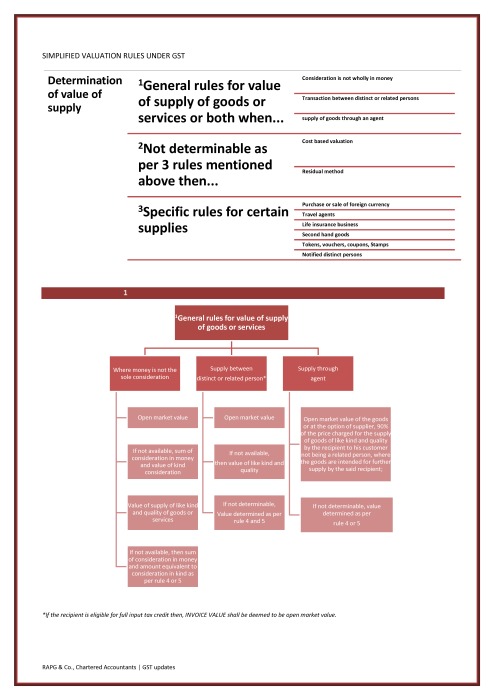

GST Valuation rules flowchart

GST valuation rules are recently released. In this article we have prepared GST valuation rules flow chart. These rules are helpful in deciding the value of a supply. GST levy refers […]

Transitional provisions under GST-Part I

In our 9th article of the series, we are discussing the very important aspect of MGL that is transitional provisions, provided in model law for all the existing taxpayers. […]

Transitional provisions under GST law (MGL)-Part II

In our last article we discussed 5 issues that may arise on transition to GST law for existing tax payers. The 5 issues are summarized as below:

Transitional provisions in GST:

What is the significance of migration process?

Migration of existing registered persons into the GST is an exercise for updation and validation of data of existing taxpayers […]

RAPG & co

@rapg

Not recently activeRAPG & co

OOPS!

No Packages Added by RAPG & co. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewRAPG & co wrote a new post, GST Valuation rules flowchart 8 years, 10 months ago

GST Valuation rules flowchart

GST valuation rules are recently released. In this article we have prepared GST valuation rules flow chart. These rules are helpful in deciding the value of a supply. GST levy refers […]

RAPG & co wrote a new post, Transitional provisions under GST-Part I 8 years, 11 months ago

Transitional provisions under GST-Part I

In our 9th article of the series, we are discussing the very important aspect of MGL that is transitional provisions, provided in model law for all the existing taxpayers. […]

RAPG & co wrote a new post, Transitional provisions under GST-Part II 8 years, 11 months ago

Transitional provisions under GST law (MGL)-Part II

In our last article we discussed 5 issues that may arise on transition to GST law for existing tax payers. The 5 issues are summarized as below:

Migration […]

RAPG & co wrote a new post, FAQs:Transitional provisions under Revised MGL 8 years, 11 months ago

Transitional provisions in GST:

What is the significance of migration process?

Migration of existing registered persons into the GST is an exercise for updation and validation of data of existing taxpayers […]