of the above Agreements, the Petitioner was providing technical consultancy services and software development services to Openwave Mobility Inc.

It is the case of the Petitioner that, as per Section 2(6) of the Integrated Goods and Service Tax Act, 2017 (“IGST Act”), the transaction which was the subject matter of the said Agreements qualified as a transaction for export of services. Further, it is also the case of the Petitioner that, as per Section 16 of the IGST Act, export of goods or services or both is terms as “Zero rated supply”. Accordingly, as per the provisions of Section 54 of the Central Goods and Services Tax Act (“CGST Act”), the Petitioner filed applications for refund of unutilised IGSTcredit on such export of services without payment of tax and refund of tax paid on such export of goods in case of export of services with payment of tax.

Observation

Even if a statute does not prescribe the time within which the Order is required to be passed by the Appellate Authority, such an Order must be passed within a reasonable period of time. In the present case, the said Appeals have been filed by the Petitioner in 2019, 2020 and 2021. Even considering the disruption caused by the COVID-19 Pandemic, Respondent No.4 ought to have passed Orders in the said Appeals by now.

In the aforesaid circumstances, and for the aforesaid reasons, the following Orders are passed:

- Respondent No.4 is ordered and directed to pass orders in the said Appeals within a period of six weeks from the date this Order is intimated to Respondent No.4 after giving the Petitioner an opportunity of personal hearing in each of the said Appeals. b. Rule is made absolute in the aforesaid terms.

- In the facts and circumstances of the case, there will be no order as to costs.

Read and download the copy of judgment- Openwave India private ltd Vs Union of India

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.