Cancellation of Registration Under GST – Why, How & What to Do After Cancellation?

Life is full of uncertainties. You had taken the GST number with a lot of frenzies, but due to some unforeseen circumstances, you have to get it cancelled. There may be multiple reasons for it. Some in your control, some maybe not. Today we are going to tell you, what are the various causes by which your GST number may be cancelled.

Table of Contents

- Meaning and consequences of cancellation of GST registration

- Who can initiate the process of cancellation?

- Conditions where the taxpayer can voluntarily apply for cancellation [sec 29(1)]

- Conditions where the legal heirs can apply

- Conditions where the GST officer can suo moto cancel the registration

- Suspension of registration

- Procedure for Voluntary Cancellation of GST Registration

- Grounds of non-acceptance of such application

- Procedure for Suo moto Cancellation of registration

- Procedure for revocation of suo moto suspension

- Some case laws

- (1) Vidyut Majdoor Kalyan Samiti vs State Of U.P. And 3 Others on 18 January, 2021 at Allahabad High court

- (2) M/S Ansari Construction vs Additional Commissioner Central on 24 November 2020 at Allahabad High court

- (3) Tvl Vectra computer solutions Vs Commissioner of Commercial Taxes( Madras high court)

- (4) Case law of Ramakrishnan Mahalingam

- (5) M/s. Avon Udhyog Versus State Of Rajasthan Through The Commissioner Of State Tax and others

- Latest Update on Cancellation of Registration Under GST

- Conclusion

Meaning and consequences of cancellation of GST registration

- The taxpayer will no longer remain a GST registered person.

- He will not have to pay or collect GST.

- He can not claim the input tax credit.

- He is not required to file GST returns.

- He can not undertake those businesses where GST registration is mandatory. If he continues such business even after cancellation, then he is committing an offence under GST Act and heavy penalties will apply.

- He cannot make interstate outward supply (Except in case of a supply of services up to a limit, subject to certain conditions)

- He cannot issue a tax invoice and cannot pass on the input tax credit to his customer.

- He remains liable for unpaid tax dues (tax attracted before the cancellation date, interest, penalty) whenever identified.

- The cancellation of registration under the SGST Act or the UTGST Act, as the case may be, shall be deemed to be a cancellation of registration under the CGST Act and IGST Act and vice versa.

- He can apply for revocation of cancellation only if the GST officer has cancelled the registration suo moto, subject to certain conditions.

- If in case of suo moto cancellation, he does not apply for revocation of cancellation and apply for fresh registration then the proper officer may reject such application. Sec 29(2)(e) and Circular No. 95/14/2019-GST.

If he had applied for cancellation voluntarily, then he cannot apply for revocation but has to apply for fresh registration if he wants to start the business again or there is a change in any circumstances.

Related Topic:

Who can initiate the process of cancellation?

- The process of cancellation of GST registration can be initiated by any of the three persons; (According to sec 29 of the CGST Act)

- Voluntarily by the taxpayer

- The legal heirs of the taxpayer ( in case of his death)

- Suo moto (on his own motion ) by the proper GST officer

Conditions where the taxpayer can voluntarily apply for cancellation [sec 29(1)]

- If he has discontinued the business.

- If the business has been transferred fully (sale, amalgamation, merger, demerger, or otherwise disposed of) and the transferee entity has got registered. The transferor ceased to exist.

- If the constitution of the business has changed. (partnership firm to Pvt Ltd. company)

- If he is no longer liable to be registered under the GST Act

- Not covered by mandatory GST registration u/s 24 of the CGST Act ( casual taxable person or Non-resident taxable person)

- His turnover falls below the threshold limit u/s 22 of the Act.

Related Topic:

Conditions where the legal heirs can apply

Due to the death of the registered person, his legal heirs can apply for the cancellation of the GST registration, if they do not want to continue the business.

Conditions where the GST officer can suo moto cancel the registration

These conditions are provided u/s 29(2) of the CGST Act

- The registered person has contravened the provisions or rules which are prescribed under this act.

