PPT on Limited Liability Partnership

PPT on Limited Liability Partnership

The PPT on Limited Liability Partnership was made by CA MAYUR ZANWAR. The ppt covers almost every aspect and the information to be needed by us.

| Content | |

| 1. | Various form of Business Organizations |

| 2. | Benefits as compared to Corporate firm |

| 3. | Benefits as compared to Partnership firm |

| 4. | Allowable Business in LLP |

| 5. | What is LLP? |

| 6. | Features of LLP |

| 7. | Documents required for formation of LLP |

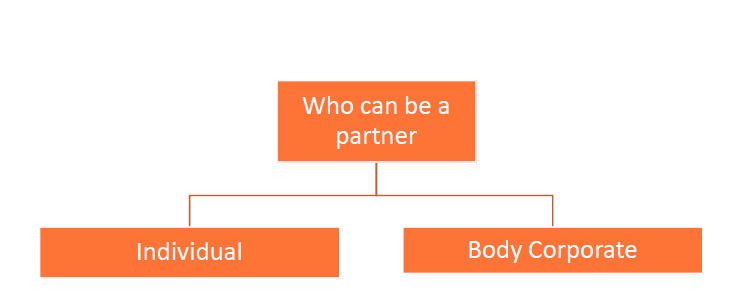

| 8. | Who can be a Partner |

| 9. | The process of Incorporation of an LLP |

| 10. | Queries |

Forms of Business Organizations:

COMPANY

A business entity which acts as an artificial legal person, formed by a legal person or a group of legal persons to engage in or carry on a business or industrial enterprise.

SOLE PROPRIETORSHIP

Simplest, oldest, and most common form of business ownership in which only one individual acquires all the benefits and risks of running an enterprise.

PARTNERSHIP

A type of business organization in which two or more individuals pool money, skills, and other resources, and share profit and loss in accordance with terms of the partnership agreement.

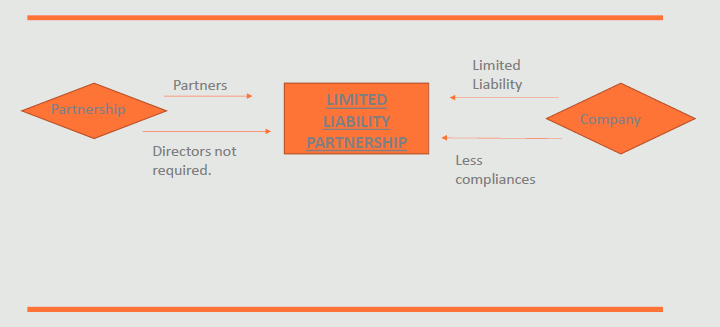

LIMITED LIABILITY PARTNERSHIP

A limited liability partnership in which all partners have limited liability. It has the same elements as partnerships and corporations, although one partner is not responsible for the misconduct of others.

Benefits as Compared to Corporate Firm:

• Easy to Form

• Easy to Run & Manage

• Less Compliances

• Low cost of Formation

• Minimum Contribution of Rs. 1Lakh.

• Less Government Intervention

• Less requirement as to the maintenance of statutory records

• No Dividend Distribution Tax

• Easy to withdraw Profit and Capital.

• Can distribute Remuneration to partners.

• Easy to exit and wind up

Benefits as Compared to Partnership Firm:

• Highest no. of partners (up to 200)

• Limited Liability of Partners (except in cases of fraud or where the no. of Designated Partners is reduced to 1 and LLP continues for 6 months).

• No liability for the wrongful act of the other partner.

• Less exposure to the personal assets of the partners.

• Easy Registration.

Allowable Business in LLP:

| All profit making activities | LLP can be a member of Stock Exchange |

| LLP can undertake profession – CA, CS, CWA, Architect, Doctors etc. | LLP formed with other objectives may undertake group Investment activity. Provided it limits to a 50% criteria of RBI. |

| For CS both Attestation & Non-Attestation Services are permitted |

Download the PPT on Limited Liability Partnership, by clicking the below image:

What is LLP?

