Calculation Of Income Tax And Filing Of ITR On Income Tax Portal

Just a decade ago filing an ITR was considered a herculean task for the normal taxpayer It was some kind of rocket science to be performed by a few professionals. Undoubtedly, with the advent of income tax return filing software and utilities provided by the department, the monotonous job of filing ITR has become easy and interesting. Today we shall try to answer some of the generally asked questions. This would enlighten the readers and remove their fears.

Table of Contents

- Calculation of Taxable Income

- Who Has To File ITR?

- Liability To File I.T.R.

- Mandatory Return Filing

- How to Calculate Income tax

- Tax Deducted at Source (TDS) Certificates and Form 26AS

- Choose the right Income Tax Form

- Filing The Return On The Income Tax Portal

- Offline Method

- Online Method

- Validation of ITR

- Learn how to file ITR On Income Tax Portal with a certificate course on ConsultEase

Calculation of Taxable Income

Every person earning an income has to pay Income tax to the Government of India. A person can earn from multiple sources of income. According to I.T. Act, all of them have been broadly segregated into five categories:

INCOME HEADS

Income from Salary xxxxx

Income from House Property + xxxxx

Income from PGBP (business and profession) + xxxxx

Income from Capital Gains + xxxxx

Income from Other Sources + xxxxx

= G.T.I. GROSS TOTAL INCOME (*)

– EXEMPTIONS

– SPECIFIC DEDUCTIONS FROM DIFFERENT INCOME HEADS

= GROSS TAXABLE INCOME (!)

– GENERAL DEDUCTIONS UNDER CHAPTER VI-A

= N.T.I. NET TAXABLE INCOME (#)

EXPLANATIONS FOR VARIOUS TERMS USED ABOVE

GROSS TOTAL INCOME- Sum total of income earned (received and receivable) during the financial year from various sources under all the heads without reducing any exemptions and deductions.

EXEMPTIONS –These amounts are reduced directly from specific income sources, not from the total income. They are not considered as income for calculation of income tax according to I.T. Act but have to be compulsorily declared in the return.

SPECIFIC DEDUCTIONS – These amounts are reduced from the income of specific income heads as they are pertaining to the nature of that income head. For e.g. Sec 16 deductions are particular for the head Salaries and Sec 24 deductions are available only for income from house property.

GENERAL DEDUCTIONS – These amounts are reduced from Gross taxable income owing to the nature of their payment. They are available in accordance with chapter VI-A, like series of deductions under section 80c to 80u

Related Topic:

How To File ITR Using The New Filing Portal of Income Tax

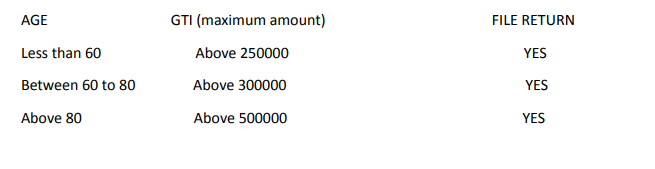

Who Has To File ITR?

Add all the incomes from various heads i.e. Gross Total Income( without giving the effect of any exemptions, deductions), and compare it with the maximum amount not chargeable to tax. If it is more than that, file return otherwise filing of return is optional. If you have filed any return in previous years it is advisable to file a return each year.

Related Topic:

Income Tax Search and Seizure: Whether a new claim can be raised in the Income Tax return filed u/s 153A of the act

Liability To File I.T.R.

Mandatory Return Filing

If a person fulfills any of the below conditions it is mandatory for him to file ITR

1) Every person –

a) being a company or a firm; or

b) being a person other than a company or a firm, if his total income during the previous year exceeds the maximum amount not chargeable to tax for that person.

2) The person is a beneficial owner of any asset (including financial asset) outside India or a signing authority of an account outside India.

Related Topic:

Notification No. 23/2018- Income tax

3) The person is a beneficiary of any income arising from any asset outside India.

4) Has deposited an aggregate amount exceeding one crore in one or more current accounts maintained with banking companies or a cooperative bank, or

5) Has incurred expenditure in aggregate of the amount exceeding two lakhs for himself or any other person for travel to a foreign country; or

6) Has incurred expenditure in aggregate of an amount exceeding one lakh towards consumption of electricity.

7) Any specified condition as may be prescribed by the department.