- Not conducting the business from the registered place of business.

- Not issuing a tax invoice at the time of making an outward supply.

- a person who has opted for a composite scheme (u/s 10) has not furnished returns {CMP(08)} for three consecutive tax periods.

- any registered person, other than a person registered under the composite scheme has not furnished returns for a continuous period of six months.

- any person who has taken voluntary registration under sub-section (3) of section 25 fails to commence business within six months from the date of registration.

- When the registration has been obtained by means of fraud, willful misstatement or suppression of facts.

Related Topic:

Documents required for Registration under GST of AOP/BOI/Trust/Local authorities

(A) Newly introduced rules under which the officer can cancel the registration

(i) Rule 21

Registration to be cancelled in certain cases:

The registration granted to a person may be cancelled if the said person;

- Does not conduct any business from the declared place of business (The said person was not traceable at the declared place of business)

- Issues Tax invoice or bill only, without actual supply of goods or services in violation of the provisions of this Act in order to pass on fake ITC.

- Violates the provisions of section 171 (Anti-profiteering provisions).

(a). According to Section 171 of the CGST Act, 2017, the suppliers of goods and services should pass on the benefit of any reduction in the rate of tax or the benefit of input tax credit to the recipients by way of the corresponding reduction in prices.

(b). The Suppliers are not allowed to “profit” (wilful action of not passing on the above benefits to the recipients in the manner prescribed) when the department is intentionally reducing the tax rates or changing the statute to benefit the consumer.

- Violates the provisions of rule 10A (Non-Furnishing of bank account details)

(a). As per the Rule 10A of the Central Goods and Services Tax (CGST) Rules, 2017 relating to “Furnishing of Bank Account Details after Registration”, newly registered taxpayers {except those registered under rules 12 (those who have got registered to deduct TDS or collect TCS) and 16 (who have been registered suo moto by the officer)} have to submit their bank account details at GST Portal within 45 days from the date of registration or the due date for filing of first GSTR-3B (as per sec39), whichever is earlier.

- Avails excess, fraudulent, or inappropriate input tax credit in violation of the provisions of section 16 of the Act or the rules therein.

- Declares outward supplies in FORM GSTR-1 under section 37 for one or more tax periods that exceed the outward supplies declared by him in his valid return under section 39 for the said tax periods. There is a mismatch in the amount of turnover declared by the taxpayer in his GSTR 1 and 3B for a particular tax period and turnover disclosed in GSTR 1 is more than turnover in 3B.

- Violates the provision of rule 86B

Related Topic:

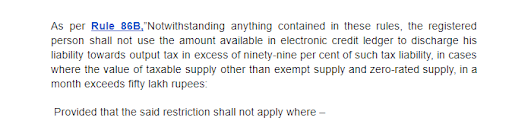

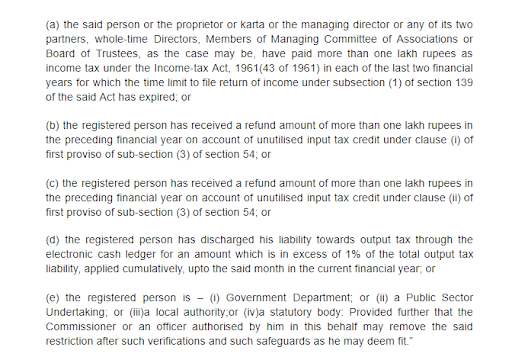

(ii) Rule 86B

(a) Restrictions on use of the amount available in electronic credit ledger.-

(b) Explanation to the rule 86B

- In the case where a taxpayer whose monthly turnover exceeds 50 lakhs (except exempt and zero-rated sales), and he discharges more than 99% of his output tax liability by electronic credit register (input available on the strength of making taxable purchases), i.e. not even 1% of output tax liability is discharged by the electronic cash register, then he is in violation of the rule 86B, provided the taxpayer does not fall in the exemption list.

- This rule has been made to refrain the taxpayers from indulging in unfair practices of availing fake ITC by declaring fake purchase invoices without making actual purchases and paying tax thereon.

