Attachment should be done only when it is necessary for protection of revenue (Pdf Attach)

Table of Contents

Cases Covered:

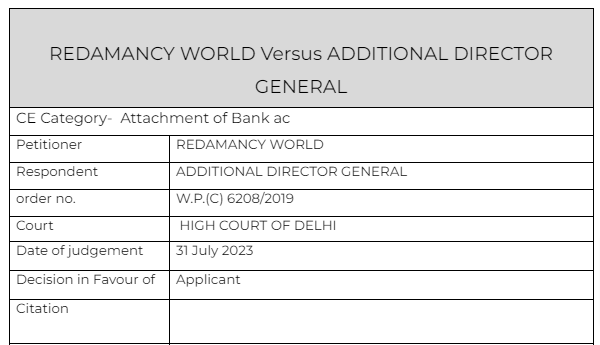

REDAMANCY WORLD Versus ADDITIONAL DIRECTOR GENERAL

Facts of the cases :

The petitioner became aware that its bank account was directed to be frozen by an communication dated 29.04.2019 (Letter No.DGGI/GZU/INV/Gr-E/REDAMANCY/191/2018-19) from a letter dated 24.05.2019, issued by Canara Bank, sent in response to its letter dated 23.05.2019.

It is apparent that no order in the requisite Form GST DRC-22 was issued to the petitioner.

The petitioner also impugns the communication sent to various customers of the petitioner directing them not to make payments for the goods supplied by the petitioner.

Observations & Judgement of the court

Section 83 of the CGST Act empowers the Commissioner to issue orders for provisional attachment of assets including the bank account of the taxpayer provided that it is necessary to protect the interest of the Revenue. We do not find that there is any specific noting in the files, to the effect that such an action is necessary in the facts of the present case. Although, the files produced today indicate that there are allegations of wrongful availment of Input Tax Credit by the petitioner and the respondent authorities are also investigating the chain of suppliers

The communications issued to the petitioner’s customers restraining them from making any payment against supplies made by the petitioner is also without authority of law. But the same is withdrawn the provisional attachment of the bank account is concerned, even if an order under Section 83 of the CGST Act was issued, the same would have lapsed by virtue of Section 83(2) of the CGST Act.

Thus the grievance doesnt exist anymore.

Read & Download the Full REDAMANCY WORLD Versus ADDITIONAL DIRECTOR GENERAL

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.