Mr. Deepak Bholusaria is a commerce graduate and fellow member of the Institute of Chartered Accountants of India. He has also completed various certificate courses of ICAI on Indirect taxes, Blockchain, Information Systems Audit, and Valuation. A seasoned professional, author, speaker, public figure and YouTuber with 21 years of experience.

This presentation on Changes in Income Tax Returns AY 2019-20 has been prepared for academic use only for sharing knowledge on the subject.

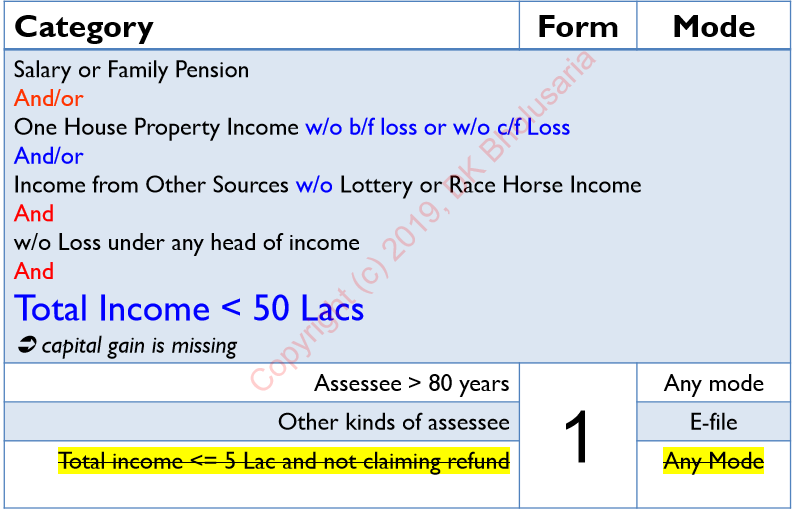

Change in e-filing mode

Compulsory e-filing

w.e.f. AY 2019-2020, […]

“Ignorance of the law is no excuse in any country. If it were, the laws would lose their effect, because it can always be pretended”. – Thomas Jefferson (1829).

Indian tax laws are perceived to be the second […]

ITR Forms issued For FY 2017-18

With the notification issued by the government of India, the ITR forms have been issued with the notification. There are some basic changes in the ITR forms. Following are ITR […]

Proposed drafts of GST Audit report is out (drafted by ICAI)

Indirect Taxes Committee of The Institute of Chartered Accountants of India has drafted following reports and Forms:

Online or offline? All about LUT

In order to make the export of goods or services, without payment of GST , a Letter of Undertaking (LUT) is required to be obtained under the provisions of Section 16 of IGST A […]

GST E-way bill explained

GST e-way bill is the new and latest hot topics for the people in market, consultancy and commerce. Every person want there basics cleared and GST e-way bill explained which is applied […]

Invoice Series for new Financial year under GST

As of April 3rd, 2018, GSTN portal does not allow you to enter same invoice number in 2018-2019, which you had entered in any GSTR-1 of 2017-2018. There should be […]

Due Dates for GSTR-1

Please be informed that Government of India, has reduced number of days for submission or due dates for GSTR-1(Monthly).

Till now there was a gap of 1 month and 10 days, with in the end of […]

HOW TO CHANGE EMAIL ID AND MOBILE NUMBER OF AUTHORISED SIGNATORY

a) So first login… and use non-core amendment option

b) Then edit existing authorised signatory… remove checkbox from Primary and save

c) […]

Deepak Bholusaria, CA

Quitters do not win, winners do not quit.

Paid User

@intellia

active 6 years agoDeepak Bholusaria, CA

Mr. Deepak Bholusaria is a commerce graduate and fellow member of the Institute of Chartered Accountants of India. He has also completed various certificate courses of ICAI on Indirect taxes, Blockchain, Information Systems Audit, and Valuation. A seasoned professional, author, speaker, public figure and YouTuber with 21 years of experience.

Registered Categories

Location

Delhi, India

OOPS!

No Packages Added by Deepak Bholusaria, CA. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewDeepak Bholusaria, CA wrote a new post, Resolution to GST audit major issues based on ICAI’s Guide 6 years ago

Writeup from the technical guide of ICAI

Based on major issues discussed in various groups, I have tried to compile this draft.

