Bail Petition Accepted- Petitioner compliance to Summons, No Tampering of Evidence, Section 167 of Cr. Pc

Table of Contents

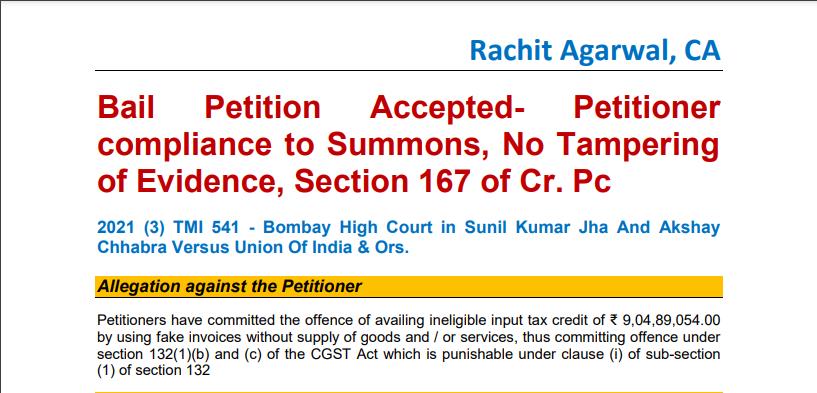

Bail Petition Accepted- Petitioner compliance to Summons, No Tampering of Evidence, Section 167 of Cr. Pc

2021 (3) TMI 541 – Bombay High Court in Sunil Kumar Jha And Akshay Chhabra Versus Union Of India & Ors.

The allegation against the Petitioner

Petitioners have committed the offense of availing ineligible input tax credit of ₹ 9,04,89,054.00 by using fake invoices without the supply of goods and/or services, thus committing offense under section 132(1)(b) and (c) of the CGST Act which is punishable under clause (i) of sub-section (1) of section 132

Respondent’s Reason for Detention

Detention of the two petitioners is not only for the purpose of custodial interrogation but also to ensure that petitioners do not tamper with the documents and influence the witnesses.

Respondents relied on

1. Telangana High Court in P.V. Ramana Reddy Vs. Union of India 2019(25) G.S.T.L. 185 (Telangana)

2. An order passed by this Court in the case of Ashish Jain Vs. Union of India Order dated 31.07.2019 passed Cri. W.P. NO. 3804 of 2019

Order of Hon’ble Court

1. Recording of reasons to believe by the Commissioner that a person has committed the offence and is required to be arrested is the sine qua non for exercise of such power.

2. Not only that a number of employees and officials of the petitioner company as well as independent directors had appeared before the investigating authorities and their statements were also recorded.

3. We do not find any instance of the petitioners tampering with documents or trying to influence any witness being brought on record. Merely saying or apprehending that in the future they may tamper with evidence or induce any witness as observed by the learned Magistrate cannot be a justification to deny bail.

4. Maximum sentence that can be imposed upon conviction for the said offense is imprisonment for five years. Section 167 of the Cr. P.C. Section 167(2)(a)(ii) makes it clear that a person cannot be kept in detention beyond a total period of sixty days where investigation relates to an offense punishable for imprisonment for a term of not less than ten years and is not completed.

5. The allegation against the two petitioners is that they had played a crucial role in illegally availing input tax credit of ₹ 9,04,89,054.00. In all, petitioners have paid ₹ 4,80,58,988.00 to date and they have made a statement that they would be bound to pay whatever amount is found due and payable upon investigation and adjudication subject to their right of appeal.

6. Relying upon Arnesh Kumar (supra), this Court in Daulat S. Mehta (supra) and In Arnesh Kumar (supra), Supreme Court for considering the Bail Application

Without expressing any opinion at this stage as to the legality and validity of the initial arrest, we are of the view that continued detention of the petitioners would not at all be justified.

CA Rachit Agarwal

CA Rachit Agarwal