Brand Equity Stayed, All Eyes on Supreme Court

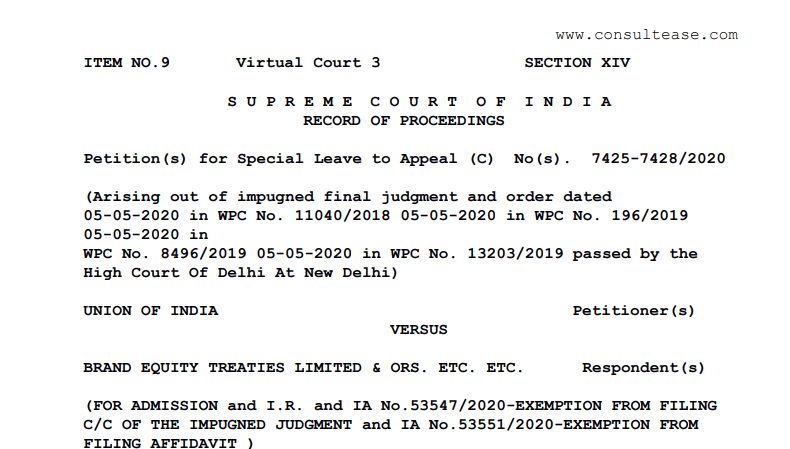

The battle of Transitional ITC has reached to climax. Now the supreme court stays the Brand equity judgment. In many cases, various high courts upheld the right of the taxpayer for transitional ITC. Adfert Technology, Reliance Elektrik, brand equity are some of them. In this case, the Delhi high court upheld that a time limit of 90 days is not applicable in transitional cases. But the time limit under limitation Act is applicable. That time limit is 3 years. It ends on 30th June 2020. Delhi high court permitted to file Tran-1 by this date. But CBIC amended section 140 of the CGST Act. In the case of SKH steel, Delhi high court held that even after the amendment. Meanwhile, the government filed an SLP against the order of brand equity. The Supreme court provided stay on that judgment. Now every taxpayer is looking at the apex court for the final verdict.

Read & Download the full order in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.