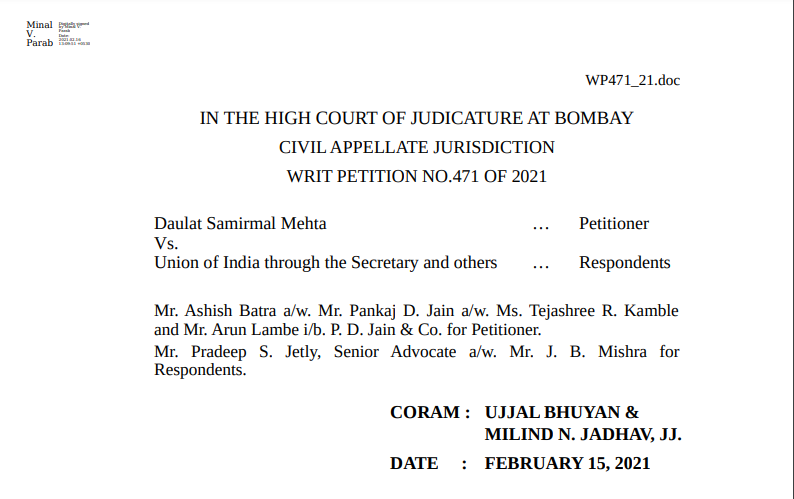

Bombay HC in the case of Daulat Samirmal Mehta Versus Union of India

Table of Contents

Case Covered:

Daulat Samirmal Mehta

Versus

Union of India

Facts of the Case:

This petition under Article 226 of the Constitution of India challenges the constitutional validity of section 132(1) (b) of the Central Goods and Services Tax Act, 2017 (briefly “the CGST Act” hereinafter) and seeks a declaration that the power under section 69 of the CGST Act can only be exercised upon determination of the liability. A further prayer has been made to restrain respondent No.4 from filing any criminal complaint against the petitioner for alleged violation of the provisions of the CGST Act which are compoundable offenses. Additionally, petitioner seeks a direction to respondent Nos.2 and 3 to make a decision by passing a speaking order on the compounding applications dated 28.01.2021 filed by the petitioner and the two companies of which he is a director. An interim prayer has been made for enlarging the petitioner on bail since he is under judicial custody with effect from 21.01.2021.

Though facts lie within a very narrow compass, to have a proper perspective it would be apposite to briefly advert to the relevant facts as averred in the writ petition.

Related Topic:

Bombay HC in the case of Dharmendra M. Jani Versus Union of India

Observations:

The requirement under subsection (1) of section 69 is reasons to believe that not only a person has committed any offence as specified but also as to why such a person needs to be arrested. From a perusal of the reasons recorded by the Principal Additional Director General, we find that other than paraphrasing the requirement of section 41 Cr.P.C., no concrete incident has been mentioned therein recording any act of tampering of evidence by the petitioner or threatening / inducing any witness besides not co-operating with the investigation, not to speak of fleeing from the investigation. In such circumstances, we are of the view that the Principal Additional Director General could not have formed a reason to believe that the petitioner should be arrested.

In the S.L.P. filed by the Union of India against the decision of the Bombay High Court granting pre-arrest bail to Sapna Jain, Supreme Court while issuing notice on 29.05.2019 observed that while it did not interfere with the privilege of pre-arrest bail granted by the High Court, in future while entertaining such request for pre-arrest bail, High Court should keep in mind that Supreme Court had dismissed the S.L.P. filed against the decision of the Telangana High Court

The Decision of the Court:

In the light of the above discussions and having reached the conclusion as above, we direct that the petitioner Mr. Daulat Samirmal Mehta shall be enlarged on bail subject to the following conditions:-

1) petitioner shall be released on bail on furnishing cash surety of Rs.5,00,000.00 before the Additional Chief Metropolitan Magistrate, 8th Court, Esplanade, Mumbai and within two weeks of his release, to furnish two solvent sureties of the like amount before the said authority;

2) petitioner shall co-operate in the investigation and shall not make any attempt to interfere with the ongoing investigation;

3) petitioner shall not tamper with any evidence or try to influence or intimidate any witness;

4) petitioner shall also deposit his passport before the Additional Chief Metropolitan Magistrate, 8th Court, Esplanade, Mumbai.

5) within 15 days of his release, petitioner or any of the companies in which he has a substantial interest and which are under investigation, shall deposit a sum of Rs.10 crores with respondent Nos.2 and 3 which shall be without prejudice to his rights and contentions;

6) after the said amount is deposited, the petitioner or any of the companies in which he has a substantial interest and which are under investigation shall deposit a further amount of Rs.15 crores before respondent Nos.2 and 3 within 30 days of the first deposit which again shall be without prejudice to his rights and contentions;

6.1) However, the last two conditions shall be executed by the petitioner upon his release which shall not be a ground for delaying his release.

We make it clear that any default by the petitioner may compel us to take an adverse view of the matter.

The record in original is returned back to Mr. Mishra.

Stand over to 20.04.2021.

Related Topic:

Bombay HC in the case of KLT Automotive and Tubular Products Limited

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.