- Some exemptions are also made to safeguard honest taxpayers who are already paying taxes diligently from being captured in this rule.

Related Topic:

Suspension of registration

Suspension is the precursor to cancellation. This acts as a buffer and a warning signal to the taxpayer. The proper officer shall first suspend the registration and then decide on cancellation, revocation of suspension, or revocation of cancellation ( if applied by the taxpayer) in accordance with the rules on a case to case basis. Suspension means to put a temporary hold on the GSTIN till the completion of any proceedings under these Act or rules as per the CGST (Amendment) Act, 2018, 1st Feb 2019.

(I) Rule 21A vide Notification 94/2020-Central Tax dated: 22.12.2020,

(I) Sub-rule (1) In case of voluntary cancellation – If a registered person has applied for voluntary cancellation of registration, the registration shall be deemed to be suspended from the later of the two dates;

- date of submission of the application or

- the date from which the cancellation is sought.

(II) Sub-rule (2) In case of Suo Moto cancellation – When the proper officer has enough reasons to believe that the registration of a person is liable to be cancelled (suo moto) under the provisions of sec 29 or rule 21, then the officer may suspend the registration of such person with effect from a date determined by him.

The suspension shall continue till the completion of the proceedings for cancellation of registration are pending.

(II) Subrule (2A) Circular No. 145/01/2021-GST dated 11.02.2021

(A) Where a comparison of the returns furnished by a registered person under section 39 ( GSTR 3B) is made with;

(a) the data of outward supplies declared in FORM GSTR-1; or

(b) the data of inward supplies ( taxable purchases and ITC thereon ) derived from the data of the outward supplies declared by his suppliers in their FORM GSTR-1, (i.e when 3B is compared with the data in the 2A and 2B of the taxpayer); or

(c) such other analysis, as may be carried out on the recommendations of the Council,

(d) shows that there are significant variances or anomalies which prima facie indicate contravention of the provisions of the Act or its rules, eventually leading to the cancellation of registration of the said person, then his registration shall be suspended.

Related Topic:

(B) Explanation of subrule (2A)

(i) If on comparing the details of the outward supplies (turnover and output tax) furnished under Form GSTR-1 and Form GSTR-3B by the taxpayer for a particular tax period, it becomes evident that the taxpayer is trying to suppress his actual turnover or output tax liability, OR

(ii) If on comparing details of inward supplies reflecting in the Form GSTR-2A and ITC available in the Form GSTR-2B ( both auto-drafted ) with the Form GSTR-3B (filed by the taxpayer), it is confirmed that the taxpayer is adjusting more ITC than eligible for him against his output tax liability, OR

(iii) Any other ratio analysis or audit procedure is applied to prove that the taxpayer is fraudulently reducing his output tax liability, adjusting an inappropriate amount of ITC, or providing artificial ITC to his customer, then his registration is suspended and a show-cause notice is sent.

(C) Procedure to be followed under the said rule – Giving a show-cause notice in form REG-31 under sub-rules 2 and 2A of rule 21A

The said person shall be given a show-cause notice in form GST REG-31 electronically, on the common portal, or by sending a communication to his registered email address, providing details of the said differences and anomalies and asking him to explain, within a period of thirty days, as to why his registration shall not be cancelled.

(III) Sub-rule (3) and (3A) of 21A Effects of suspension

(a) Sub-Rule (3) (for both) – A registered person, whose registration has been suspended under {sub-rule (1), voluntary} or {subrule (2) or sub-rule (2A), suo moto} of rule 21A, then he;

(a) can not make any taxable supply during the period of suspension and will not be required to furnish any return under section 39.

(b) Sub Rule (3A) {only for suo moto cancellation} – A registered person, whose registration has been suspended under sub-rule (2) or sub-rule (2A), shall not be granted any refund under section 54, during the period of suspension of his registration.

(IV) Explanation for sub-rule (3) and (3A)

For the purposes of this sub-rule, the meaning of the expression,” shall not make any taxable supply ” is;

- It means that the registered person whose registration has been suspended, can not issue a tax invoice and, accordingly, will not charge output tax on the outward supplies made by him during the period of suspension.