A limited liability partnership(Hybrid Structure with advantages of Partnership and Corporate Entities) is a newer form of business partnership where all of the owners have limited personal liability for the financial obligations of the business but allows its partners the flexibility for organizing their internal structure as a partnership.

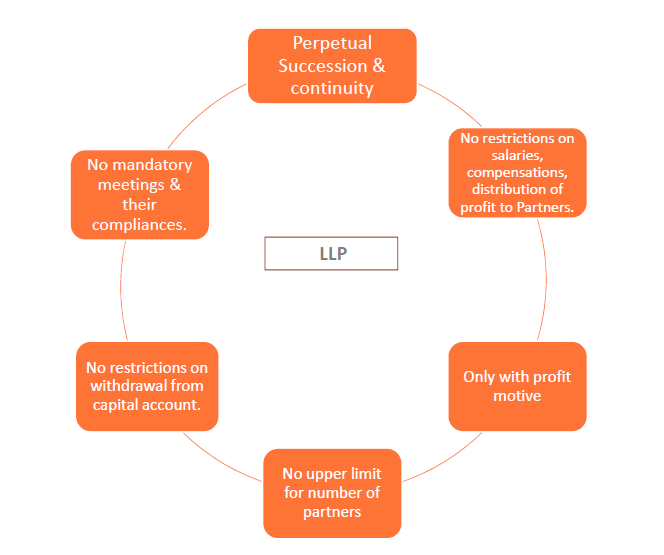

Overview of LLP:

Requirements for Formation of LLP:

Contribution:- there is no concept of any share capital but every partner is required to contribute towards the LLP in some manner which he cannot withdraw (i.e. fixed capital)

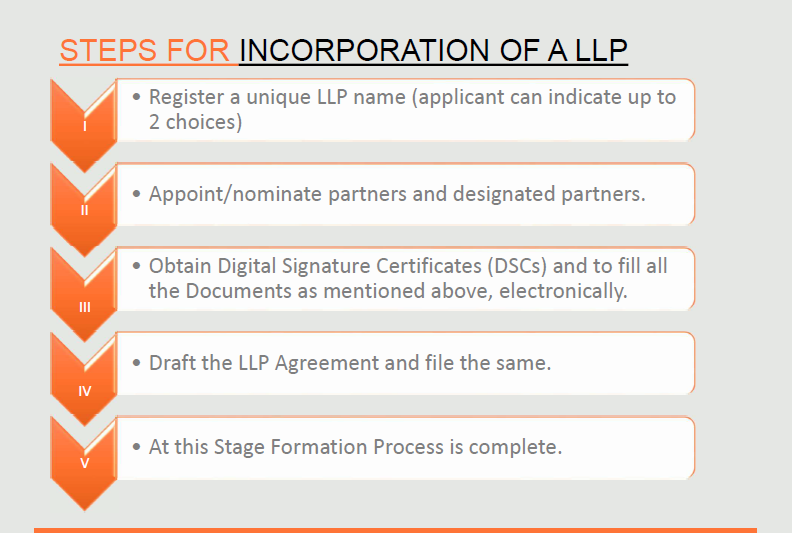

Minimum two Designated Partners:-Every limited liability partnership shall have at least two designated partners who are individuals and at least one of them shall be a resident in India (Designated Partner’ means a partner who is designated as such in the incorporation documents or who become a designated partner by and in accordance with the Limited Liability Partnership Agreement)

Designated Partner Identification Number(DPIN)

LLP Name (at Least 2 Name (With its Meaning/ Reason of Name)

LLP Agreement (After Incorporation Certificate)

Registered Office

Sharing Ratio

1.Profit

2.Remuneration

3.Fixed Capital/Contribution

Signed on Subscription Sheet (After Name Approval)

DPIN:

Designated Partner Identification Number (DPIN) is a registration required for any person who wishes to be appointed as a Designated Partners of a Limited Liability Partnership (LLP).

