Rajasthan HC in the case of Chambal Fertilisers And Chemicals Limited Versus Union Of India

Table of Contents

Case Covered:

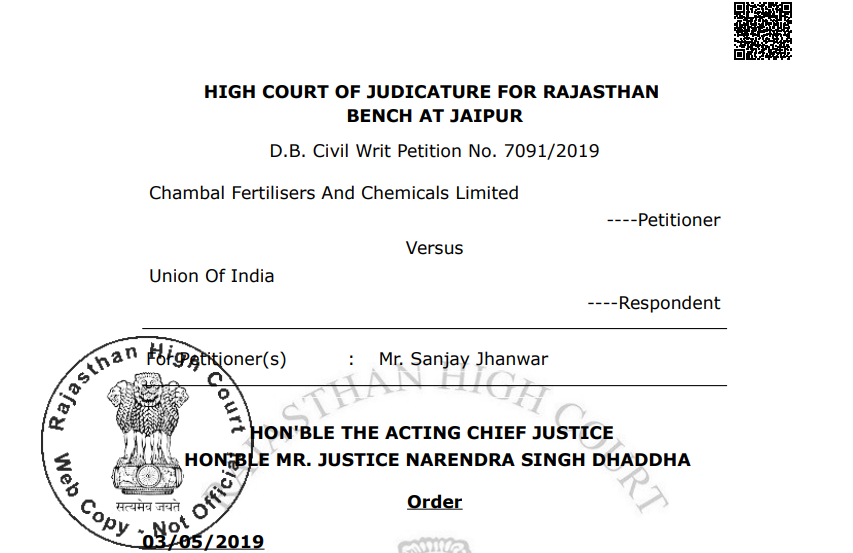

Chambal Fertilisers And Chemicals Limited

Versus

Union Of India

Facts of the case:

The petitioner has challenged the constitutional validity of Section 96(2) of the Rajasthan Goods and Service Tax Act, 2017 (for short, ‘the RGST Act’) and Section 96 of the Central Goods and Services Tax Act, 2017 (for short, ‘the CGST Act’) to the extent they prescribe for the constitution of the Authority for Advance Ruling (for short, ‘AAR’) consisting of members from amongst the officers of Central tax and the officers of State tax, and Rule 103 of the CGST Rules and Rule 103 of the RGST Rules, and prayed for declaring the same as arbitrary and unconstitutional. The petitioner has further prayed to declare the provisions of Section 99 of the CGST Act and Section 99 of the RGST Act to the extent they prescribe for the constitution of the Appellate Authority for Advance Ruling (for short, ‘the AAAR’), which consists of Chief Commissioner of Central Tax and Commissioner of State Tax, as its members, as arbitrary and unconstitutional.

Observations of the court:

It is argued that in case of import of goods on FOB basis, the petitioner avails the Transportation Services of the Transporter, i.e., foreign shipping company for bringing the goods into India and is liable to pay consideration for the Transportation Services, and, therefore can be considered as a recipient of services and liable to pay IGST on reverse charge basis. According to the proviso to Section 5(1) of the IGST Act the integrated tax on goods imported into India shall be levied and collected in accordance with the provisions of Section 3 of the Customs Tariff Act, 1975. Section 3 of the Custom Tariff Act, 1975 levies the additional duty of goods imported to the territory of India. Section 14(1) of the Customs Act lays down that the value of imported articles shall be the transaction value of such goods, which is the price actually paid or payable for the goods when sold for export to India for delivery at the time and place of importation where the buyer and seller of the goods are not related and the price is the sole consideration for the sale. According to the second proviso to Section 14(1) of the Customs Act, the ‘transaction value’ of the imported article among other charges, as specified, will also include the ‘cost of transportation to the place of importation’. Rule 10 of the Customs Valuation (Determination of Value of Imported Goods) Rules, 2007 lays down the provisions to determine the ‘transaction value’ of the imported goods, which will also include the transportation services. Thus, the levy of IGST twice on transportation services, i.e., under the impugned notification, amounts to double taxation.

The judgement of the court:

Learned counsel has cited the orders passed by Gujarat High Court in Special Civil Application No.726/2018 (Mohit Minerals Pvt Ltd. Vs. Union of India) dated 9.2.2018 and 12.12.2018.

Issue notice, returnable by 10th July 2019. A requisite number of copies of the petition be served in the offices of Mr. R.D. Rastogi, learned Additional Solicitor General and Mr. M.S. Singhvi, learned Advocate General, and receipts of the same are filed in the Registry. The service on the respondents may thereupon be treated complete. Names of Mr. C.S. Sinha on behalf of learned Additional Solicitor General and that of Mr. Ronak Singhvi on behalf of learned Advocate General be shown in the cause list.

In the meanwhile, no coercive steps are taken against the petitioner.

Read the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.