How to calculate max ITC in GSTR 3b?

What is changed related to ITC in GSTR 3b?

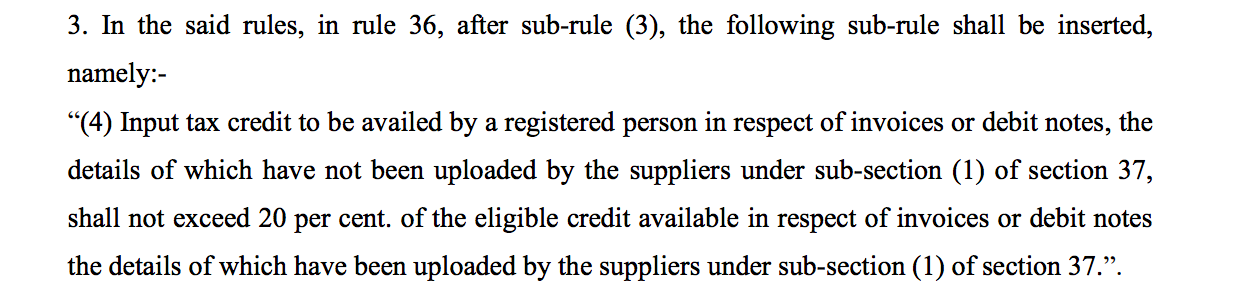

In light of recent updates in GST, we have compiled this article. Rule 36 is inserted into CGST rules. The text of the same is reproduced here.

This rule is the latest reason for the nightmares of businesses and consultants. In this article, I will throw some light on how to calculate this 20%. This is a personal view and translation of provision. It may change with time. But as of now, it can help you to understand the effect of the provision.

It says that the ITC of invoices is not declared in the return u/s 37 of the CGST Act shall be restricted. What is the parametre of restriction? 20% of eligible ITC of invoices declared. There are many unanswered questions behind this provision of one para. You can watch this video on the same topic

allowfullscreen=”allowfullscreen”>

Whether the ITC of invoices not required to be declared u/s 37 will be available or not?

The answer to this question is complex. But the right to claim ITC of all purchases is derived from section 16. This rule cant override section 16. ITC of purchases like, import and RCM which are not required to be declared by the vendor shall be available. Max amount of ITC to be taken in GSTR 3b will be:

Reflected in 2A- Ineligible ITC+ Import+ RCM + 20% of Reflected in 2A – ineligible ITC.

E.g.

ITC in 2A: Rs. 1000

Purchase during the month:

Domestic: Having a tax of Rs. 15000

Import: Having tax of Rs. 20000

RCM: Rs. 10000

Now while filing GSTR 3b the ITC which can be claimed is:

Import ITC: 100%: Rs. 20000

RCM: 100% : Rs. 10000

Reflacted in 2A: Rs. 1000 (Assuming that entire ITC was eligible)

Provisional ITC: Rs. 200(20% of declared in 2A)

How ITC of the taxpayers filing section 37 return quarterly?

In this case, ITC will be blocked for the quarter. Corporates may start to avoid placing orders to this kind of vendor. This will result in a hit to the small scale sector. A taxpayer having a turnover up to Rs. 1 Cr is required to file their GSTR 1 quarterly. But if they are required to upload invoices consistently then their compliance burden will increase. This is a hardship for SME GST dealers.

My personal view is that this provision will be postponed or will be redrafted. In another case it is going to create havoc in the industry.

Post your queries st following link:

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.