Interest on Net Cash Liability

Amendment to Section 50 notified w.e.f. 01.09.2020

Section 100 of Finance Act inserting a proviso to Section 50(1) has been notified w.e.f. 01.09.2020 vide Notification No. […]

GST on Sale of Developed Plot

The scheme of legislative powers under the Constitution of India is clearly demarcated with separate fields being given to the Centre and State to legislate. These powers are […]

GST Implications on Deputation and Secondment of Employees

Introduction

It is a common practice (especially in group companies) that an employee employed with one company is deputed for work to another company. […]

Contractual Obligation To Pay To Vendors After 180 Days – A Controversy On ITC Reversal

Management of cash flows during the COVID-19 pandemic presents novel challenges. To manage cash flows, Taxpayers would r […]

10 Case Studies under GST

Case Study 1

GST implications on ICAI membership fees and similar bodies?

What is the supply?

Section 7 of the CGST Act

(1) Supply includes

(a) all forms of supply of goods and/or […]

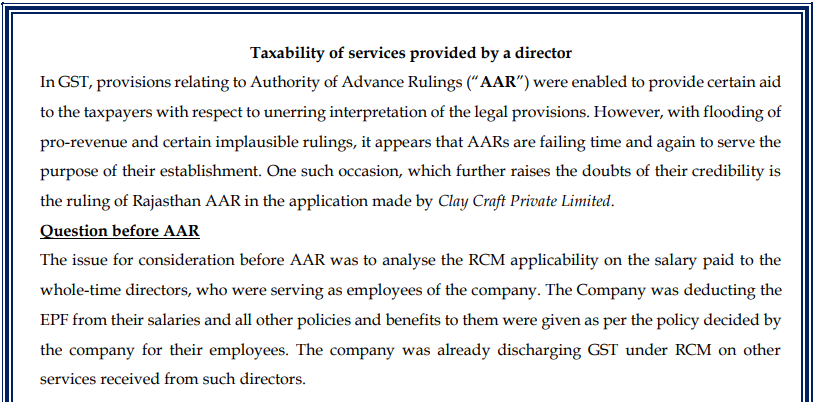

Taxability of services provided by a director

In GST, provisions relating to Authority of Advance Rulings (“AAR”) were enabled to provide certain aid to the taxpayers with respect to unerring interpretation of […]

Reversal of service tax credit on receipt of completion certificate by a developer in GST Regime – A Controversy

Background

Once a booming industry, the current phase through which the real estate industry is p […]

Recent major judgements of Indirect Tax Volume 3

GST

A. GST: AAR shall be required to determine the place of supply wherever it is necessary for determining the liability of the registered person to pay tax

The […]

Case Covered:

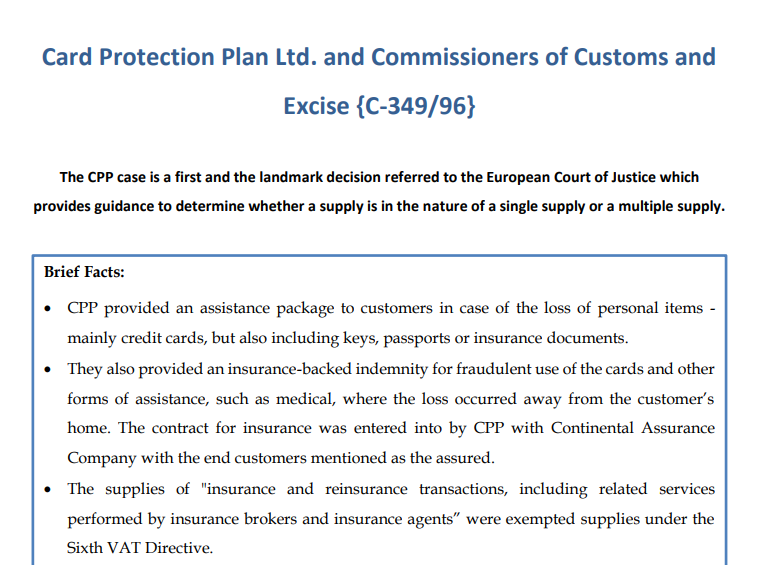

Card Protection Plan Ltd. and Commissioners of Customs and Excise

The CPP case is a first and the landmark decision referred to the European Court of Justice which provides guidance to determine […]

Summary of major Indirect Tax Case Laws

GST

A. GST: Refund claim on the export of goods from 01.07.2017 to 30.09.2017 allowed even though drawback availed.

The revenue rejected refund of IGST paid on the export […]

CA Tushar Aggarwal

@tushar-aggarwaltattvamadvisors-com

active 5 years, 1 month agoCA Tushar Aggarwal

OOPS!