Related Topic:

Order passed at the time when Income Tax Portal was dysfunctional, Assessment Order was set Aside

Some other conditions which also necessitate furnishing of return;

(i) For claiming an income tax refund.

(ii) For carrying forward losses.

(iii) A proof of return filing is required for applying for a loan or visa.

Related Topic:

Tax Liability on Issue of Gift Vouchers.

How to Calculate Income tax

● Enter the name, address, PAN no, age (if an individual), residential status, organizational status, bank details into the software.

● The software will verify the PAN number from the income tax portal.

● Enter the amounts of the various income sources under different heads, corresponding expenses incurred and any other information needed by the software.

● If salaried, enter the type of employment and all the amounts ( basic, DA,

● Pension, gratuity, HRA, leave salary, etc ) received under different categories of salary. Enter the amounts from Form 16 or the salary slip provided by the employer.

● If there is any capital gain, enter asset sold, consideration, cost of acquisition, holding period, etc.

● If there is business income, be careful that turnover disclosed in income tax and GST should be the same. Also, enter any brought forward loss or unabsorbed depreciation.

● Enter all the amounts paid for medical insurance, life insurance, tuition fees of children, interest, and principal of the home loan or education loan, donations, pension schemes, mutual funds investment, etc.

● The software will take care of the calculation of all the exemptions, specific and general deductions, and rebates.

Related Topic:

Sharing of Data between Income Tax and GST Authorities

● Download the form 26 AS from the TDS (TRACES) portal and enter the amounts of TDS, TCS and advance tax paid if any.

● After this software will calculate the N.T.I., calculate tax and adjust for taxes already collected by the authorities and tell the taxpayer if any more tax is to be paid or there is a refund. If there is any further tax liability then it has to be paid before filing of return. The filed return has to be verified by Adhar of the taxpayer.

Related Topic:

Is Income Tax & GST Applicable on Cryptocurrencies?

CALCULATION OF TAX – Tax is calculated on N.T.I. at the rates specified in the assessment year. Some types of incomes like long-term and short-term capital gains have a specific fixed-rate and are calculated separately, before the normal slab rates.

If a specific rate is not applicable for short-term capital gain, then it is clubbed with other incomes and taxed according to the slab rate.

For eg STCG on listed equity shares sold through an exchange are taxed at 15% (U/S 111A) and STCG on unlisted equity shares is clubbed to Gross Taxable Income.

REBATE (U/S 87A) – After the calculation of tax on net taxable income, a tax rebate is claimed from the total tax payable. Till F/Y 2018-19 maximum rebate available was Rs 2500, but now from F/Y 2019-20 maximum rebate available is Rs 12500.

Related Topic:

How to File the Income Tax Return of a Salaried Person in 2021

DUE DATES FOR FILING ITR – It is the date by which an assessee can file ITR without any late fee or penalty.

a) The due date for filing ITR by taxpayers (Other than those whose accounts have to be audited) has been extended from 31 July 21 to 30 Sept 21.

b) The due date for filing ITR by taxpayers ( whose accounts have to be audited) has been extended from 30 Sep 21 to 30 Nov 21.

c) The due date for filing ITR by taxpayers ( transfer pricing cases, U/s 92 E) has been extended to 31 Dec 21.

d) The due date to file a belated or revised return has also been extended by one month to 31 Jan 22.

Tax Deducted at Source (TDS) Certificates and Form 26AS

As the name suggests this concept envisages collection of tax at the very source of income. According to this idea, a person (deductor) who is liable to make payment of specified nature, over and above a specified amount to any person (deductee) shall deduct tax at source.

Then he shall remit the same into the account of the central government. Every deductor has been allotted a TAN no (Tax deductor account number) by the department.

Note -T.D.S. (Tax deduction at source), T.C.S. (Tax collection at Source), and Advance tax is not payment of tax, they are merely taxed and data collection mechanisms adopted by the authorities.

Related Topic:

Ambiguities Due to Extension of Due Dates for ITR

Form 26AS – It is a statement that provides details of any amount deducted as TDS from various sources of income, TCS collected while purchasing something, and advance tax deposited by the taxpayer. This amount deducted or collected is then remitted with the government along with complete information and the PAN number of the taxpayer.

It also reflects details of advance tax/self-assessment tax and high-value transactions entered into by the taxpayer. It can be downloaded from the TDS (TRACES) portal.