- It means he can make outward supplies but he has to work as if he is a non-registered person. He will not be able to avail any ITC on purchases made during the said period and tax paid on his inputs shall become his costs.

- He will not file return GSTR 1 and 3B during this period.

- He shall remain registered, but not function as a registered person.

Notes

- The GST registration of any taxpayer becomes liable to suo moto cancellation according to the provisions of section 29(2), and Rule 21. These two provisions call for cancellation after suspension.

- Before such cancellation, the proper officer has to first suspend the registration under subrule (2) of rule 21A. The opportunity of being heard is provided after the suspension.

- The newly introduced subrule (2A) of rule 21A also calls for suspension.

Related Topic:

Procedure for Voluntary Cancellation of GST Registration

(Rule 20 and 22)

(1) Rule 20 Making an application- When a registered taxpayer or the legal heirs (in case of death of the taxpayer) voluntarily seek cancellation of his registration u/s 29(1), then he shall electronically submit an application in FORM GST REG-16. Such application should include the details of inputs held in stock, inputs contained in the semi-finished state, or finished goods held in stock and of capital goods held in stock, on the date from which the cancellation of registration is sought. It should also disclose the tax liability thereon, the details of the payment, if any, made against such liability.

(2) If the reason mentioned for the cancellation request is, “transfer, merger or amalgamation of business”, then there is no need to reverse the ITC (as it is already adjusted) on the inputs held in stock because the transferee entity will continue the operations and make taxable output supplies out of those inputs.

(3) If there is any other reason then, before cancellation, the ITC on the inputs held in stock, and the ITC availed on capital goods has to be reversed in an appropriate ratio (as it is already adjusted) [u/s 29(5)].

(4) All the returns till the date of making the application for cancellation must be furnished otherwise the portal itself will not make the request for cancellation.

(5) Rule 22 Cancellation order – When the proper officer completely satisfies himself that the person, who has submitted an application for cancellation of his registration is no longer liable to be registered, or his registration is liable to be cancelled, he shall issue an order in FORM GST REG-19 within a period of thirty days from the date of application.

(6) After the filing of an application for cancellation of registration in FORM GST REG-16, the status of GSTIN will be changed to “Suspended” till the final order of cancellation is passed by the proper officer.

Grounds of non-acceptance of such application

(a) When a proper officer receives an application for voluntary cancellation of registration, he may decide against accepting the application due to the following reasons;

- The submitted application is incomplete.

- If the reason mentioned for the cancellation request is ‘transfer, merger or amalgamation of business, and the new entity hasn’t registered with the tax authority before the submission of the application.

(b) In these situations, the concerned officer intimates the nature of the discrepancy through a written notice to the applicant. The applicant must reply to the same within seven days of the date of receipt of the letter. If the applicant does not reply, the concerned officer may reject the application after providing him/her with an opportunity to be heard. Reasons for the rejection must be recorded in the intimation letter.

Related Topic:

E-book on meaning of important terms used in GST by CA Ashok Batra

Procedure for Suo moto Cancellation of registration

(Rule 22)

(1) Suo moto under sec 29(2) and rule 21 – When the proper officer has credible, relevant reasons to reach the decision that the registration of such taxpayer is liable to be cancelled under section 29 or rule 21, then he shall issue a show-cause notice (SCN) to such person in form GST REG-17. This SCN has to be replied to within a period of seven working days from the date of the service of such notice, as to why his registration shall not be cancelled.

(2) Reply- The reply to the (SCN) issued in subrule (1), has to be furnished in form GST REG–18 within the prescribed period.

(3) Cancellation order- When such person does not reply to the SCN or does not provide a satisfactory reason for such non-compliance then, the proper officer shall issue an order in FORM GST REG-19, within a period of thirty days from the due date of the reply to the show cause. The effective date of cancellation shall be determined by him.

