Caution: Not every compliance is deferred in GST

Table of Contents

Caution: Read before you move, Not every compliance is deferred in GST

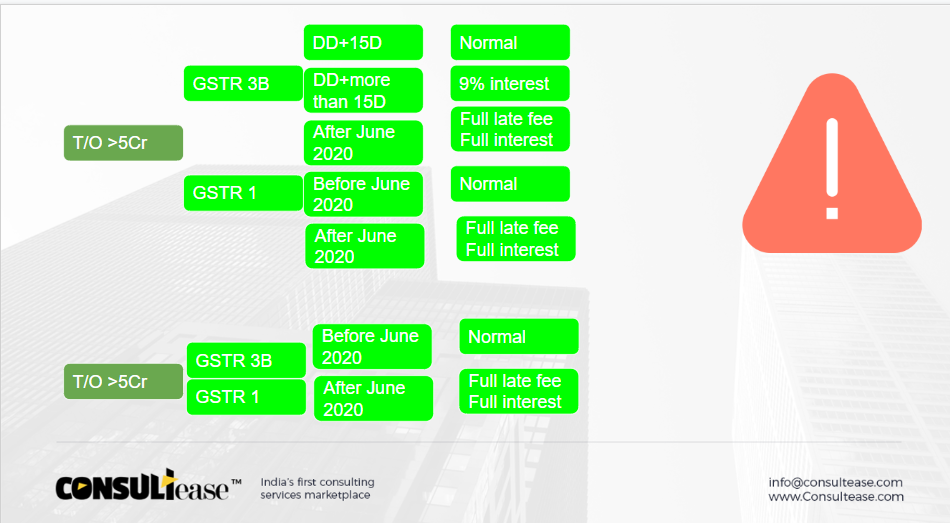

Not every compliance is deferred in GST. Yes, Pls take care before generalizing the extension. Check the necessary compliances and guide your clients to follow them. Many notifications with relaxation. We need to go into their language thoroughly. At this point in time we can divide all the compliances into three parts:

- First, where the date is not extended but late fees waived off

- The due date is extended

- Neither the due date is extended nor the late fee or penalty is waived off

Now the impact of each one of them will be different. let us go through in detail:

Due date is not extended but late fee is waived off:

The due dates of the returns of GST, GSTR 3b, and GSTR 1 is not extended. Many of us are using the due date word very loosely. Extension of the due date and conditional waiver of late fee. Both are different.

What will be the consequences?

In case you don’t file your return by the prescribed time. You will be liable for the full late fee. Yes, let me say it loud.

Related Topic:

Compliances and Returns Under Prevention of Sexual Harassment (POSH) Act

e.g. Mr. X is having a turnover of less than 5 Cr. He skipped the filing of GSTR 3b and GSTR 1 for the month of March to May. But he filed it on 24th June.

- No late fee no interest

Let us assume he skipped to file it till July 2020. He finally filed it on the 10th of July.

- Full late fee from March 2020 to July

GSTR 3b

| Month | From | To |

| Feb | 21st March | 9th July |

| March | 21st April | 9th July |

| April | 21st May | 9th July |

| May | 21st June | 9th July |

Plus in this case, interest liability will also be there. If the return is nil, the late fee will be 20 Rs. per day up to Rs. 10,000. In the case of turnover, the late fee will be Rs. 50 per day restricted to Rs. 10,000. It is only for one month. Now multiply it with the number of months. You can file a NIL return via SMS only. Thus it is not advisable to skip your return.

Related Topic:

Compliances and Returns Under Prevention of Sexual Harassment (POSH) Act

GSTR 1: (For monthly return filers)

| Month | From | To |

| Feb | 12th March | 9th July |

| March | 12th April | 9th July |

| April | 12th May | 9th July |

| May | 12th June | 9th July |

For quarterly return filers also there will be a late fee from the due date till the actual filing.

The due date is extended:

Notification no.35/2020 provides a blanket extension to all compliances. But some exceptions are marked in that notification.

First, explore the exception. The rest is extended. Let us start with what is not extended. So all the provisions except the following are extended till the 30th of June 2020.

Related Topic:

Compliances and Returns Under Prevention of Sexual Harassment (POSH) Act

“such extension of time shall not be applicable for the compliances of the provisions of the said Act, as mentioned below –

(a) Chapter IV;

(b) sub-section (3) of section 10, sections 25, 27, 31, 37, 47, 50, 69, 90, 122, 129;

(c) section 39, except sub-section (3), (4) and (5);

(d) section 68, in so far as e-way bill is concerned; and

(e) rules made under the provisions specified at clause (a) to (d) above”

(excerpt from the notification)

Related Topic:

Bill of Entry Late Filing Waiver Extended Till 3-6-2020- Tughlakabad ICD

Due dates in these cases are not extended: Not every compliance is deferred in GST.

- Chapter IV covers the provisions related to the time of supply in GST. Thus the time of every supply will hit as per the provisions of section 12 and section 13 of the CGST Act. In the case of goods, the date of the invoice is the time of supply. In case of services date of invoice or payment, whichever is earlier is a time of supply. Now all the transactions hitting time of supply are also liable for payment of tax.

- Section 10(3): Exit from composition Levy when turnover crosses the maximum limit.

- Section25: Liability to take registration within 30 days

- Section 27: Registration of CTP or NRTP

- Section31: Liability to raise an invoice

- Section 37:Liability to file GSTR 1

- Section39: Except for 3,4 & 5 covers the returns of TDS, ISD, and NRTP. It means that their returns due date is extended but not of GSTR 3B.

- Section 47: Late fee for non-filing of return

- Section50: Interest

- Section 69: Power to arrest

- Section 90: Liability of partners to pay firms tax

- Section122: Penalty

- Section 129: Detention, search, and release of conveyances in transit.

- Section68: E-way bill compliances

- Rules made under all of the above provisions

Takeaway:

All compliances under these provisions need compliance. None of these is extended. Apart from these provisions, all other provisions are extended. You can see section 16 is not on the list. the last date to take the ITC under section 16 shall also stand extended. Also, the reversal of ITC for non-payment in 180 days is also not covered by the exception.

Thus be careful before sitting relaxed. Not every compliance is deferred in GST. Check the necessary compliances and guide your clients to follow them. Penalty provisions are also not extended. On the other hand arrest, search, seizure etc are also covered by the exception of extension. Now at the end again, Not every compliance is deferred in GST.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.