GST on Real Estate

Benjamin Franklin once quoted taxes as one of the inevitable certainties in this world, and when it comes to purchasing residential area estate in India, homebuyers have had to deal with many […]

Deemed Duty Drawback under GST

It is a pleasure to send the following Article on Deemed Duty Drawback under GST law. The main motto of the govt. is to garb the export incentive to the exporter & supply of goods […]

On 30th July 2020, the Central Board of Indirect Taxes and Customs (CBIC) released a notification and introduced the “Schema for E-Invoice” for imposing the e-i […]

Principles of Classification

Under indirect tax laws, classification is the categorization of goods and services crucial to ascertain whether a subject matter is eligible to tax, exemption, rate of tax, etc. […]

New TDS Return 01.07.2020

1. In the Income-tax Rules, 1962 in rule 31A, in sub-rule (4):

As per the amendment under rule 31A (4) (viii) of the Income-tax Act, the word ‘not deducted’ now shall be inserted wit […]

Search, Seizure, Inspection, and Arrest

Taxation is one of the most sources of revenue to the government. Our government has performed various methods to stop tax evasion but tax evasion is the major problem in […]

Service of Notice Under GST Regime

“Service” means giving legally required notice to other parties that you have filed papers asking for a court order that may affect them. The court papers can only be del […]

Show Cause Notice Under GST Regime

Demand and recovery can be initiated for short-levy, non-levy, short paid, non-paid, erroneous refund, wrong availment, and incorrect utilization of input tax credit. All demand […]

As we know that the basic motive of the principle of natural justice is to ensure fairness in social and economic activities of the people and also shields i […]

The following is the Article on the taxability of Movable and Immovable property in the pre-GST Regime & Post GST Regime. In this article Hon’ble High Court category explains the meaning of m […]

Warehousing / Bonded Movement Under Customs Act, 1962 And Provisional Assessment

In This Article, We Will analyze various Provisions of Custom Laws in context to “Custom Bonded Warehousing, Warehousing/bonded m […]

Introduction:

A case of remission of duty on work-in-progress and semi-finished goods due to fire broke out in the factory.2014 (308) E.L.T. 431 (Tri. – Del.)

IN THE CESTAT, PRINCIPAL BENCH, NEW DELHI

Introduction

In The Era of GST, there is a clause mentioned in the Act that “WRONG AVAIMENT Or UTILIZATION “of ITC will attract penal provision(Section 73 r/w Section 122).

The same provisions were there in […]

Case Covered:

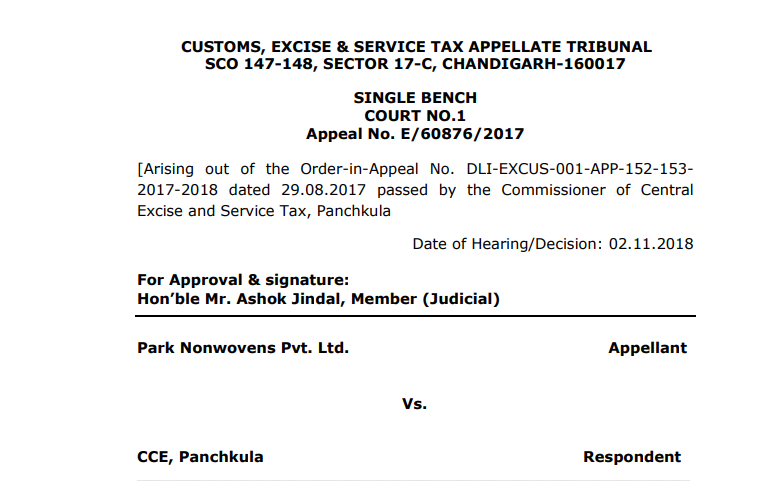

Park Nonwovens Pvt. Ltd.

Versus

CCE, Panchkula

Read the full text of the case here.

Introduction:

The above cited case which was argued by me relates to remission of duty on final […]

