Procedures and Returns under UAE VAT

Article (71) of the Decree Law

VAT Return, also known as ‘Tax return’ is a periodical statement which a registered person needs to submit to the authority. The details and […]

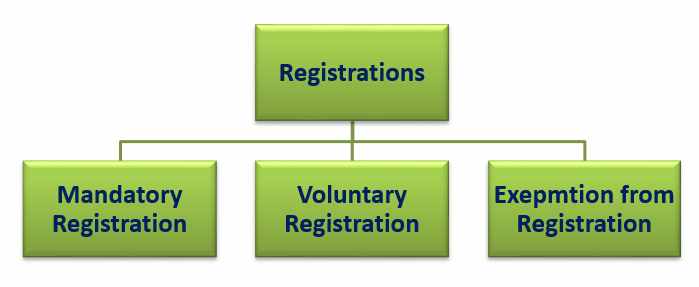

Registration under UAE VAT

Registration under UAE VAT law means that a business is acknowledged by the government, as a supplier of Goods and Services and is authorized to collect VAT from customers and remit […]

Valuation of Supplies, Job Work and Transitional Provisions under UAE VAT

Valuation of Supplies under UAE VAT

Being a completely new form of indirect taxation there are many questions in the minds of the […]

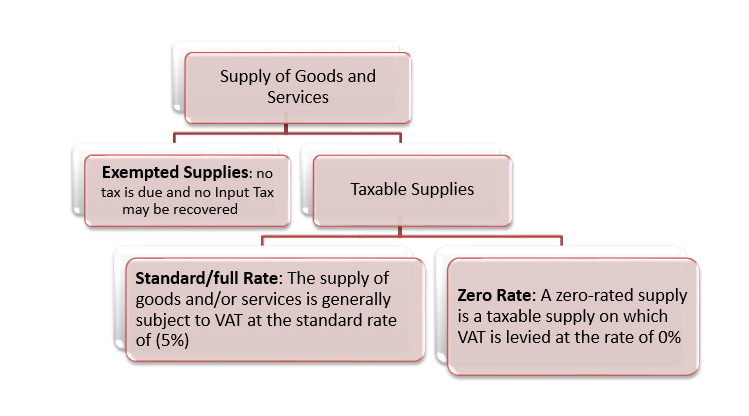

Input Credit and Tax Payments under UAE VAT

VAT in UAE is a general consumption tax which will be levied on the majority of transactions of goods and services unless specifically exempted by the Law. Under this, […]

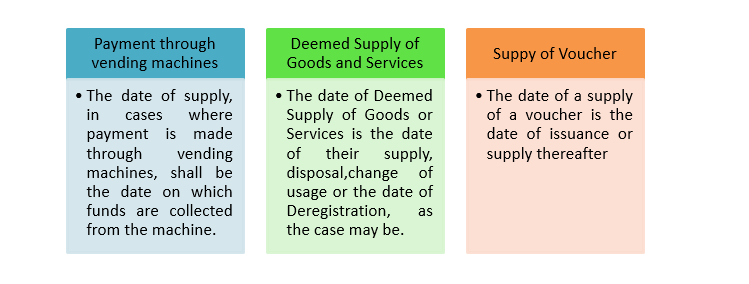

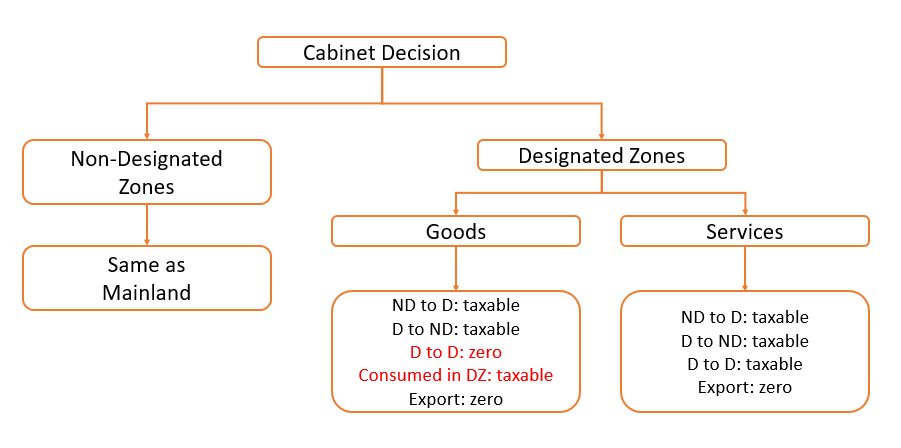

Date and Place of Supply under UAE VAT

The tax which has been levied and needs to be assessed, will require a specific date to be established for the transaction for taxpayer and tax administration to carry out […]