Related Topic:

Income Tax Deductions – Individuals and HUF (FY 2019-20)

Choose the right Income Tax Form

There are seven ITR forms, namely ITR 1, ITR 2—–ITR 7 which have been notified by the department for the taxpayers to file the information regarding their income earned and tax thereon. The applicability of ITR forms depends on the sources of income, amount of income earned, and the organizational structure of the taxpayer like individual, HUF, company, partnership firm, etc.

ITR 1 (SAHAJ)

Income heads – Salary, House Property (one house), Other Sources (excluding cases of brought forward losses), Agriculture income up to Rs 5000

Person – Individual

Residential status – Only Ordinary Resident Total income – Gross Total Income <= 50 lakhs

Other conditions – Does not have income from lottery, racehorses, gambling, taxable long and short-term capital gains, business, and profession. Must not be a beneficial owner of an asset outside India or a signing authority in any account outside India. Should not be a director in a company or hold any unlisted equity shares.

ITR 2

Income heads – salary, House property, Capital gains, other sources, agricultural income>5000, owning foreign assets, or earning foreign income.

Person- Individual and HUF, Director of a company, and an individual having investment in unlisted equity shares.

Residential status – Both ordinary and Not ordinary Resident

Total income – No Restriction

Other conditions – Does not have business income

ITR 3

Income heads- Business and profession(both tax audit and non-audit cases), capital gains, all the incomes of ITR1

Person – Individual or HUF having business income not chargeable under presumptive taxation, Partners of a partnership firm

Residential status – Both ordinary and Not ordinary Resident, Non-Resident also

Total income – No Restriction

Other conditions – No Restriction

ITR 4

Income heads – Business Income U/S 44AD or 44AE, Income from profession U/S 44ADA, Salary House property, Other sources individually up to 50 lakhs

Person – Individual / HUF/Partnership Firm

Residential status – Ordinary Resident

Other conditions – Income under PGBP chargeable on presumptive bases mandatory, having TO up to 2 crores, books of accounts should not be audited, Income from Salary, House property, Other sources individually should not exceed 50 lakhs.

ITR 5

Income heads – All heads except salary

Person – Firms, LLPs, AOPs, BOIs, AJPs, Estate of Deceased, Estate of Insolvent, Business Trust, Cooperative Society, Investment Fund, Local Authority.

Other conditions – Should not file return U/S 139(4A),139(4B),139(4C),139(4D), Should file audit report under various subsections of section 10, section 44, section 80, section 115.

ITR 6

Income heads – All heads except salary

Person– Companies that do not claim an exemption under sec 11

Other conditions – Audit U/S 44 AB

ITR 7

Person – All persons filing return U/S 139(4A), 139(4B), 139(4C), 139(4D) i.e

1) Trust for charitable or religious purposes.

2) Political party

3) Scientific Research Association, News Agency, Hospital, Educational Institution.

4) University, college, or other institution which is not required to furnish the return in any other provision of this section

The taxpayer can accomplish the above-mentioned tasks with the help of software or with the help of utilities provided by the department. We are giving the procedure if you are using the department’s utility.

Filing The Return On The Income Tax Portal

A person can file a return on the portal in two ways. Online and Offline methods. Only ITR forms 1 and 4 can be filed by online method. We are explaining both methods to our readers.

Related Topic:

New Regime of Income Tax Search and Seizure Assessments – Glaring Implications

Offline Method

To e-File the ITR using the upload XML method, the user must download the Excel Utility. Following are the steps to download the Excel Utility, then to generate and Upload the XML:

1) Go to the Income Tax e-Filing portal wwwdotincometaxindiaefilingdotgovdotin

2) Download the Appropriate ITR utility under ‘Downloads > IT Return Preparation Software’.

3) Extract the downloaded utility ZIP file and Open the Utility from the extracted folder.

4) Fill in the applicable and mandatory fields of the ITR form.

5) Validate all the tabs of the ITR form and Calculate the Tax.

Note- Pre-filled XML can be downloaded post login to the e-Filing portal from ‘My Account > Download Pre-Filled XML’ and can be imported to the utility for prefilling the personal and other available details.

Generation of the XML file

1) Generate and Save the XML.

2) log in to the e-Filing portal by entering user ID (PAN), Password, Captcha code, and click ‘Login’.

3) Click on the ‘e-File’ menu and click the ‘Income Tax Return’ link.

