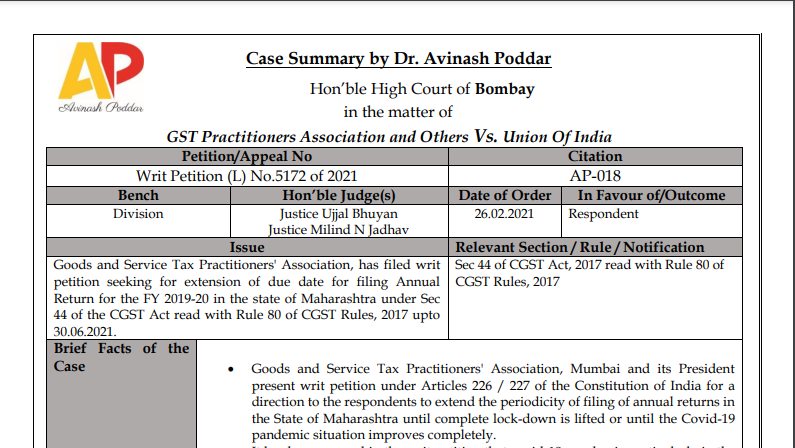

Bombay HC in the case of GST Practitioners Association Versus Union Of India

Table of Contents

Case Covered:

GST Practitioners Association

Versus

Union Of India

Issue:

Goods and Service Tax Practitioners’ Association, has filed a writ petition seeking for extension of the due date for filing Annual Return for the FY 2019-20 in the state of Maharashtra under Sec 44 of the CGST Act read with Rule 80 of CGST Rules, 2017 up to 30.06.2021.

Brief Facts of the Case:

• Goods and Service Tax Practitioners’ Association, Mumbai and its President present writ petition under Articles 226 / 227 of the Constitution of India for a direction to the respondents to extend the periodicity of filing of annual returns in the State of Maharashtra until complete lock-down is lifted or until the Covid-19 pandemic situation improves completely.

• It has been averred in the writ petition that the covid-19 pandemic particularly in the State of Maharashtra is not yet over. Rather in recent days, there has been an increase in the number of cases of people being infected with covid-19. Lockdown imposed in the State of Maharashtra has not yet been completely withdrawn. As a matter of fact, several areas in the State of Maharashtra have seen fresh lock-downs in different forms in the recent past.

• Because of the aforesaid reasons, petitioners had represented before the Grievance Redressal Committee, Pune on 08.01.2021. Finding no response, they made a further representation to the Goods and Services Tax (GST) Council on 11.02.2021. As no decision was forthcoming, the present writ petition has been filed seeking relief.

Brief Arguments by Petitioner/ Appellant:

It is submitted that in terms of section 44 of the Central Goods and Services Tax Act, 2017 (briefly ‘the CGST Act’ hereinafter) and rule 80 of the Central Goods and Services Tax Rules, 2017 (briefly ‘the CGST Rules’ hereinafter), every registered person is required to file an annual return for every financial year in the electronic form before 31st day of December following the end of such financial year. In the case of the financial year 2019-20, the date for filing such an annual return was 31.12.2020. By notification No.95/2020 dated 30.12.2020, the time-limit for furnishing such annual return for the financial year 2019-20 was extended till 28.02.2021.

It is further submitted that filing or furnishing of annual return is dependent upon finalization of audit report under the Income Tax Act, 1961. Though the date for finalization of the audit report under the Income Tax Act, 1961 is the 30th day of September of the preceding year, for the financial year 2019-20 the due date under the Income Tax Act, 1961 was extended up to 15.01.2021. In other words, Chartered Accountants responsible for furnishing annual returns under the CGST Act would have less than 45 days after finalization of audit report under the Income Tax Act, 1961 to file an annual return under section 44 of the CGST Act.