The documents mentioned must be attested or certified by a Gazetted Officer or Notary Public or Company Secretary or Chartered Accountant or Cost Accountant.

Documents Required for Formation of LLP:

A. Documents of Partners:

i. PAN

ii. ADHAAR

iii. Email id

iv. Mobile No.

v. Digital Signature

1. Identity Proof (Any One of Below)

a. Voter id

b. Passport

c. Driving License

2. Address Proof (Any One of Below)

a. Bank Statement

b. Electricity Bill (on Own Name)

c. Telephone Bill (on Own Name)

d. Mobile Bill (on Own Name)

B. Documents of LLP

1.Address of Registered Office

2.Proof of Registered Office

3. LLP Agreement

Body Corporate Includes

1.Limited liability partnership registered under LLP Act

2.Limited liability partnership incorporated outside India and

3.Company incorporated outside India

Even Foreigners can form an LLP in India. Since a partner need not be resident in India except a designated Partner who should be resident in India.

The process of Incorporation of an LLP:

The Contents of LLP Agreement:

• Name Clause

• Names and addresses of the partners and designated partners

• The form of contribution and interest on contribution

• Profit sharing ratio

• Remuneration of partners

• Rights and duties of partners

• The proposed business

• Rules for governing the LLP

• Duration of the LLP

LLP Agreement:

• LLP agreement is very CRUCIAL constitutional document – governing the relationship between LLP & its partners & inter se among the partners.

• It can be executed after name availability before formation i.e. filing of LLP Form No. 2 – LLP can’t be a party.

• Stamp duty on LLP agreement is to be paid as per relevant state stamp act for Partnership entry based on capital contribution slabs. (Entry 47 of schedule I of Bombay stamp act, 1958.)

(a) No share of contribution in partnership, or by way of cash does not exceed 50,000: Five hundred rupees.

b) Brought in by way of cash is in excess of rupees 50,000: 1% of the amount of share contribution subject to maximum of rupees fifteen thousand. (earlier Rs. 500 for every Rs. 50,000 or part thereof of contribution, subject to the maximum duty of Rs. 5,000).

• If the LLP Agreement is not executed, Schedule 1 to the LLP Act shall apply as regards the mutual rights and obligations of the partners.

Compliances after Registration:

• Execute LLP Agreement, file LLP Form No. 3, if not done at time of incorporation

• Obtain PAN, TAN, registrations under other Acts

• Open Bank Account

• Print letterheads with LLPIN

• Prepare rubber stamps

• Prepare Common Seal of the LLP, if it decides to have one (Section 14(c))

• Obtain all required registrations, licenses and permissions

• Maintain necessary registers if specified by LLP agreement

• Maintain proper books of accounts (mandatory requirement)

