Benami Act will apply to past transactions where the property is “held” even after its applicability

Table of Contents

Commentary-

An important judgment where the Apex courts judgment was clarified so as to cover the past transactions in Benami

The applicability of Benami Act was settled by the Apex court in case of “Ganpati Dealcom Private Limited”-

(a.) Section 3(1) of 1988 Act is vague and arbitrary .

(b.) Section 3(1) created an unduly harsh law against settled principles and Law Commission recommendations.

(c.)Section 5 of 1988 Act, the provision relating to civil forfeiture, was manifestly arbitrary .

(d.) Both provisions were unworkable and as a matter of fact, were never implemented.

“91. Having arrived at the aforesaid conclusions that Sections 3 and 5 were unconstitutional under the 1988 Act, it would mean that the 2016 amendments were, in effect, creating new provisions and new offences . Therefore, there was no question of retroactive application of the 2016 Act. As for the offence under Section 3(1) for those transactions that were entered into between 05.09.1988 to 31.10.2016, the law cannot retroactively invigorate a stillborn criminal offence, as established above.”

Now as many articles are suggesting that the decision of Apex court is changed, Here I would like to clarify that the applicability of Benami law will be prospective only.

The point discussed in this case is that the definition of Benami property as amended by the law of 2016 also use the word”held”. This word is important because earlier it was only about a transaction but now it is also about continuously holding the benami property.

If the person was holding the property after the Benami law applicability , it will fall under the law. So applicability is not retrospective but a property held even after 2016 will fall under benami. Thus even in prospective applicability the old cases may be covered if the property is still held by the benamiholder.

(author can be reached at shaifaly.ca@gmail.com)

Citation-

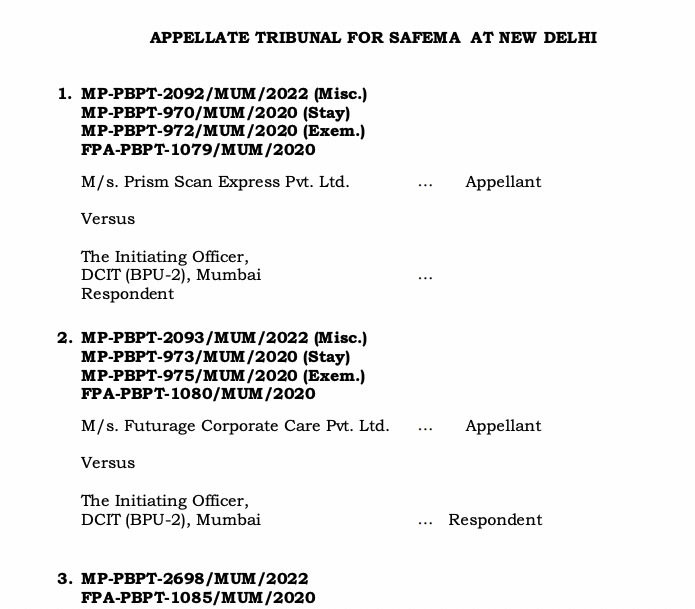

| Petitioner | M/s. Prism Scan Express Pvt. Ltd |

| Respondent | Initiating officer |

| Order no. | MP-PBPT-2092/MUM/2022 (Misc.)

MP-PBPT-970/MUM/2020 (Stay) MP-PBPT-972/MUM/2020 (Exem.) FPA-PBPT-1079/MUM/2020 |

| Court | APPELLATE TRIBUNAL FOR SAFEMA AT NEW DELHI |

| Date of judgement | 15.12.2023 |

| Decision in Favour of | Department |

| Citation | Commissioner of Wealth Tax, (CWT) Versus Suresh

Seth, (1981) 2 SCC 790. C.I.T Vs. Vatika Township Private Limited (2015) (1) SCC (1). Nexus Feeds Limited & Others Versus The Assistant Commissioner of Income Tax in Writ Petition No. 14695 of 2021 |

Pleading

The notices sent to the petitioner should quashed as they are time barred.

Facts

It is stated that one of the appellants Suresh Bhageria, is a promoter and Director of M/s Bhageria Industries Limited (In short “BIL”) and part of Bhageria Group of Companies. A survey was conducted under section 133 A of the Income Tax Act, 1961 on Bhageria Industries Ltd.

It was alleged that there is benami purchase of shares of B.I.L. by Benamidars, M/s Prism Scan Express Pvt. Ltd. and M/s Futurage Corporate Care Private Limited.

It was also alleged that the financials of M/s Prism Scan Express Pvt. Ltd. and M/s Futurage Corporate Care Private Limited are not administered with the credentials of their Directors.

Based on the survey, an inference was drawn that M/s Prism Scan Express Pvt. Ltd. and M/s Futurage Corporate Care Private Limited are involved in Benami transactions.

During the course of the survey, statements of Directors of all the four companies were recorded under section 131 of the Income Tax Act

The two companies were treated as Benamidars for purchase of shares of Bhageria Industries Ltd. and accordingly a show cause notice was served under section 24 (1) of the Act of 1988.

Observation

The Tribunal in case of Prism ScanExpress held that-

“25. If it is a case of transfer of property prior to the amendment in the definition of “Benami Transaction” and such property is not held by the benamidar as on the date of the amendment or subsequent to it, then the Amending Act of 2016 would not be applicable to such a transaction.

- In other case, where though transfer of the property is prior to the Amending Act 2016, but it is still held by the benamidar even subsequent to the amendment, it would be a “benami transaction” under the Amending Act, 2016.”

The appellant has referred to the definition only by taking the first part, i.e. transfer of shares ignoring the second part of the definition regarding holding of property. If a person is holding a property as on the date of the amendment or subsequent to it, whose consideration was paid or provided by another person, then it will fall under the definition of “Benami Transaction”. The consideration of definition of “Benami Transaction” by dividing it into two parts was not made earlier.

In the instant case, a contest was made by the counsel for the respondents who submitted that if anyone is holding a property after the amendment by the Amending Act, 2016 though transfer of property is prior to 01.10.2016, such a transaction would fall in the definition of “Benami Transaction” as given under section of 2 (9) (A) of the Act of 2016.

In view of the discussion made above, we do not find any force in the appeals and accordingly the same are dismissed

Read/ download the copy of judgment of M/s. Prism Scan Express Pvt. Ltd

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.