On the Income-tax return page

1) PAN will be auto-populated

2) Select ‘Assessment Year’

3) Select ‘ITR form Number’

4) Select ‘Filing Type’ as ‘Original / Revised return’

5) Select ‘Submission Mode’ as ‘Upload XML’

6) There will be a display of all the bank accounts connected with the PAN. Select any one of the accounts for receiving the refund, if any

Verification of the submitted return

1) Choose any one of the following options to verify the Income Tax Return:

a) Digital Signature Certificate (DSC).

b) Aadhaar OTP.

c) EVC using Prevalidated Bank Account Details.

d) EVC using Prevalidated Demat Account Details.

2) Click ‘Continue’

3) Attach the ITR XML file.

4) Upon choosing any one of the following

a) DSC as a verification option, Attach the signature file generated from the DSC management utility.

b) Aadhaar OTP as a verification option, Enter the Aadhaar OTP received in the mobile number registered with UIDAI.

c) EVC through Bank account, Demat account, or Bank ATM as verification option, Enter the EVC received in the mobile number registered with Bank or Demat Account respectively.

Apart from the above, there are two more options to verify the return

1) The submitted ITR should be e-Verified later by using the ‘My Account > e-Verify Return’ option.

2) Take the printout of ITR- V and send the signed copy to CPC Bangalore

Now SUBMIT the return

To View The Uploaded ITRs

Go to the Income Tax e-Filing portal, wwwdotincometaxindiaefilingdotgovdotin

Log in to the e-Filing portal by entering user ID (PAN), Password, Captcha code and click ‘Login’.

Click on the ‘e-File’ menu and click the ‘Income Tax Return’ link.

Online Method

Enter the relevant data directly online at the e-filing portal and submit it.

Taxpayers can file only ITR 1 and ITR 4 online.

On Income Tax Return Page:

1) PAN will be auto-populated

2) Select ‘Assessment Year’

3) Select ‘ITR Form Number’

4) Select ‘Filing Type’ as ‘Original/Revised Return’

5) Select ‘Submission Mode’ as ‘Prepare and Submit Online

6) Click on ‘Continue’

7) There will be a display of all the bank accounts connected with the PAN. Select any one of the accounts for receiving the refund, if any

8) Read the Instructions carefully and Fill all the applicable and mandatory fields of the Online ITR Form.

Note:

To avoid loss of data/rework due to session timeout, Click on the ‘Save Draft’ button periodically to save the entered ITR details as a draft. The saved draft will be available for 30 days from the date of saving or till the date of filing the return or till there is no change in the XML schema of the notified ITR (Whichever is earlier).

Choose the appropriate Verification option in the ‘Taxes Paid and Verification’ tab.

Validation of ITR

Choose any one of the following options to verify the Income Tax Return:

1) EVC generated through bank ATM or Generate EVC option under My Account

2) Aadhaar OTP

3) Prevalidated Bank Account

4) Prevalidated Demat Account

Apart from the above, there are two more options to verify the return

1) The submitted ITR should be e-Verified later by using the ‘My Account > e-Verify Return’ option.

2) Take the printout of ITR- V and send the signed copy to CPC Bangalore

Note- 1)The EVC/OTP should be entered within 60 seconds, else the Income Tax Return (ITR) will be auto-submitted. The submitted ITR should be verified later by using the ‘My Account > e-Verify Return’ option or by sending signed ITR-V to CPC.

2) The submitted return should be verified within 120 days. The I.T department does not process the unverified return. An ITR submitted but not verified is treated as an invalid return. An invalid return would mean that you have not filed your return for that particular assessment year.

Today we are recommending for you one of the finest online return filing courses.

Learn how to file ITR On Income Tax Portal with a certificate course on ConsultEase

This certification course on the filing of ITRs on the e-filing portal is the first step in making a person “ATMA NIRBHAR” in filing his own ITR. This will decrease his dependency on a tax consultant. This course should be done by persons of every age and in any field. This course is specially developed by Consultease in association with CA Rohit Kapoor. This course will help every individual in practically understanding the nuances of the portal and entering the correct information in the right table. It will help in choosing the appropriate ITR form according to the income of the person. It will also help a technology-shy person in becoming computer savvy. It can be accessed any time, anywhere on an easy-to-operate online ConsultEase dashboard. The pre-recorded video can be watched any number of times. The course fee is also very nominal. You will also be provided with a certificate from ConsultEase after completion of the course. It is available now at a 50% discount i.e Rs 1000/- only

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.