Introduction of VAT in UAE

GCC i.e. Gulf Cooperation Council is a political and economic alliance of six middle eastern countries- Saudi Arabia, Kuwait, UAE, Qatar, Bahrain and Oman. The GCC was established in […]

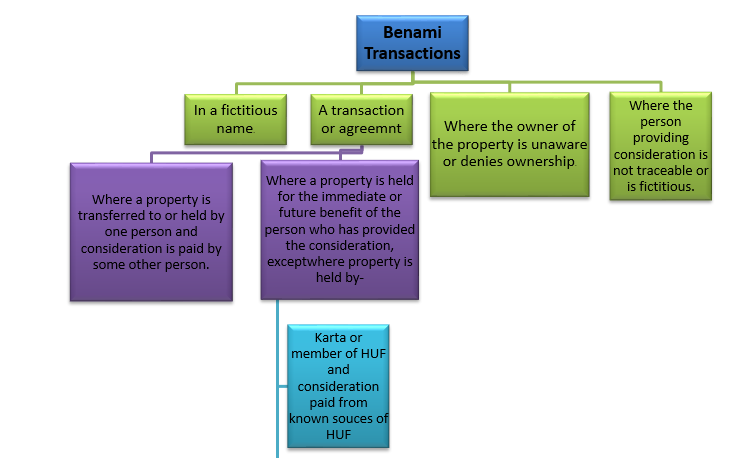

Benami Transaction (Prohibition) Act, 1988

History of Benami Transactions

Benami is a Persian term which essentially means something “without a name”. However, in the present context, it means proxy. So, a ben […]

UAE VAT- Important Definitions and Meaning

In the application of the provisions of this Decree-Law, the following words and expressions shall have the meanings assigned against each unless the context otherwise […]

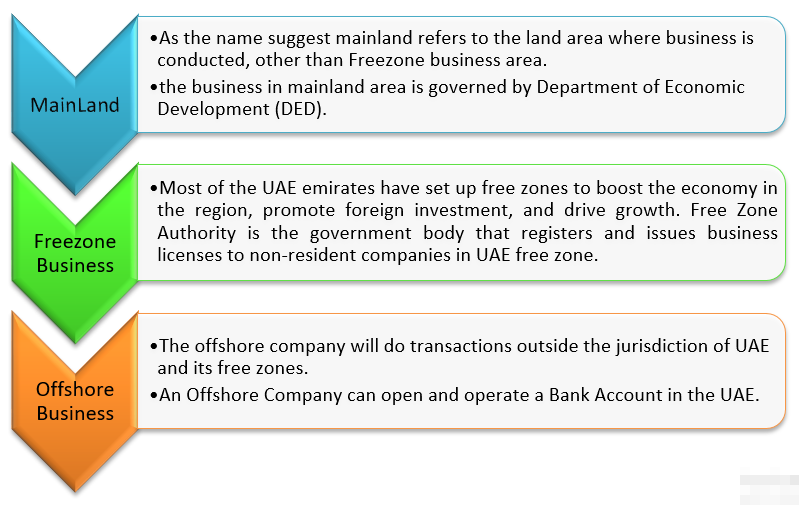

How to operate Business in UAE

Your type of business in will determine the kind of license you require to operate Business in UAE. Whether it’s commercial, professional or industrial licenses, these will define […]

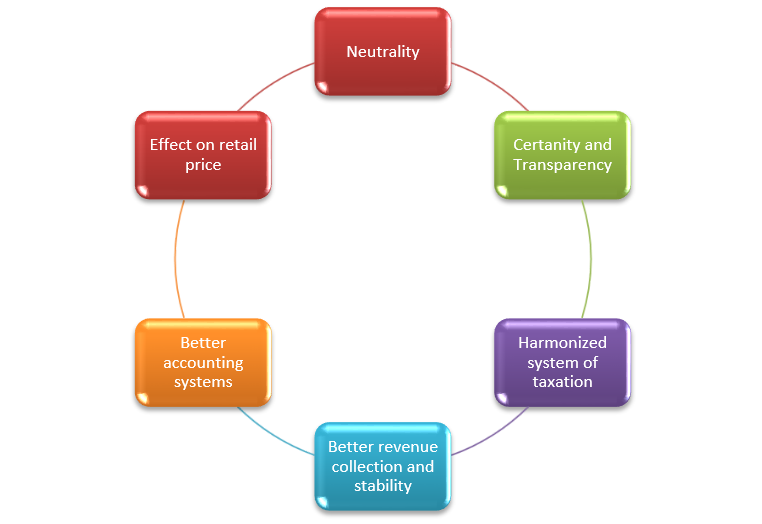

UAE – VAT (VALUE ADDED TAX)