No Packages Added by CA Tushar Aggarwal. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

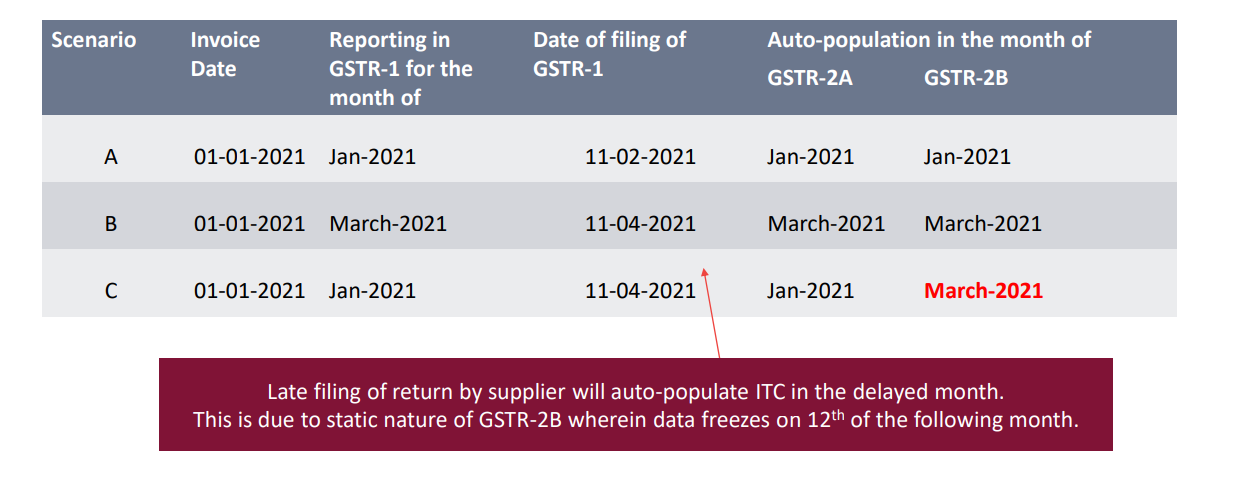

Read InterviewCA Tushar Aggarwal wrote a new post, All About GSTR 2B – A new return launched by GSTN 5 years, 5 months ago

GSTR-2B Enabled by GSTN

GSTR-2B available from the month of July 2020

New features in GSTR-2B

Static GSTR-2B

• Static statement and available once a month

• Freezing of data on the 12th of the month suc […]

CA Tushar Aggarwal wrote a new post, Interest on Net Cash Liability 5 years, 6 months ago

Interest on Net Cash Liability

Amendment to Section 50 notified w.e.f. 01.09.2020

Section 100 of Finance Act inserting a proviso to Section 50(1) has been notified w.e.f. 01.09.2020 vide Notification No. […]