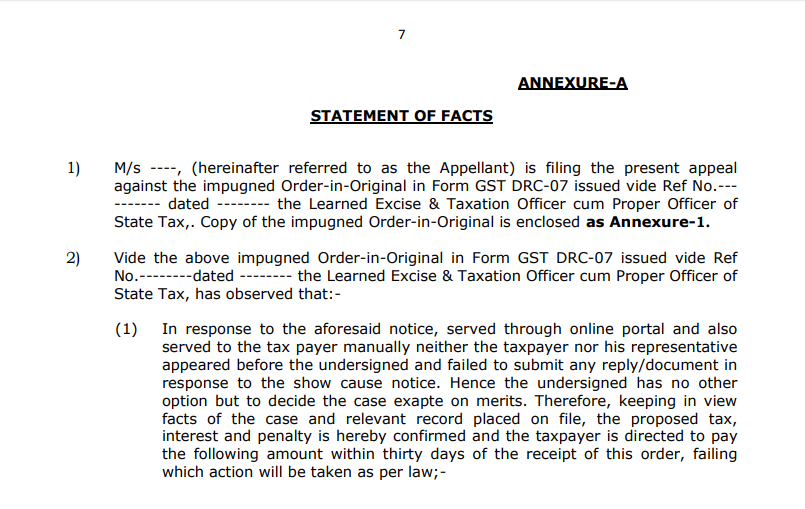

STATEMENT OF FACTS

1) M/s —-, (hereinafter referred to as the Appellant) is filing the present appeal against the impugned Order-in-Original in Form GST DRC-07 issued vide Ref No.— ——- dated ——– the […]

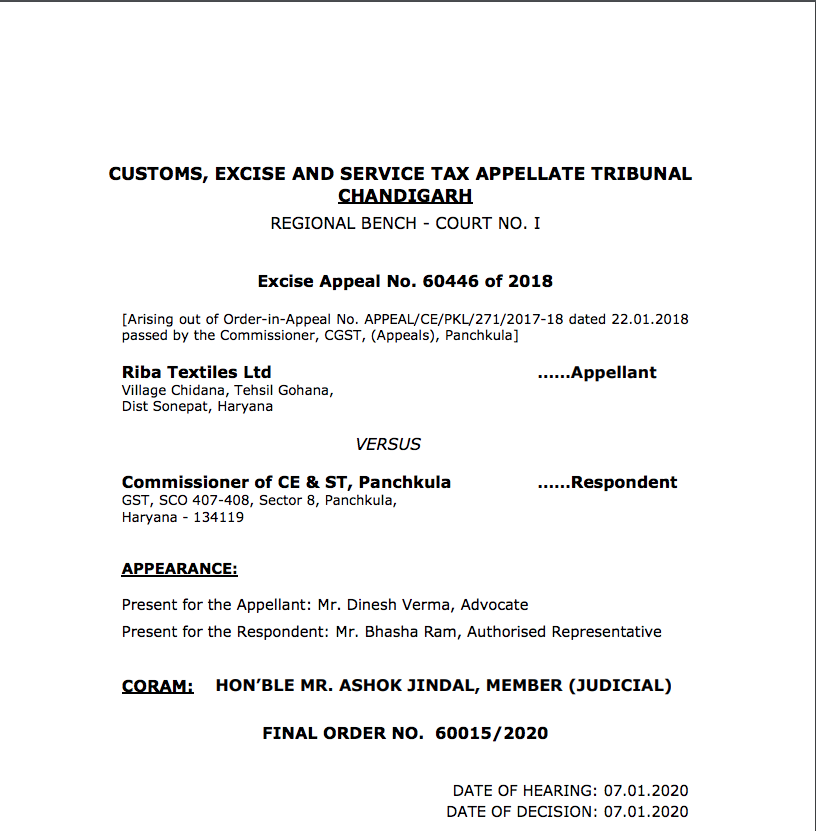

Appellant is entitled to interest for the period from the date of deposit: RIBA Textiles

The Hon’ble Cestat Chandigarh Bench in the case of RIBA TEXTILE LTD. Vs. CCE & ST PANCHKULA, after examining various […]

Advocate Dinesh Verma

@dinesh-verma

Not recently activeAdvocate Dinesh Verma

OOPS!

No Packages Added by Advocate Dinesh Verma. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewAdvocate Dinesh Verma wrote a new post, CGST Commissioner Order in the case of M/s Indian Oil Corporation Limited. 4 years, 9 months ago

1. This copy is granted free of charge for the private use of the person (s) to whom it is sent.

2. Any person aggrieved with this Order may appeal against this Order to the Customs, Excise and Service […]

Advocate Dinesh Verma wrote a new post, GST on Real Estate 5 years ago

GST on Real Estate

Benjamin Franklin once quoted taxes as one of the inevitable certainties in this world, and when it comes to purchasing residential area estate in India, homebuyers have had to deal with many […]

Advocate Dinesh Verma wrote a new post, Deemed Duty Drawback under GST 5 years, 4 months ago

Deemed Duty Drawback under GST

It is a pleasure to send the following Article on Deemed Duty Drawback under GST law. The main motto of the govt. is to garb the export incentive to the exporter & supply of goods […]

Advocate Dinesh Verma wrote a new post, format of GST Appeal Final Commissioner (Appeal) 5 years, 5 months ago

Format of GST Appeal to Final Commissioner (Appeal)

Format of GST Appeal- Form GST APL – 01

[See Rule 108(1)]

Appeal to Appellate Authority

1.