Mr. Joshi, learned counsel for the petitioners submits that following amendment to section 44 of the Maharashtra Goods and Services Tax Act, 2017, a proviso has been inserted therein as per which the Commissioner may on the recommendation of the GST Council and for reasons to be recorded in writing by a notification extend the time limit for furnishing the annual return for such class of registered persons as may be specified therein. Further, any extension of the time-limit notified by the Commissioner of Central Tax shall be deemed to be notified by the Commissioner under the Maharashtra Goods and Services Tax Act, 2017. He further submits that there is no involvement of revenue in the matter as an extension of the time limit would not result in the loss of any revenue.

Brief Arguments by Respondents:

Mr. Singh learned Additional Solicitor General has referred to and relied upon written instructions dated 25.02.2021 issued by the Central Board of Indirect Taxes and Customs.

He submits therefrom that the government has been considerate of the difficulties faced by the taxpayers due to the covid-19 pandemic and accordingly, the due date for filing annual returns and reconciliation statements has been extended. Timeline for filing such returns and statements for the financial year 2019-20 has already been extended from 31.12.2020 to 28.02.2021 considering the difficulties faced by the taxpayers.

Mr. Singh submits that the portion of the order of the Rajasthan High Court which had extended the deadline for submitting returns has been stayed by the Supreme Court in S.L.P. No.3839 of 2020 vide order dated 10.02.2020.

Ms. Chavan, learned AGP submits that the State of Maharashtra has no independent say in the matter. She submits that the Commissioner can extend the time-limit only upon recommendations made by the GST Council. On his own, he cannot extend the time-limit.

Cases relied upon by:

Petitioner

Tax Bar Association Vs. Union of India

Respondent

–

Judgement/ Ratio (in brief):

Submissions made by learned counsel for the parties have received the due consideration of the Court.

On due consideration, we are not inclined to accede to the prayer made by the petitioners that too at this eleventh hour. It is not that the time-limit has not been extended. The initial due date of 31.12.2020 has been extended to 28.02.2021. That apart, ongoing through the relevant provisions of the CGST Act, more particularly the provision of section 47(2) thereof, we do not find that non-extension of the time-limit beyond 28.02.2021 would lead to any extinguishment of the right. We find from the written instructions dated 25.02.2021 that vide notification No. 77 of 2020 – Central Tax dated 15.10.2020 filing of annual return in the prescribed form for businesses with annual turnover up to Rs.2 crores has been made optional for the financial years 2017-18, 2018-19 and 2019- 20; and for businesses with annual turnover up to Rs.5 crores filing of the prescribed form for the financial years 2018-19 and 2019-20 has been waived off vide notification No.79/2020 – Central Tax dated 15.10.2020.

We also take note of the fact that it is the professional body of GST practitioners who are before us and not any individual taxable person expressing any difficulty in adhering to the extended timeline of 28.02.2021.

In the circumstances, Court is not inclined to entertain the writ petition. The writ petition is accordingly dismissed.

Head Note/ Judgement in Brief:

Goods and Services Tax Practitioners Association and Others have filed a writ petition for an extension of the due date of filing of Annual Return in FORM GSTR-09 for the FY 2019-2020 up to 30.06.2021, whereas Hon’ble court has dismissed the petition on the fact that it is the professional body of GST practitioners who are before us and not any individual taxable person expressing any difficulty in adhering to the extended timeline of 28.02.2021.

Views of the Author:

In this case, the court was not inclined to entertain the writ petition and the same was dismissed on the basis that the professional body of GST practitioners has approached Hon’ble Court instead of any individual taxable person expressing any difficulty in adhering to the extended timeline of 28.02.2021.

Dr. Avinash Poddar

Dr. Avinash Poddar

Ahemdabad, India

Avinash Poddar, currently practicing as a lawyer, as a Law Graduate, a fellow member of Institute of Chartered Accountants of India, Certified Financial Planner, Microsoft Certified Professional and DISA (Diploma in Information Systems Audit) from ICAI. He has also completed various certificate courses of ICAI such as Arbitration, Forensic Accounting and Fraud Detection, Valuation, IFRS, Indirect Taxes. He has also completed post-graduate diploma is Cyber Crime (PGCCL).