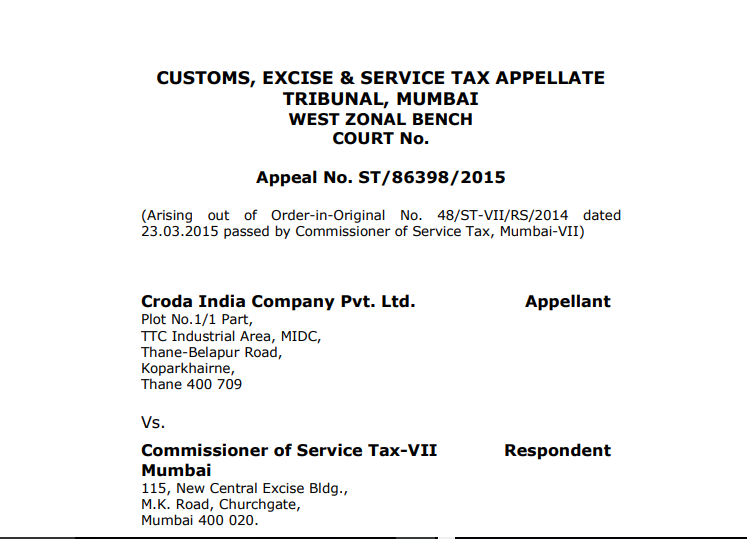

CESTAT in the case of Croda India Company Pvt. Ltd. Versus Commissioner of Service Tax

Table of Contents

Case Covered:

Croda India Company Pvt. Ltd.

Versus

Commissioner of Service Tax-VII

Facts of the case:

This appeal is directed against order in original No 46/ST-VII/RS/2014 dated 23.03.2015 of Commissioner Service Tax –VII Mumbai. By the said order Commissioner has held as follows:

“4.1 I confirm the demand of Service Tax of Rs 1,32,57,559/- (Rupees One Crore Thirty-Two Lakhs Fifty Seven Thousand Five Hundred and Fifty Nine only) and order its recovery from M/s Croda Chemicals (India) Private Limited under the provisions of Section 73(2) of the Finance Act, 1994 for the reasons discussed above.

4.2 I order recovery of interest at the appropriate rate from the due date till the date of payment, on the amount of demand confirmed at Para 4.1 above, from M/s Croda Chemicals (India) Private Limited under the provisions of Section 75 of the Finance Act, 1994.

4.3 I impose a penalty of Rs 1,32,57,559/- (Rupees One Crore Thirty-Two Lakhs Fifty Seven Thousand Five Hundred and Fifty Nine only) on M/s Croda Chemicals (India) Private Limited under the provisions of Section 78 of the Finance Act, 1994.

4.4 I impose a penalty of Rs 10,000/- (Rupees Ten Thousand only) under Section 77 of the Finance Act, 1994 on M/s Croda Chemicals (India) Private Limited.”

Appellant is registered with the department for providing various taxable services viz Technical Inspection and Certification Agency Services, Maintenance and Repair Services, Business Auxiliary Services, Transport of Goods by Road Transport Agency Service, Business Support Service, and Information Technology Software Services.

Observations:

Thus in view of discussions as above, we respond to questions framed by us in para 4.3 as follows:

I. The demand in relation to the commission received by appellants in respect of the sale of goods of associated group companies can be sustained up to 26.02.2010. For the period post 26.02.2010, the benefit of the export of service will be admissible to them. Matter remanded for requantification of demand up to 27.02.2010.

II. Demand in respect of reimbursements made by the overseas group associate companies in relation to expenses incurred by the appellant cannot be sustained. The demand is set aside subject to verification of the fact that appellants have not availed any CENVAT credit in respect of such reimbursable expenses.

III. Demand in respect of the reimbursements made to the overseas group associate companies in relation to expenses incurred by them is sustained. However, since the appellants have disputed the computation of demand the matter is remanded back to original authority for recomputation of demand.

IV. The extended period of limitation is invokable in the present case.

V. DEMAND for interest under Section 75 and penalties under section 77 and 78 of Finance Act, 1994, to uphold. However, the quantum of interest and penalties need to be redetermined in terms of recomputed demand.

Judgement:

Thus we dispose of the appeal by setting aside the impugned order and remand the matter back to adjudicating authority for re-computation of demand, interest, and penalties as indicated in para 4.9 above.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.