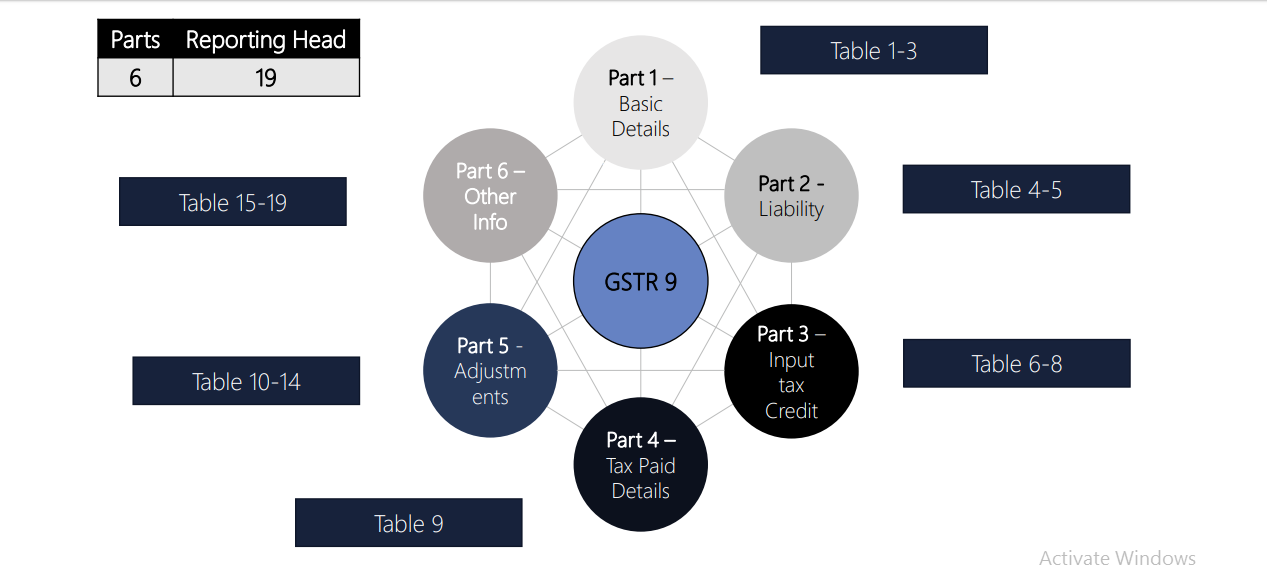

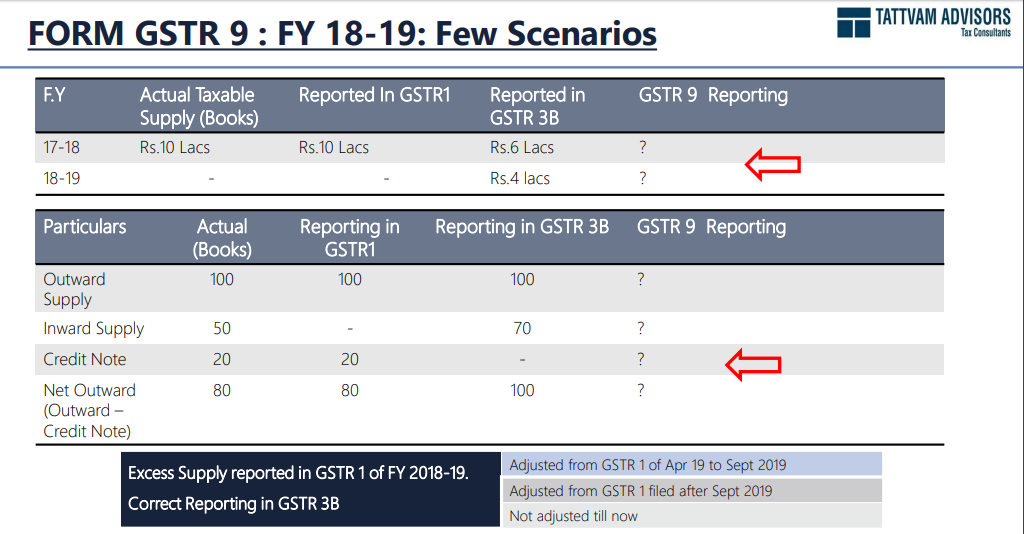

CA Tushar Aggarwal wrote a new post, Detailed Analysis of GSTR 9 and GSTR 9C 5 years, 6 months ago

Detailed Analysis of GSTR 9 and GSTR 9C

Requirement of Audit

Annual Return

Section 44(1): A registered person is required to furnish an annual return.

Reconciliation & Audit

Section 35(5): Requirement […]

CA Tushar Aggarwal wrote a new post, GST – Cross Border Transactions Including SEZ, EOU and FTWZ 5 years, 7 months ago

GST – Cross Border Transactions Including SEZ, EOU, and FTWZ

Basic Provision

Import and Export

Import of Goods [S 2(10)]

Bringing goods into India from a place outside India

Export of Goods [S 2(5)] […]

CA Tushar Aggarwal wrote a new post, GST on Sale of Developed Plot 5 years, 7 months ago

GST on Sale of Developed Plot

The scheme of legislative powers under the Constitution of India is clearly demarcated with separate fields being given to the Centre and State to legislate. These powers are […]

CA Tushar Aggarwal wrote a new post, GST Implications on Deputation and Secondment of Employees 5 years, 8 months ago

GST Implications on Deputation and Secondment of Employees

Introduction

It is a common practice (especially in group companies) that an employee employed with one company is deputed for work to another company. […]

CA Tushar Aggarwal wrote a new post, Contractual Obligation To Pay To Vendors After 180 Days – A Controversy On ITC Reversal 5 years, 9 months ago

Contractual Obligation To Pay To Vendors After 180 Days – A Controversy On ITC Reversal

Management of cash flows during the COVID-19 pandemic presents novel challenges. To manage cash flows, Taxpayers would r […]

CA Tushar Aggarwal wrote a new post, 10 Case Studies under GST 5 years, 10 months ago

10 Case Studies under GST

Case Study 1

GST implications on ICAI membership fees and similar bodies?