The word tax has not been specifically defined under any Law. However, it simply means compulsory extortion of money by any Government within Constitutional power of the Country. I […]

There shall be levied a tax called the Central/State Goods and Services Tax (CGST/SGST) on all intra-State supplies of goods and/or services on the value determined under section 15 and at such rates as may be n […]

A detailed analysis of Section 12 for time of supply in GST

As per Section 12 (1) of Model GST law the liability to pay CGST / SGST on the goods or services shall arise at the time of supply . The time of supply […]

CA Deepak Bharti

@dipak

Not recently activeCA Deepak Bharti

Registered Categories

Location

Delhi, India

OOPS!

No Packages Added by CA Deepak Bharti. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Deepak Bharti wrote a new post, Procedures and Returns under UAE VAT 7 years, 2 months ago

Procedures and Returns under UAE VAT

Article (71) of the Decree Law

VAT Return, also known as ‘Tax return’ is a periodical statement which a registered person needs to submit to the authority. The details and […]

CA Deepak Bharti wrote a new post, Registration under UAE VAT 7 years, 2 months ago

Registration under UAE VAT

Registration under UAE VAT law means that a business is acknowledged by the government, as a supplier of Goods and Services and is authorized to collect VAT from customers and remit […]

CA Deepak Bharti wrote a new post, Valuation of Supplies, Job Work and Transition under UAE VAT 7 years, 2 months ago

Valuation of Supplies, Job Work and Transitional Provisions under UAE VAT

Valuation of Supplies under UAE VAT

Being a completely new form of indirect taxation there are many questions in the minds of the […]

CA Deepak Bharti wrote a new post, Input Credit and Tax Payments under UAE VAT 7 years, 2 months ago

Input Credit and Tax Payments under UAE VAT

VAT in UAE is a general consumption tax which will be levied on the majority of transactions of goods and services unless specifically exempted by the Law. Under this, […]

CA Deepak Bharti wrote a new post, Date and Place of Supply under UAE VAT 7 years, 2 months ago

Date and Place of Supply under UAE VAT

The tax which has been levied and needs to be assessed, will require a specific date to be established for the transaction for taxpayer and tax administration to carry out […]

CA Deepak Bharti wrote a new post, Introduction of VAT in UAE 7 years, 2 months ago

Introduction of VAT in UAE

GCC i.e. Gulf Cooperation Council is a political and economic alliance of six middle eastern countries- Saudi Arabia, Kuwait, UAE, Qatar, Bahrain and Oman. The GCC was established in […]

CA Deepak Bharti wrote a new post, Benami Transaction (Prohibition) Act, 1988 7 years, 2 months ago

Benami Transaction (Prohibition) Act, 1988

History of Benami Transactions

Benami is a Persian term which essentially means something “without a name”. However, in the present context, it means proxy. So, a ben […]

CA Deepak Bharti wrote a new post, UAE VAT- Important Definitions and Meaning 7 years, 6 months ago

UAE VAT- Important Definitions and Meaning

In the application of the provisions of this Decree-Law, the following words and expressions shall have the meanings assigned against each unless the context otherwise […]

CA Deepak Bharti wrote a new post, How to operate Business in UAE 7 years, 6 months ago

How to operate Business in UAE

Your type of business in will determine the kind of license you require to operate Business in UAE. Whether it’s commercial, professional or industrial licenses, these will define […]

CA Deepak Bharti‘s profile was updated 7 years, 6 months ago

CA Deepak Bharti wrote a new post, UAE – VAT (VALUE ADDED TAX) 7 years, 6 months ago

UAE – VAT (VALUE ADDED TAX)

The word tax has not been specifically defined under any Law. However, it simply means compulsory extortion of money by any Government within Constitutional power of the Country. I […]

CA Deepak Bharti wrote a new post, Levy of, and Exemption from, GST 9 years ago

There shall be levied a tax called the Central/State Goods and Services Tax (CGST/SGST) on all intra-State supplies of goods and/or services on the value determined under section 15 and at such rates as may be n […]

CA Deepak Bharti wrote a new post, Time of Supply of Goods & Services 9 years ago

A detailed analysis of Section 12 for time of supply in GST

As per Section 12 (1) of Model GST law the liability to pay CGST / SGST on the goods or services shall arise at the time of supply . The time of supply […]

CA Deepak Bharti became a registered member 10 years, 9 months ago