Irrespective of Retrospective Amendment – Form GST TRAN -1 Can be Filed Till 30.06.2020

Delhi High Court

SKH SHEET METALS COMPONENTS

Versus

UNION OF INDIA & ORS.

W.P.(C) 13151/2019 dated […]

A. What it is about?

In a major relief to media company New Delhi Television Ltd (NDTV), the Supreme Court on 03.04.2020 allowed its appeal to quash the notice issued by the Income Tax Department seeking to […]

Notifications issued as on 9th June 2020

1. Notification 45/2020 dated 9th June 2020

The transition procedure prescribed by CBIC to ascertain tax period, to transfer ITC and taxes for persons whose place of […]

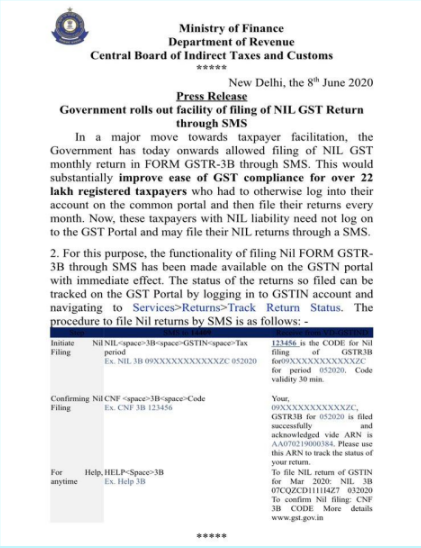

To make the compliance easier for taxpayers, the Government on today i.e. 08.06.2020 allowed the filing of Nil GST monthly return in FORM GSTR-3B through SMS.

This w […]

IBBI Imposes Penalty on an Insolvency Professional; Penalty Levied For Moratorium Violation by Allowing Transfer of Assets of a Corporate Debtor During CIRP

1. Brief Facts of the Case:-

In exercise of its […]

National Anti Profiteering Authority (NAA) Imposes Penalty For Profiteering Amount And Directed It To Be Deposited In Consumer Welfare Funds In The Case Of Rahul Sharma Vs Tanya Enterprises

1.1. Brief Facts Of […]

Maharashtra State Warehousing Corporation Versus DCIT

Business loss on giving effect to ITAT’s order to be carried forward even if no claim raised in subsequent ITRs.

TOPIC A: – MAHARASHTRA STATE WAREHOUSING […]

Misuse of DFCE Scheme Delhi HC Imposes One Lakh Rupees Cost on Exporter to Deposit in ‘PM CAREs’ Fund

A. The Delhi High Court has recently imposed a cost of Rs. 1,00,000 on an exporter for

Background

A. The most effective and lethal weapon used by the government against evasive tactics used by the assessee, to convert their unaccounted money in accounted one is section 68 of the Income Act […]

A plea based on equity or/and hardship is not legally sustainable and the constitutional validity of taxing provisions cannot be struck down on such reasoning: Supreme Court

In Prashanti Medical Services & […]

CA Udit Swami

@ca-udit-swami

active 5 years, 8 months agoCA Udit Swami

OOPS!

No Packages Added by CA Udit Swami. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

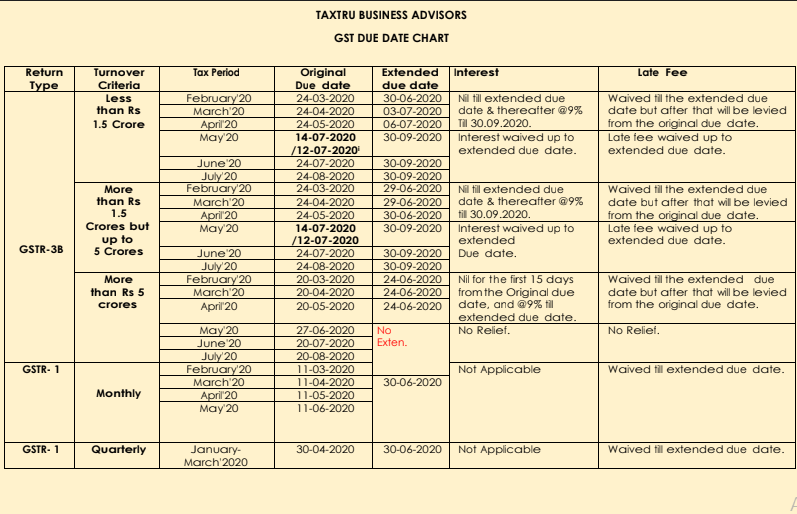

Read InterviewCA Udit Swami wrote a new post, GSTR-3B and GSTR-1 Compliance Calendar for Period February to May 2020 5 years, 7 months ago

GST Due Date Chart

Return

Type

Turnover

Criteria

Tax Period

Original

Due date

Extended

due date

Interest

Late Fee

GSTR-3B

Less

than Rs

1.5 […]

CA Udit Swami wrote a new post, Irrespective of Retrospective Amendment – Form GST TRAN -1 Can be Filed Till 30.06.2020 5 years, 8 months ago

Irrespective of Retrospective Amendment – Form GST TRAN -1 Can be Filed Till 30.06.2020

Delhi High Court

SKH SHEET METALS COMPONENTS

Versus

UNION OF INDIA & ORS.

