Can Assessee Claim a Refund of Taxes Paid in Cash for Export of Goods Due to the Unavailability of Accumulated Transitional ITC at the Time of Supply.

Table of Contents

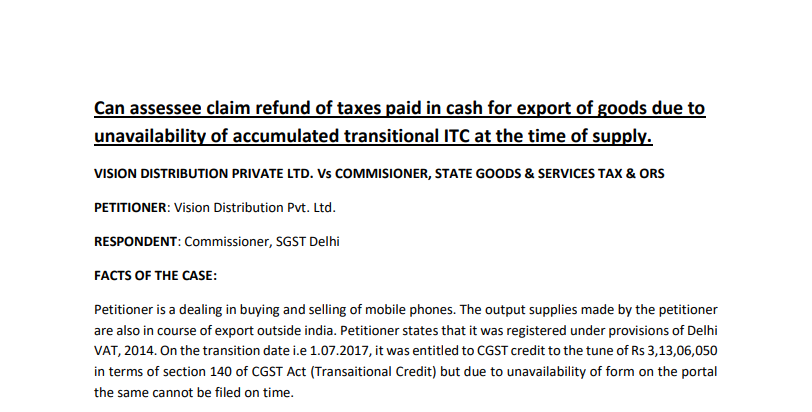

Can assessee claim a refund of taxes paid in cash for export of goods due to the unavailability of accumulated transitional ITC at the time of supply.

VISION DISTRIBUTION PRIVATE LTD. Vs COMMISSIONER, STATE GOODS & SERVICES TAX & ORS

PETITIONER: Vision Distribution Pvt. Ltd.

RESPONDENT: Commissioner, SGST Delhi

Facts of The Case:

The petitioner is dealing with buying and selling mobile phones. The output supplies made by the petitioner are also in course of export outside India. Petitioner states that it was registered under provisions of Delhi VAT, 2014. On the transition date i.e 1.07.2017, it was entitled to CGST credit to the tune of Rs 3,13,06,050 in terms of section 140 of the CGST Act (Transitional Credit) but due to unavailability of form on the portal, the same cannot be filed on time.

Learned Counsel For Petitioner:

It is stated that the petitioner has made exports in the month of July and August 2017 and paid tax in cash to the tune of Rs 1,37,37,029. Learned counsel also stated that due to admittedly unavailability of transitional form on a timely basis, the petitioner couldn’t file the same in the month of July or August and the same was filed in the month of December 2017. Now, the request has been made to issue an order for a refund of tax paid in cash i.e Rs 1,37,37,029 also the Input Tax Credit earned on zero-rated supplies made in the months of July and August 2017 which were Rs. 50,42,831/- for the month of July 2017 and Rs. 1,17,29,495/- for the month of August 2017, aggregating to Rs. 3,05,09,355/-.

Learned Counsel For Respondent:

Submits that under the GST regime, there is no provision for a grant of refund of the accumulated ITC and the result of the Petitioner of paying the tax in cash to the tune of Rs. 1,37,37,029/- has been that the Petitioner has earned ITC for the equivalent amount which is lying credited in its ITC ledger from November 2017 onwards, and it is open to the Petitioner to utilize the same in future. He submits that under Rule 86 (3) of the CGST Rules, where a registered person claims refund on any unutilized amount from the electronic credit ledger in accordance with the provisions of Section 54, the amount to the extent of the claim is required to be debited in the said ledger. In case an assessee claims a refund for the months of July and August 2017, there has to be unutilized ITC credit lying in the electronic credit ledger of the assessee for the said months, which is not the case.

Held:

Had the government been able to facilitate the form on a timely basis, the petitioner would have utilized the accumulated ITC which is paid in cash. So petitioner’s claim for refund of cash deposit to the tune of Rs. 1,37,37,029/-certainly not be denied to him. A person should not suffer due to the inefficiency of the respondent for his vested right. A partial refund of the amount claimed by the petitioner is allowed. So far as the Petitioner’s claim for the refund of the remaining amount is concerned, the Petitioner has already submitted the documents in that regard. The Respondents are directed to pass a reasoned order on the same.

Crux:

The refund has to be granted for the amount of tax paid in cash against export. Vested right of an assessee cannot be taken away merely due to the inefficiency of revenue on technical grounds.