(4) He will notify the taxable person and shall direct him to pay arrears of any tax, interest or penalty including the amount liable to be paid under sec 29 (5) [ as ITC is already availed on inputs that are still in stock and reversal of ITC on capital goods in an appropriate ratio ].

(5) The provisions of sub-rule (3) shall, mutatis mutandis (Equitably), also apply to the legal heirs of a deceased proprietor, as if the application had been submitted by the proprietor himself.

Note

As Per sec 29(5)

The amount payable on cancellation ( both in the case of voluntary and suo moto) by the taxable person will be;

(a) in the case of Inputs,

- Reversal of the ITC in raw materials, or inputs in semi-finished/finished goods held in stock on the day immediately preceding the date of cancellation OR

- The output tax payable on such goods,

-whichever is higher

(b) In the case of capital goods,

- The ITC took on the said capital goods reduced by a certain percentage ( based on usage, age or any other appropriate criteria)

OR

- The output tax on the transaction value of such written down capital goods

– whichever is higher

Related Topic:

Procedure for revocation of suo moto suspension

- Revocation means,” Official annulment of a previously made decree, decision or a promise”. Here it means, “recalling the previous order of suspension of registration”

- Subrule (4) of Rule 22 (Revocation of suspension order) – Where the reply furnished by the taxpayer (in reply to the SCN) is found to be satisfactory, the proper officer shall halt the proceedings and pass an order in form GST REG –20. The suspension will be revoked and the registration shall again be restored.

- The situation where the suspension was due to non-furnishing of returns or non-payment of tax liability – Where the person instead of replying to the notice, furnish all the pending returns {u/s 29(2) clause (b) and (c) } and makes full payment of the tax dues along with applicable interest and late fee, then the proper officer shall stop the further proceedings and pass an order of revocation of suspension in form GST-REG 20

- Subrule (4) of rule 21A When the proceedings initiated by the proper officer under rule 22 are completed, then the suspension of registration shall be deemed to be revoked. The effective date of revocation shall be the date on which such suspension was made. Though the proper officer has the authority to revoke the suspension anytime during the pendency of the proceedings for cancellation if he deems fit.

- Subrule (5) of rule 21A Where an order for revocation of suspension of registration has been passed, the provisions of clause (a) of section 31(3) [ provisions regarding the issuance of the revised invoice within one month of registration ] and section 40 [ declaring all the outward supplies made during the intervening period of grant of registration and becoming liable to get registration, in the first return ] in respect of the supplies made during the period of suspension and the procedure specified therein shall apply.

Related Topic:

Procedure for revocation of cancellation

(Rule 23)

- Here revocation means, “recalling the previous order of cancellation of registration”.

- In the case of suo moto cancellation of registration by the proper officer, the registered person has to submit an application for revocation of cancellation of registration, in form GST REG-21, to such proper officer, within thirty days from the date of the service of the order of cancellation of registration at the common portal. Such an application can also be filed through a facilitation centre notified by the Commissioner.

- If the registration has been cancelled because of the failure of the registered person to furnish returns, then the taxpayer has to first furnish such returns along with any amount due as tax, interest, penalty, and late fee in respect of the said returns. Then only he can make an application for revocation of cancellation.

- Furthermore, all the returns due for the period between the date of the order of cancellation of registration and the date of the order of revocation of cancellation of registration shall be furnished by the said person within thirty days from the date of order of revocation of cancellation of registration.

- In the situation of retrospective cancellation of the registration, the registered person shall furnish all the returns relating to the period, from the effective date of cancellation of registration till the date of order of revocation of cancellation of registration within thirty days from the date of order of revocation of cancellation of registration.

- The proper officer, after getting satisfied that there are sufficient grounds for revocation of cancellation of registration, shall revoke the cancellation of registration by an order in form GST REG-22 within thirty days from the date of the receipt of the application and communicate the same to the applicant.

- Where the proper officer is not satisfied with the reasons provided by the taxpayer then he may reject the application for revocation of cancellation of registration and pass an order in form GST REG-05. The said order shall be communicated to the applicant.