What is the supply?

Section 7 of the CGST Act

(1) Supply includes

(a) all forms of supply of goods and/or […]

CA Tushar Aggarwal wrote a new post, Top 15 issues faced by Taxpayers 5 years, 10 months ago

Top 15 issues faced by Taxpayers

Question 1 GST on salary paid to directors – Clay Crafts India Pvt Ltd?

Applicability of RCM on the director’s salary

RCM Notification requires a company to pay tax for the s […]

CA Tushar Aggarwal wrote a new post, Taxability of Service by Directors 5 years, 10 months ago

Taxability of services provided by a director

In GST, provisions relating to Authority of Advance Rulings (“AAR”) were enabled to provide certain aid to the taxpayers with respect to unerring interpretation of […]

CA Tushar Aggarwal wrote a new post, Reversal of service tax credit on receipt of completion certificate by a developer in GST Regime – A Controversy 5 years, 10 months ago

Reversal of service tax credit on receipt of completion certificate by a developer in GST Regime – A Controversy

Background

Once a booming industry, the current phase through which the real estate industry is p […]

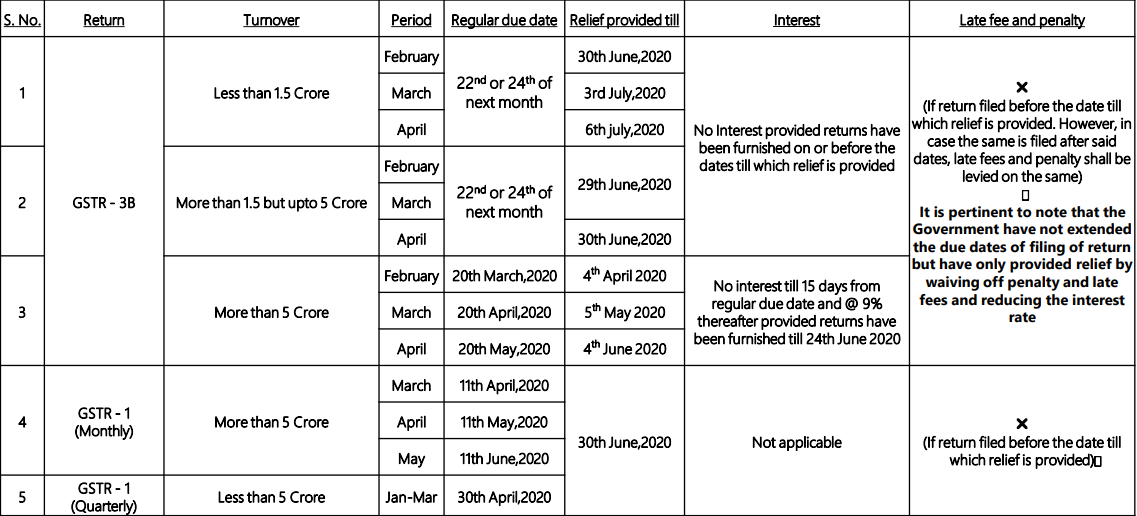

CA Tushar Aggarwal wrote a new post, GST Due Dates and Other Changes 5 years, 10 months ago

GST Due Dates and Other Changes

Relief in respect of due date on account of COVID-19

Taxpayers who are required to deduct tax at source, ISD, non-resident taxable person and the person required to collect tax […]

CA Tushar Aggarwal wrote a new post, Recent major judgements of Indirect Tax Volume 3 5 years, 10 months ago

Recent major judgements of Indirect Tax Volume 3

GST

A. GST: AAR shall be required to determine the place of supply wherever it is necessary for determining the liability of the registered person to pay tax

The […]

CA Tushar Aggarwal wrote a new post, European court case over single and multiple supply. 5 years, 10 months ago

Case Covered:

Card Protection Plan Ltd. and Commissioners of Customs and Excise

The CPP case is a first and the landmark decision referred to the European Court of Justice which provides guidance to determine […]

CA Tushar Aggarwal wrote a new post, Summary of major Indirect Tax Case Laws 5 years, 10 months ago

Summary of major Indirect Tax Case Laws

GST

A. GST: Refund claim on the export of goods from 01.07.2017 to 30.09.2017 allowed even though drawback availed.

The revenue rejected refund of IGST paid on the export […]