W.P.(C) 13151/2019 dated […]

CA Udit Swami wrote a new post, New Delhi Television Ltd. Vs. Deputy Commissioner of Income Tax 5 years, 8 months ago

A. What it is about?

In a major relief to media company New Delhi Television Ltd (NDTV), the Supreme Court on 03.04.2020 allowed its appeal to quash the notice issued by the Income Tax Department seeking to […]

CA Udit Swami wrote a new post, GST Insight on Recent Notifications and Circulars 5 years, 8 months ago

Notifications issued as on 9th June 2020

1. Notification 45/2020 dated 9th June 2020

The transition procedure prescribed by CBIC to ascertain tax period, to transfer ITC and taxes for persons whose place of […]

CA Udit Swami wrote a new post, Enablement of SMS For Filing GSTR-3B on portal 5 years, 8 months ago

Enablement of SMS For Filing GSTR-3B

To make the compliance easier for taxpayers, the Government on today i.e. 08.06.2020 allowed the filing of Nil GST monthly return in FORM GSTR-3B through SMS.

This w […]

CA Udit Swami wrote a new post, IBBI Imposes Penalty on an Insolvency Professional; Penalty Levied For Moratorium Violation by Allowing Transfer of Assets of a Corporate Debtor During CIRP 5 years, 8 months ago

IBBI Imposes Penalty on an Insolvency Professional; Penalty Levied For Moratorium Violation by Allowing Transfer of Assets of a Corporate Debtor During CIRP

1. Brief Facts of the Case:-

In exercise of its […]

CA Udit Swami wrote a new post, Rahul Sharma Vs Tanya Enterprises: Part I 5 years, 8 months ago

National Anti Profiteering Authority (NAA) Imposes Penalty For Profiteering Amount And Directed It To Be Deposited In Consumer Welfare Funds In The Case Of Rahul Sharma Vs Tanya Enterprises

1.1. Brief Facts Of […]

CA Udit Swami wrote a new post, Maharashtra State Warehousing Corporation Versus DCIT & ITR Changes 5 years, 8 months ago

Maharashtra State Warehousing Corporation Versus DCIT

Business loss on giving effect to ITAT’s order to be carried forward even if no claim raised in subsequent ITRs.

TOPIC A: – MAHARASHTRA STATE WAREHOUSING […]

CA Udit Swami wrote a new post, Maharashtra Govt. Issues Clarification on GST Appeals in regard to Non-Constitution of Appellate Tribunal 5 years, 8 months ago

Maharashtra Govt. Issues Clarification on GST Appeals in regard to Non-Constitution of Appellate Tribunal

1.

The Government received various representations that have been received wherein the issue […]

CA Udit Swami wrote a new post, Misuse of Duty-Free Credit Entitlement Scheme (DFCE) 5 years, 8 months ago

Misuse of DFCE Scheme Delhi HC Imposes One Lakh Rupees Cost on Exporter to Deposit in ‘PM CAREs’ Fund

A. The Delhi High Court has recently imposed a cost of Rs. 1,00,000 on an exporter for

The blatant […]

CA Udit Swami wrote a new post, Taxability of Bogus Share Capital Under Section 68 of Income Tax Act 1961 5 years, 8 months ago

Background

A. The most effective and lethal weapon used by the government against evasive tactics used by the assessee, to convert their unaccounted money in accounted one is section 68 of the Income Act […]

CA Udit Swami wrote a new post, Prashanti Medical Services & Research Foundation 5 years, 8 months ago

A plea based on equity or/and hardship is not legally sustainable and the constitutional validity of taxing provisions cannot be struck down on such reasoning: Supreme Court

In Prashanti Medical Services & […]

CA Udit Swami wrote a new post, New Claim While Responding to Notice U/s 153A of I.T. Act 1961 5 years, 8 months ago

PCIT v. JSW Steel Limited [2020]

Hon’ble Bombay High court in the case of PCIT v. JSW Steel Limited [2020] adjudicated the following issues:

Whether assessee can make an additional claim in return of […]