Changes in GST via FB 2023 – Clausewise PDF

Union budget was presented by the Finance minister. Although we dont expect a lot of changes in GST. But some important amendments are incorporated into GST by FM via FB 2023. Here we have compiled the clausewise discussion for all those provisions. you can also download the PDF.

Registered Person supplying Goods through ECO can opt for Composition Levy: –

Source

Clause 128 of the Finance Bill, 2023.

Effective Date

Prospectively from the date of the enactmentAmendment:

(2) The registered person shall be eligible to opt sub-section (1), if: –

(d) he is not engaged in making any supply of goods or services through an electronic commerce operator who is required to collect tax at source under section 52;

(2A) Notwithstanding anything to the contrary contained in this Act, but subject to the

provisions of sub-sections (3) and (4) ofsection 9, a registered person, not eligible to opt to pay tax under sub-section (1) and sub-section (2), whose aggregate turnover in the preceding financial year did not exceed fifty lakh rupees, may opt

to pay, in lieu of the tax payable by him under sub-section (1) of section 9, an amount of tax calculated at such rate as may be prescribed, but not exceeding three per cent of the turnover in State or turnover in Union territory, if he is not-

(c) engaged in making any supply of goods or services through an electronic commerce operator who is required to collect tax at source under section 52;

Non-payment within 180 days to lead to ITC reversal and not payment of output taxNon-payment within 180 days to lead to ITC reversal and not payment of output taxNon-payment within 180 days to lead to ITC reversal and not payment of output tax

Non-payment within 180 days to lead to ITC reversal and not payment of output tax-

Source Clause 129 of the Finance Bill, 2023.

Effective Date Prospectively from the date of the enactment Affected Provision Sub section 2 of Section 16 of the CGST Act, 2017

Provision before Amendment Provided further that where a recipient fails to pay to the supplier of goods or services or both, other than the supplies on which tax is payable on reverse charge basis, the amount towards the value of supply along with tax payable thereon within a period of one hundred and eighty days from the date of issue of invoice by the supplier, an amount equal to the input tax credit availed by the recipient shall be added to his output tax liability, along with interest thereon, in such manner as may be prescribed :

Provided also that the recipient shall be entitled to avail of the credit of input tax on payment made by him of the amount towards the value of supply of goods or services or both along with tax payable thereon.

Provision after Amendment Provided further that where a recipient fails to pay to the supplier of goods or services or both, other than the supplies on which tax is payable on reverse charge basis, the amount towards the value of supply along with tax payable thereon within a period of one hundred and eighty days from the date of issue of invoice by the supplier, an amount equal to the input tax credit availed by the recipient shall be paid by him along with interest payable under section 50, in such manner as may be prescribed :

Provided also that the recipient shall be entitled to avail of the credit of input tax on payment made by him to the supplier of the amount towards the value of supply of goods or services or both along with tax payable thereon.

ITC restricted for supply of warehoused goods before home consumption

Source Clause 130(a) of the Finance Bill, 2023.

Effective Date Prospectively from the date of the enactment Affected

Provision Explanation to the Sub-section (3) of the Section 17 of the CGST Act, 2017

Provision before Amendment

(3) The value of exempt supply under sub-section (2) shall be such as may be prescribed, and shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building.

Explanation – For the purposes of this sub-section, the expression “value of exempt supply” shall not include the value of activities or transactions specified in Schedule III, except those specified in paragraph 5 of the said Schedule.

Provision after Amendment

(3) The value of exempt supply under sub-section (2) shall be such as may be prescribed and shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building.

Explanation – For the purposes of this sub-section, the expression “value of exempt supply” shall not include the value of activities or transactions specified in Schedule III, except,

(i) the value of activities or transactions specified in paragraph 5 of the said Schedule; and

(ii) the value of such activities or transactions as may be prescribed in respect of clause (a) of paragraph 8 of the said Schedule.

SKA_Clausewise GST analysis_Finance Bill 2023

SKA_Clausewise GST analysis_Finance Bill 2023

ITC not available on goods and services received for CSR activities: –

Source

Clause 130(b) of the Finance Bill, 2023.

Effective Date

Prospectively from the date of the enactment

Affected Provision

Section 17(5) of the CGST Act, 2017

New Clause Clause (fa) has been inserted

Amendment (5)

Notwithstanding anything contained in sub-section (1) of section 16 and sub-section (1) of section 18, input tax credit shall not be available in respect of the following, namely:

(fa) goods or services or both received by a taxable person, which are used or intended to be used for activities relating to his obligations under corporate social responsibility referred to in section 135 of the Companies Act, 2013.

