Blocking of E way Bill w.e.f. 01-12-2019

Introduction:

1. As per Rule 138E, non furnishing of CMP-08 for 2 consecutive quarters shall result in blocking of E way bill for Composition Dealers. CMP-08 for April to June 2019 was required to be filed till 31-08-2019 (N/N 35/2019- CT dated 29-7-2019) and CMP-08 for July to Sep 2019 is required to be filed till 22nd October 2019[ N/N 50/2019 dtd 24-10-19] . For subsequent quarters due date for CMP-08 is 18th of month suceeding quarter. Hence blocking shall be from 19th.

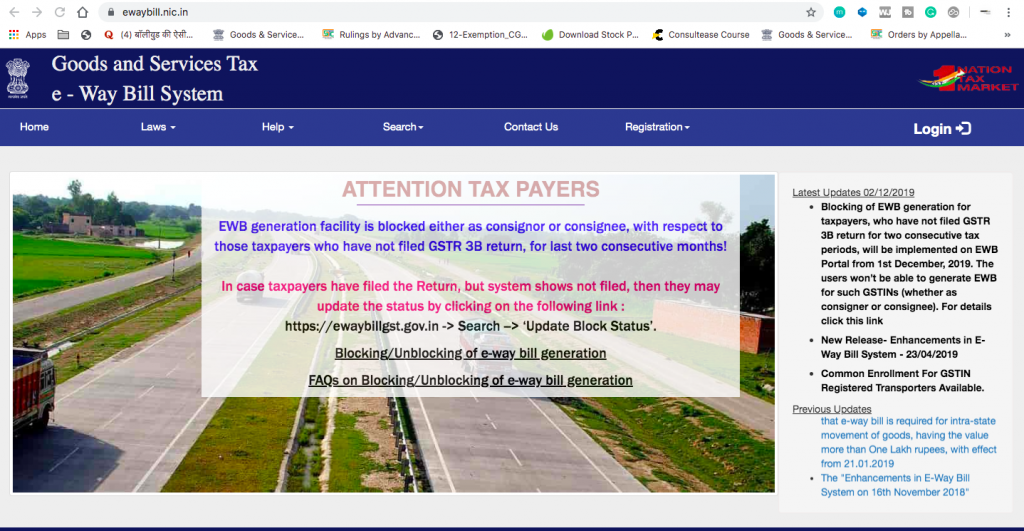

2. Non furnishing of GSTR 3B for 2 consecutive months for normal taxpayers shall result in blocking of e way bill for normal dealers. GSTR 3B is required to be filed till 20th of next month. Hence blocking shall be from 21st. Nofiling of GSTR-1 shall not result in blocking of e way bill.

3. Effective Date:

Blocking of E way bill has been made effective from 01-12- 2019 on portal. Earlier blocking was proposed w.e.f. 21-06-19 but extended to 21-8-19 by N/N 25/2019-CT and further extended to 21-11- 2019 by N/N 36/2019. Cautionary messages during November were conveyed while generating E way bill, however blocking has been put into operation only w.e.f. 01-12-2019.

4. State of J&K:

Due to poor Internet connectivity in state of J&K, number of people have not able to file GSTR 3B. Now effective from 01-12-2019, e way bill for goods consigned to/from J&K have been blocked.

5. Transporters registered with GSTIN shall also be blocked if they fail to file GSTR-3B for 2 consecutive months. Consignors and consignees transporting through such transporters can generate E way bill. However, Transporters only enrolled for e way bill and not registered shall not be affected

6. If blocking is done for consignor then consignee also cannot generate E way bill for inward supplies. Similarly if consignee is blocked, then consignor also can’t generate e way bill for goods to be dispatched to consignee. Transporter also can not generate e way bill for blocked consignor and consignee

7. Unblocking of E way Bill can be done by:

a. Filing GSTR 3B/CMP-08 and reducing default to lesser than 2 consecutive periods. E way bill shall be unblocked automatically next day. If status is still not updated, then log in e way bill portal and click on option Search>Update Block status. Enter GSTIN followed by captcha. Then click on Update Unblock status from GST Common Portal

b. Unblocking can also be done by jurisdictional officer online on GST portal upon considering manual representation from taxpayer [FAQ 2 and 9}

c. Online application for unblocking in EWB-05 can also be filed where representing sufficient cause for non filing of GSTR 3B. Jurisdictional Commissioner may by reasoned order in EWB-06 unblock the E way bill. Rejection of request shall not be made without providing opportunity of being heard. Facility of online application is not available for the time being.

8. Cases where blocking has been done for non filing of one returns only or cases where returns couldn’t be filed due to poor connectivity or natural calamities should make manual representation for unblocking to Jurisdictional officer

CA Vinamar Gupta

CA Vinamar Gupta

Amritsar, India