Version 1.0 is Extended!

▪ The Production Linked Incentive (PLI) Scheme for promotion of domestic manufacturing of critical Key Starting Materials (KSMs)/Drug Intermediates (DIs) and Active Pharmaceutical I […]

Various pre-GST concepts were transitioned into the GST era, but many were embedded with legacy disputes as well. To mention the best illustration, ‘Intermediary ’ could be one of them.

Show Cause notice

“Tax laws are the most imaginative fiction being written today.

Audi Alteram Partem

It is a time-tested principle of natural justice i.e. Audi alteram partem meaning ‘let the other side be hea […]

In a series of tweets, Finance Minister explained that GST exemption to domestic supplies and commercial import of COVID drugs, vaccines, and oxygen concentrators would make these items costlier for […]

Advance Authorization is issued to allow duty-free import of input, which is physically incorporated in export product (making normal allowance for wastage). In […]

India’s retail giant Kishore Biyani’s Future Retail is stuck in a long-standing tussle with the US tech giant Amazon.

Amazon has been blocking a deal worth $3.4 billion between Future […]

DRI!

As the apex intelligence organization of Indian Customs, it is the prime responsibility of DRI to enforce the provisions of the Customs Act, 1962.

The charter of duties of the DRI includes the collection, […]

Indian Tax Authorities Will Not Grant Refund of Taxes Paid In Foreign Jurisdictions

The Hon’ble Mumbai ITAT in the case of the Bank of India , has held that an Indian tax payer will not be entitled to claim r […]

Introduction

In the first Budget for the new decade, the good part is that there is neither change in the tax rates nor the introduction of any new Cess for individuals, even as the fiscal deficit increased due […]

Payment of Tax By Fixed Sum Method Under QRMP Scheme

W.e.f. 1st January 2021, the following two options, are available to the Taxpayers who are under Quarterly Returns and Monthly Payment of Tax (QRMP) Scheme […]

Are states now defying the Centre’s authority on GST matters?

A circular issued on 12 January 2021 by the Office of the Commissioner of State Tax, Maharashtra, says that whenever CBIC issues any circular, the […]

Benefits of Filing Income Tax Return

Easy Loan Approval: Filing the ITR will help individuals, when they have to apply fora vehicle loan (2-wheeler or 4-wheeler), House Loan, etc. All major banks can ask for a […]

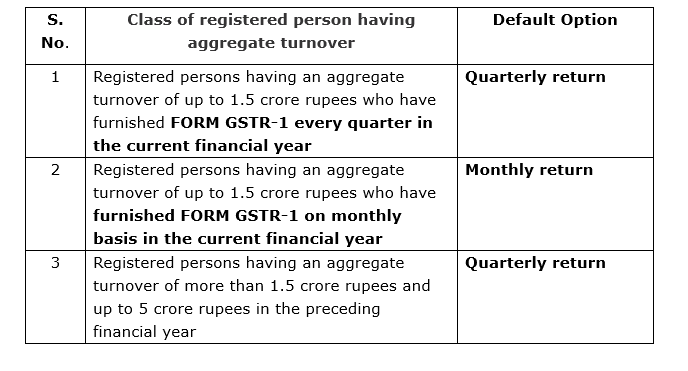

Quarterly Return Monthly Payment Scheme (QRMP) – New Facelift

Volume: 2

A. Exordium

The Central Board of Indirect Taxes & Customs (CBIC) vide Circular No. 143/13/2020-GST dated 10th November 2020 introduced […]

CBIC Issued SOP For Physical Verification

CBIC ASKS FOR PHYSICAL VERIFICATION OF PREMISES OF BUSINESSES WHICH HAVE BEEN GRANTED DEEMED GST REGISTRATION BETWEEN AUGUST 21-NOVEMBER 16

TaxTru Business Advisors

@taxtru

active 5 years, 8 months agoTaxTru Business Advisors

Consultants

OOPS!

No Packages Added by TaxTru Business Advisors. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewTaxTru Business Advisors wrote a new post, Latest TDS/TCS Related Amendments 4 years, 7 months ago

Taxation is the price that civilized communities pay for the opportunity of remaining civilized!

Section 194Q

Deduction of tax at source on payment of a certain sum for the purchase of goods.

194Q. […]

TaxTru Business Advisors wrote a new post, Production Linked Incentive Scheme For Pharmaceuticals (Ver. 2.0) 4 years, 7 months ago

Version 1.0 is Extended!

▪ The Production Linked Incentive (PLI) Scheme for promotion of domestic manufacturing of critical Key Starting Materials (KSMs)/Drug Intermediates (DIs) and Active Pharmaceutical I […]

TaxTru Business Advisors wrote a new post, The Constitutional Validity of Section 13(8)(B) of IGST Act 2017 4 years, 7 months ago

Various pre-GST concepts were transitioned into the GST era, but many were embedded with legacy disputes as well. To mention the best illustration, ‘Intermediary ’ could be one of them.

Hon’ble Gujara […]

TaxTru Business Advisors wrote a new post, A complete approach on how to deal with Show Cause Notice & Summon 4 years, 8 months ago

Show Cause notice

“Tax laws are the most imaginative fiction being written today.