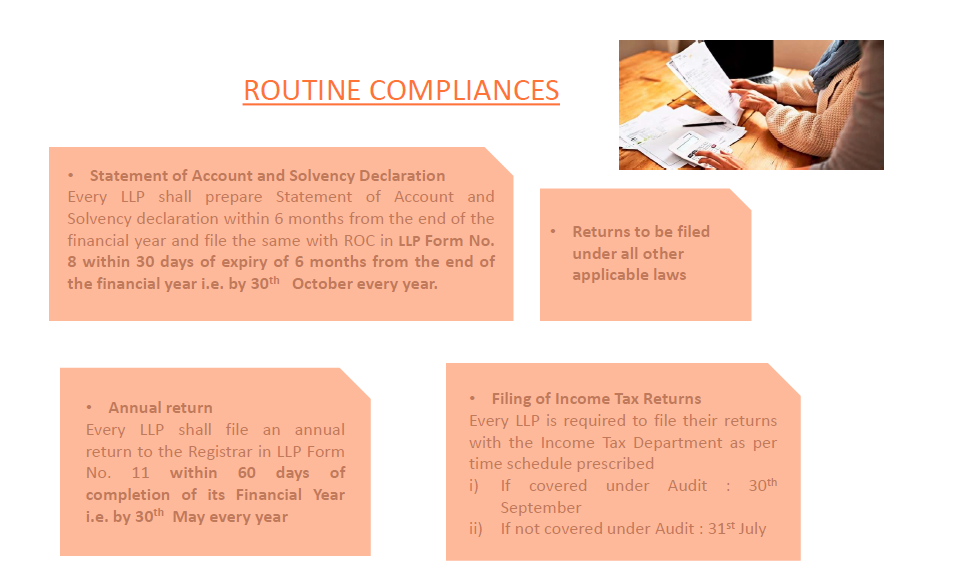

Routine Compliances:

i. LLP shall maintain books of accounts on accrual basis and according to double entry system of accounting. (Rule 24(2))

ii. Audit of books of accounts of the LLP is not mandatory if the turnover does not exceed Rs 40 lacs in any FY or contribution does not exceed Rs 25 Lakhs (Rule 24(8).

iii. An LLP has to close its financial year on 31st March every year.

iv. All the Books of accounts, other documents, and annual forms shall be preserved at its registered office for 8 years from the date on which they are made.

v. Every Designated Partner to file DIR KYC-3 Form up to 30th April, annually.

Tax Aspects:

• LLP’s is treated as Partnership Firms for the purpose of Income Tax

• There is no surcharge on income tax of LLP.

• Minimum Alternate Tax (MAT) (Sec. 115JB): The provisions are not applicable to LLP.

• Alternate Minimum Tax (AMT) (Sec.115JC to Sec.115JF): With effect from A.Y. 2011-12, LLPs are required to pay Alternate Minimum Tax (AMT) @ 18.5% on their Book Profit.

• Dividend Distribution Tax Sec 115O: NO dual taxation on distribution of its profits as DDT is not applicable.

• Deemed Dividend [Section 2(22) (e)]: Any loan given by LLP to its partners out of its accumulated Profits/Reserves is not liable to be taxed as Deemed Dividend unlike in the case of closely held companies.

• As per Finance Bill, 2015 LLP’s will be taxed @ 30%.

Deductions Allowed to an LLP:

• Interest paid to partners, provided such interest is authorized by the LLP Agreement (Section 40(b)) rate of interest being 12% per annum.

• Any salary, bonus, commission, or remuneration (by whatever name called) to a partner will be allowed as a deduction if it is paid to a working partner who is an individual.

• The remuneration paid to such working partner must be authorized by the LLP Agreement and the amount of remuneration must not exceed the given limits. (Section 40(b)).

| Particulars | Salary Allowed |

| a. On the first 3,00,000 of book profits or in case of a loss | Rs. 1,50,000 or at the rate of 90% of the book profit (whichever is higher) |

| b. On the balance of book profits | at the rate of 60% |

Audit of LLP:

Penalties and Fines:

• For defaults/ non-compliance on procedural matters such as filing through the levy of a default fee for every day for which the default continues.

• Such default fee would be payable at the rate of Rs.100 per day after the expiry of the date of filing up to a period of 300 days (section 69). This is to be paid at the time of filing only without any discretion.

• The offenses under the act can be punished either

• through payment of fine or

• through payment of fine as well as imprisonment

• The Judicial Magistrate of the first class or Metropolitan Magistrate shall have jurisdiction to try offenses under the LLP Act.

• It also provides for imprisonment penalty for following violations

• making by any person a false statement at the time of incorporation of LLP

• carrying on the business of LLP with intent to defraud or for any fraudulent purposes and

• making, knowingly, false statements or omitting any material fact, in any return, documents etc. under the act.

• The offenses which are punishable with fine only can be compounded by the Central Government, by collecting a sum not exceeding the amount of maximum fine prescribed for the offense.