GSTIN/TEMPORARY ID/UIN

XXXXX

2.

The legal n […]

Advocate Dinesh Verma wrote a new post, E-Invoice Schema Format – Mandatory Fields 5 years, 5 months ago

E-Invoice Schema Format – Mandatory Fields

On 30th July 2020, the Central Board of Indirect Taxes and Customs (CBIC) released a notification and introduced the “Schema for E-Invoice” for imposing the e-i […]

Advocate Dinesh Verma wrote a new post, Principles of Classification 5 years, 7 months ago

Principles of Classification

Under indirect tax laws, classification is the categorization of goods and services crucial to ascertain whether a subject matter is eligible to tax, exemption, rate of tax, etc. […]

Advocate Dinesh Verma wrote a new post, New TDS Return 01.07.2020 5 years, 7 months ago

New TDS Return 01.07.2020

1. In the Income-tax Rules, 1962 in rule 31A, in sub-rule (4):

As per the amendment under rule 31A (4) (viii) of the Income-tax Act, the word ‘not deducted’ now shall be inserted wit […]

Advocate Dinesh Verma wrote a new post, Search, Seizure, Inspection, and Arrest 5 years, 7 months ago

Search, Seizure, Inspection, and Arrest

Taxation is one of the most sources of revenue to the government. Our government has performed various methods to stop tax evasion but tax evasion is the major problem in […]

Advocate Dinesh Verma wrote a new post, Service of Notice Under GST Regime 5 years, 7 months ago

Service of Notice Under GST Regime

“Service” means giving legally required notice to other parties that you have filed papers asking for a court order that may affect them. The court papers can only be del […]

Advocate Dinesh Verma wrote a new post, Show Cause Notice Under GST Regime 5 years, 7 months ago

Show Cause Notice Under GST Regime

Demand and recovery can be initiated for short-levy, non-levy, short paid, non-paid, erroneous refund, wrong availment, and incorrect utilization of input tax credit. All demand […]

Advocate Dinesh Verma wrote a new post, Principle of Natural Justice 5 years, 7 months ago

Principle of Natural Justice

Respected Member’s

As we know that the basic motive of the principle of natural justice is to ensure fairness in social and economic activities of the people and also shields i […]

Advocate Dinesh Verma wrote a new post, Movable and Immovable Property 5 years, 7 months ago

Respected Members,

The following is the Article on the taxability of Movable and Immovable property in the pre-GST Regime & Post GST Regime. In this article Hon’ble High Court category explains the meaning of m […]

Advocate Dinesh Verma wrote a new post, Custom Bonding Warehousing and Provisional and Final Assessment in Custom 5 years, 9 months ago

Warehousing / Bonded Movement Under Customs Act, 1962 And Provisional Assessment

In This Article, We Will analyze various Provisions of Custom Laws in context to “Custom Bonded Warehousing, Warehousing/bonded m […]

Advocate Dinesh Verma wrote a new post, remission of duty on work-in-progress and semi-finished goods due to fire broke out in the factory 5 years, 9 months ago

Introduction:

A case of remission of duty on work-in-progress and semi-finished goods due to fire broke out in the factory.2014 (308) E.L.T. 431 (Tri. – Del.)

IN THE CESTAT, PRINCIPAL BENCH, NEW DELHI

PARK N […]

Advocate Dinesh Verma wrote a new post, CESTAT in the case of Shiv Om Paper Mills Pvt. Ltd. Versus Commissioner of C. EX. 5 years, 9 months ago

Introduction

In The Era of GST, there is a clause mentioned in the Act that “WRONG AVAIMENT Or UTILIZATION “of ITC will attract penal provision(Section 73 r/w Section 122).

The same provisions were there in […]

Advocate Dinesh Verma wrote a new post, Park Remission of duty and Warning to Commissioner 5 years, 10 months ago

Case Covered:

Park Nonwovens Pvt. Ltd.

Versus

CCE, Panchkula

Read the full text of the case here.

Introduction:

The above cited case which was argued by me relates to remission of duty on final […]

Advocate Dinesh Verma wrote a new post, Draft appeal to appellate authority 5 years, 10 months ago

STATEMENT OF FACTS

1) M/s —-, (hereinafter referred to as the Appellant) is filing the present appeal against the impugned Order-in-Original in Form GST DRC-07 issued vide Ref No.— ——- dated ——– the […]

Advocate Dinesh Verma wrote a new post, Appellant is entitled to interest for the period from the date of deposit: RIBA Textiles 6 years, 1 month ago

Appellant is entitled to interest for the period from the date of deposit: RIBA Textiles

The Hon’ble Cestat Chandigarh Bench in the case of RIBA TEXTILE LTD. Vs. CCE & ST PANCHKULA, after examining various […]