Audi Alteram Partem

It is a time-tested principle of natural justice i.e. Audi alteram partem meaning ‘let the other side be hea […]

TaxTru Business Advisors wrote a new post, Finance Minister’s view on West Bengal’s Letter seeking exemption on Covid-19 related items. 4 years, 8 months ago

In a series of tweets, Finance Minister explained that GST exemption to domestic supplies and commercial import of COVID drugs, vaccines, and oxygen concentrators would make these items costlier for […]

TaxTru Business Advisors wrote a new post, Demystifying the woes of ‘Classification’ 4 years, 9 months ago

1. Importance of Correct Classification

“You don’t pay taxes–they take taxes

The term “Classification” is defined as a systematic arrangement in groups or categories according to established criter […]

TaxTru Business Advisors wrote a new post, Denial of Integrated GST refund to Advance Authorization License Holders 4 years, 10 months ago

What is Advance Authorization Scheme?

Advance Authorization is issued to allow duty-free import of input, which is physically incorporated in export product (making normal allowance for wastage). In […]

TaxTru Business Advisors wrote a new post, Amazon-Future Tussle 4 years, 10 months ago

Amazon-Future Tussle

India’s retail giant Kishore Biyani’s Future Retail is stuck in a long-standing tussle with the US tech giant Amazon.

Amazon has been blocking a deal worth $3.4 billion between Future […]

TaxTru Business Advisors wrote a new post, DRI Officer Is Not ‘The’ Proper Officer’ 4 years, 10 months ago

DRI!

As the apex intelligence organization of Indian Customs, it is the prime responsibility of DRI to enforce the provisions of the Customs Act, 1962.

The charter of duties of the DRI includes the collection, […]

TaxTru Business Advisors wrote a new post, Indian Tax Authorities Will Not Grant Refund of Taxes Paid In Foreign Jurisdictions 4 years, 10 months ago

Indian Tax Authorities Will Not Grant Refund of Taxes Paid In Foreign Jurisdictions

The Hon’ble Mumbai ITAT in the case of the Bank of India , has held that an Indian tax payer will not be entitled to claim r […]

TaxTru Business Advisors wrote a new post, Supreme Court Ends ‘Extension Of Limitation’ 4 years, 10 months ago

Supreme Court Ends ‘Extension Of Limitation’

SUO MOTO WRIT (CIVIL) NO. 3 OF 2020

IN RE: COGNIZANCE FOR EXTENSION OF LIMITATION

It is needless to point out that the law of limitation finds its root in […]

TaxTru Business Advisors wrote a new post, No Royalty, No TDS 4 years, 11 months ago

Inclusion of Software Payments In The Definition of ‘Royalties’?

Excellence Private Limited Vs. The Commissioner of Income Tax & Anr

Civil Appeal Nos. 8733 – 8734 OF 2018 Dated 03 .03. 2021

I. Important […]

TaxTru Business Advisors wrote a new post, Union Budget 2021-22 Analysis of Direct Tax Proposals 4 years, 11 months ago

Introduction

In the first Budget for the new decade, the good part is that there is neither change in the tax rates nor the introduction of any new Cess for individuals, even as the fiscal deficit increased due […]

TaxTru Business Advisors wrote a new post, Payment of Tax By Fixed Sum Method Under QRMP Scheme 4 years, 12 months ago

Payment of Tax By Fixed Sum Method Under QRMP Scheme

W.e.f. 1st January 2021, the following two options, are available to the Taxpayers who are under Quarterly Returns and Monthly Payment of Tax (QRMP) Scheme […]

TaxTru Business Advisors wrote a new post, Are states now defying the Centre’s authority on GST matters? 5 years ago

Are states now defying the Centre’s authority on GST matters?

A circular issued on 12 January 2021 by the Office of the Commissioner of State Tax, Maharashtra, says that whenever CBIC issues any circular, the […]

TaxTru Business Advisors wrote a new post, India’s Response To S 301 Report of U.S. On Equalisation Levy 5 years ago

India’s Response To S 301 Report of U.S. On Equalisation Levy

The U.S. administration had announced the initiation of an investigation under section 301 of the U.S. Trade Act, 1974 against the taxation on d […]

TaxTru Business Advisors wrote a new post, CBIC Introduces “Flagship Liberalised Authorised Economic Operator Package” For MSMEs 5 years ago

CBIC Introduces “Flagship Liberalised Authorised Economic Operator Package” For MSMEs

Recognizing their critical contribution in supporting the economy especially during the present difficult times of the […]

TaxTru Business Advisors wrote a new post, Benefits of Filing Income Tax Return 5 years, 1 month ago

Benefits of Filing Income Tax Return

Easy Loan Approval: Filing the ITR will help individuals, when they have to apply fora vehicle loan (2-wheeler or 4-wheeler), House Loan, etc. All major banks can ask for a […]

TaxTru Business Advisors wrote a new post, Quarterly Return Monthly Payment Scheme (QRMP) – New Facelift 5 years, 1 month ago

Quarterly Return Monthly Payment Scheme (QRMP) – New Facelift

Volume: 2

A. Exordium

The Central Board of Indirect Taxes & Customs (CBIC) vide Circular No. 143/13/2020-GST dated 10th November 2020 introduced […]

TaxTru Business Advisors wrote a new post, CBIC Issued SOP For Physical Verification 5 years, 2 months ago

CBIC Issued SOP For Physical Verification

CBIC ASKS FOR PHYSICAL VERIFICATION OF PREMISES OF BUSINESSES WHICH HAVE BEEN GRANTED DEEMED GST REGISTRATION BETWEEN AUGUST 21-NOVEMBER 16

Recently, The CBIC vide […]