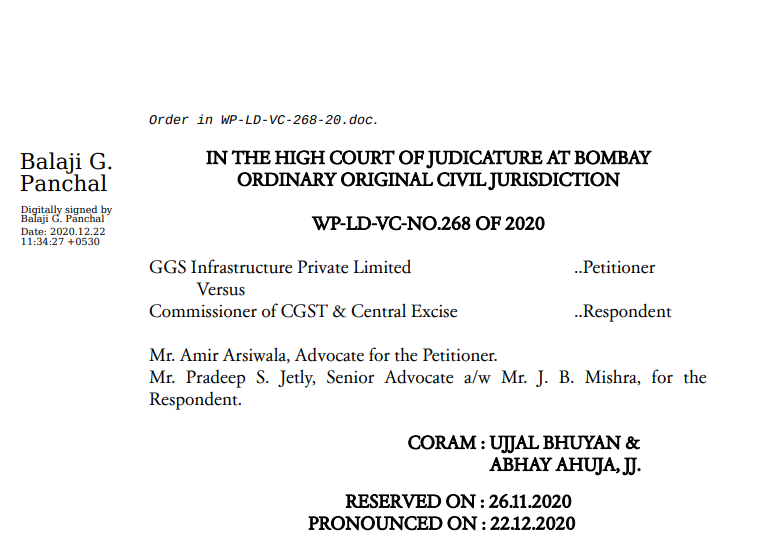

Bombay HC in the case of GGS Infrastructure Private Limited

Table of Contents

Case Covered:

GGS Infrastructure Private Limited

Versus

Commissioner of CGST & Central Excise

Facts of the Case:

By filing this petition under Article 226 of the Constitution of India, the petitioner has sought the following reliefs:-

(I) To set aside and quash the order in original dated 22.07.2020 passed by the Commissioner of Central Goods and Services Tax and Central Excise, Mumbai Central;

II) For a declaration that total liability of the petitioner to the respondent does not exceed Rs.35,54,682.55 in accordance with the order dated 30.08.2019 passed by the National Company Law Tribunal, Mumbai Bench sanctioning the resolution plan of the petitioner under section 31 of the Insolvency and Bankruptcy Code, 2016;

III) For a direction to the respondent not to appropriate an amount of Rs.6,23,82,214.00 already recovered following the order in original dated 22.07.2020;

IV) For a direction to the respondent to refund an amount of Rs.5,88,27,531.45 to the petitioner.

Related Topic:

Writ Petitions not maintainable on Mixed Question of Facts and Law

Observations:

In the present case, what we have noticed is that section 87(b) (i) was invoked as early as 18.04.2013 whereas the first show-cause cum demand notice was issued to the petitioner only on 18.04.2015. While the invocation of section 87(b)(i) and recoveries made thereunder are highly questionable, it may not be necessary for us to delve into the legality or illegality of the same in the present proceeding because of the binding nature of the resolution plan as approved by the committee of creditors and sanctioned by the Tribunal. However, an attempt by the respondent for the appropriation of the amount recovered through such questionable means in the face of the resolution place so approved and sanctioned is a live issue and hence needs to be adverted to.

The Decision of the Court:

Thus, having considered all aspects of the matter, we have no hesitation to hold that principal service tax dues quantified by the respondent vide order in original dated 22.07.2020 has to be settled at the rate of 5%, in other words, 5% of Rs.7,02,20,725.00. The directions of the respondent for the appropriation of the amount of Rs.6,23,82,214.00 already recovered cannot be sustained. Respondent shall retain 5% of Rs.7,02,20,725.00 from the above amount recovered and thereafter refund the balance amount to the petitioner. To that extent, the impugned order in the original dated 22.07.2020 is interfered with. Refunds shall be made within a period of three months from the date of receipt of a copy of this judgment and order.

Writ Petition is accordingly allowed. However, there shall no order as to cost.

This order will be digitally signed by the Private Secretary of this Court. All concerned will act on production by fax or email of a digitally signed copy of this order.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.