Table

Writeup as per technical guide of ICAI

Table 9

The purpose […]

Deepak Bholusaria, CA wrote a new post, Changes in Income Tax Returns AY 2019-20 6 years, 9 months ago

This presentation on Changes in Income Tax Returns AY 2019-20 has been prepared for academic use only for sharing knowledge on the subject.

Change in e-filing mode

Compulsory e-filing

w.e.f. AY 2019-2020, […]

Deepak Bholusaria, CA wrote a new post, Changes in ITR for AY 2018-19 7 years, 10 months ago

Changes in ITR for AY 2018-19

Section 139 Changes

Changes in Section 139(4c)

Addition to the list of section 139(4c):

Persons referred in Section 10(23AAA)

The beneficiary of funds established for t […]

Deepak Bholusaria, CA wrote a new post, Is Your Landlord an NRI? Let’s Understand If You Are on the Right Side of Tax Law Compliance 7 years, 10 months ago

“Ignorance of the law is no excuse in any country. If it were, the laws would lose their effect, because it can always be pretended”. – Thomas Jefferson (1829).

Indian tax laws are perceived to be the second […]

Deepak Bholusaria, CA wrote a new post, ITR Forms issued For FY 2017-18 7 years, 10 months ago

ITR Forms issued For FY 2017-18

With the notification issued by the government of India, the ITR forms have been issued with the notification. There are some basic changes in the ITR forms. Following are ITR […]

Deepak Bholusaria, CA wrote a new post, Proposed drafts of GST Audit report is out (drafted by ICAI) 7 years, 10 months ago

Proposed drafts of GST Audit report is out (drafted by ICAI)

Indirect Taxes Committee of The Institute of Chartered Accountants of India has drafted following reports and Forms:

Draft Form GSTR 9C – bein […]

Deepak Bholusaria, CA wrote a new post, Online or offline? All about LUT 7 years, 10 months ago

Online or offline? All about LUT

In order to make the export of goods or services, without payment of GST , a Letter of Undertaking (LUT) is required to be obtained under the provisions of Section 16 of IGST A […]

Deepak Bholusaria, CA wrote a new post, GST E-way bill explained 7 years, 10 months ago

GST E-way bill explained

GST e-way bill is the new and latest hot topics for the people in market, consultancy and commerce. Every person want there basics cleared and GST e-way bill explained which is applied […]

Deepak Bholusaria, CA wrote a new post, Invoice Series for new Financial year under GST 7 years, 10 months ago

Invoice Series for new Financial year under GST

As of April 3rd, 2018, GSTN portal does not allow you to enter same invoice number in 2018-2019, which you had entered in any GSTR-1 of 2017-2018. There should be […]

Deepak Bholusaria, CA wrote a new post, Due Dates for GSTR-1 7 years, 10 months ago

Due Dates for GSTR-1

Please be informed that Government of India, has reduced number of days for submission or due dates for GSTR-1(Monthly).

Till now there was a gap of 1 month and 10 days, with in the end of […]

Deepak Bholusaria, CA‘s profile was updated 7 years, 11 months ago

Deepak Bholusaria, CA changed their profile picture 7 years, 11 months ago

Deepak Bholusaria, CA changed their profile picture 7 years, 11 months ago

Deepak Bholusaria, CA changed their profile picture 7 years, 11 months ago

Deepak Bholusaria, CA changed their profile picture 7 years, 11 months ago

Deepak Bholusaria, CA changed their profile picture 7 years, 11 months ago

Deepak Bholusaria, CA changed their profile picture 7 years, 11 months ago

Deepak Bholusaria, CA changed their profile picture 7 years, 11 months ago

Deepak Bholusaria, CA changed their profile picture 7 years, 11 months ago

Deepak Bholusaria, CA wrote a new post, How to Change Email ID and Mobile Number of Authorised Signatory? 8 years, 1 month ago

HOW TO CHANGE EMAIL ID AND MOBILE NUMBER OF AUTHORISED SIGNATORY

a) So first login… and use non-core amendment option

b) Then edit existing authorised signatory… remove checkbox from Primary and save

c) […]