- Before passing such a rejection order, the concerned officer shall issue another notice in form GST REG–23 requiring the applicant to show cause as to why the application submitted for revocation should not be rejected. The applicant shall furnish the reply within seven working days from the date of the service of the notice in form GST REG-24.

- After the receipt of the clarification provided by the taxpayer in form GST REG-24, the proper officer shall proceed to dispose of the application in a specified manner [ as per subrule (2) of rule 23] in a period of thirty days from the date of the receipt of such information or clarification from the applicant.

Note- All the communication made with the taxpayer by the proper officer, along with all the reasons should be in writing.

Related Topic:

Some case laws

(1) Vidyut Majdoor Kalyan Samiti vs State Of U.P. And 3 Others on 18 January, 2021 at Allahabad High court

In this case, the petitioner had not filed the GSTR 3B for the last 6 months. The department had posted on the portal a show cause notice giving 7 days to the taxpayer to reply. The petitioner did not visit the portal within those 7 days and the registration was cancelled. The Additional Commissioner, Grade-02 (Appeal)-I, Commercial Tax, Bareilly, revoked such cancellation, but the department had still not restored the registration. The honorable court also upheld the revocation of cancellation of the registration. It was held that the communication of the notice was incomplete. Further, the court remarked that it is for the department and the respondents to make provisions for restoration of registration in the software and on the GST Portal. Merely because such provision has not been made, the petitioner cannot be made to suffer.

(2) M/S Ansari Construction vs Additional Commissioner Central on 24 November 2020 at Allahabad High court

In this case, the petitioner was served a show cause notice to cancel the registration certificate of the petitioner on the ground that it had failed to file the return for a continuous period of six months. In pursuance of the said notice, an ex-parte order was passed cancelling the registration of the petitioner on the 10th day of the notice. The petitioner filed an application for revocation of cancellation of registration on the ground that it had submitted all the pending returns under GST-3B and GSTR-1 and the entire tax liability was already cleared with the late fees. The honorable court reprimanded the department and imposed a cost of Rs. 10,000/- on the department to be paid to the petitioner within 30 days and it was to be drawn from the officer’s salary.

(3) Tvl Vectra computer solutions Vs Commissioner of Commercial Taxes( Madras high court)

In this case, the honorable high court held that it was compulsory for the department to provide a personal hearing to the taxpayer before cancellation of GST registration. Since it was not afforded therefore the said order was quashed.

(4) Case law of Ramakrishnan Mahalingam

In this case, the court held that the GST Authorities can’t deny Revocation of cancellation of GST Registration for alleged incorrect ITC availment.

(5) M/s. Avon Udhyog Versus State Of Rajasthan Through The Commissioner Of State Tax and others

In this case, the Court held that the proceedings of cancellation of registration cannot be kept as a hanging fire on any pretext, including that the assessee failed to file a reply within the time allowed. Authority issuing the notice is also statutorily bound to pass an order in terms of sub-rule (3) of Rule 22.

Related Topic:

Latest Update on Cancellation of Registration Under GST

As per the Notification No. 34/2021 – Central Tax, dated 29th August 2021,

It has been notified that where the registration of the persons has been cancelled under clause (b) or (c) of sub-section (2) of section 29 of the said Act;

(b) a person has opted for a composite scheme (u/s 10) has not furnished returns {CMP(08)} for three consecutive tax periods,

(c) any registered person, other than a person registered under the composite scheme has not furnished returns for a continuous period of six months,

Whose time limit for making an application for revocation of cancellation of registration falls during the period from 01.03.2020 to 31.08.2021, the time limit for making such application shall be extended up to the 30th day of September 2021.

Related Topic:

Conclusion

It is true that the GST department functions to keep the best interest of the revenue department at heart, but at the same time, it also has a responsibility to safeguard the going concern status of the taxpayer. It should strive to ensure that he is not subjected to any undue harassment. He should be afforded a proper opportunity to be heard before passing any adverse order. That is the reason why the provision of suspension and personal hearing is introduced before the cancellation of registration under GST.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.