No compulsory registration required if registration exempted under section 23

Source

Clause 131 of the Finance Bill, 2023.

Effective Date

Retrospectively from 1st July, 2017

Affected Provision

Section 23 of the CGST Act, 2017

Provision before Amendment

(1) The following persons shall not be liable to registration, namely: – (a) any person engaged exclusively in the business of supplying goods or services or both that are not liable to tax or wholly exempt from tax under this Act or under the Integrated Goods and Services Tax Act (b) an agriculturist, to the extent of supply of produce out of cultivation of land.

(2) The Government may, on the recommendations of the Council, by notification, specify the category of persons who may be exempted from obtaining registration under this Act.

Provision after Amendment

Notwithstanding anything to the contrary contained in sub-section (1) of section 22 or section 24– (a)the following persons shall not be liable to registration, namely: –

(i) any person engaged exclusively in the business of supplying goods or services or both that are not liable to tax or wholly exempt from tax under this Act or under the Integrated Goods and Services Tax Act,2017

(ii) an agriculturist, to the extent of supply of produce out of cultivation of land.

(b)the Government may, on the recommendations of the Council, by notification, subject to such conditions and restrictions as may be specified therein, specify the category of persons who may be exempted from obtaining registration under this Act.

Maximum time limit up to which GSTR-1 / 3B / 9 / 9C and 8 can be furnished

Source

Clause 132, 133, 134 and 135 of the Finance Bill, 2023.

Effective Date

Prospectively from the date of the enactment

Affected Provision

Section 37, 39, 44, 52 of the CGST Act, 2017

New Sub-section section 37(5), 39(11), 44(2) and 52(15) has been inserted.

Amendment

Insertion in Section 37 37(5) A registered person shall not be allowed to furnish the details of outward supplies under sub-section (1) for a tax period after the expiry of a period of three years from the due date of furnishing the said details:

Provided that the Government may, on the recommendations of the Council, by notification, subject to such conditions and restrictions as may be specified therein, allow a registered person or a class of registered persons to furnish the details of outward supplies for a tax period under sub-section (1), even after the expiry of the said period of three years from the due date of furnishing the said details;”

Insertion in Section 39

(11) A registered person shall not be allowed to furnish a return for a tax period after the expiry of a period of three years from the due date of furnishing the said return:

Provided that the Government may, on the recommendations of the Council, by notification, subject to such conditions and restrictions as may be specified therein, allow a registered person or a class of registered persons to furnish the return for a tax period, even after the expiry of the said period of three years from the due date of furnishing the said return.”.

Insertion in Section 44

(2) A registered person shall not be allowed to furnish an annual return under subsection (1) for a financial year after the expiry of a period of three years from the due date of furnishing the said annual return

Provided that the Government may, on the recommendations of the Council, by notification, and subject to such conditions and restrictions as may be specified therein, allow a registered person or a class of registered persons to furnish an annual return for a financial year under sub-section (1), even after the expiry of the said period of three years from the due date of furnishing the said annual return.”.

Insertion in Section 52

(15) The operator shall not be allowed to furnish a statement under sub-section (4) after the expiry of a period of three years from the due date of furnishing the said statement:

Provided that the Government may, on the recommendations of the Council, by notification, subject to such conditions and restrictions as may be specified therein, allow an operator or a class of operators to furnish a statement under sub-section (4), even after the expiry of the said period of three years from the due date of furnishing the said statement.

Removal of provisional ITC concept from refund provisions

Source

Clause 136 of the Finance Bill, 2023.

Effective Date

Prospectively from the date of the enactment

Affected Provision

Sub-section (6) of section 54 of the CGST Act, 2017

Amendment

(6) Notwithstanding anything contained in sub-section (5), the proper officer may, in the case of any claim for refund on account of zero-rated supply of goods or services or both made by registered persons, other than such category of registered persons as may be notified by the Government on the recommendations of the Council, refund on a provisional basis, ninety per cent of the total amount so claimed, excluding the amount of input tax credit provisionally accepted, in such manner and subject to such conditions, limitations and safeguards as may be prescribed and thereafter make an order under sub-section (5) for final settlement of the refund claim after due verification of documents furnished by the applicant.

Manner to be prescribed for interest on delayed refunds

Source

Clause 137 of the Finance Bill, 2023.

Effective Date

Prospectively from the date of the enactment.

Affected Provision

Section 56 of the CGST Act, 2017

Provision before amendment

If any tax ordered to be refunded under sub-section (5) of section 54 to any applicant is not refunded within sixty days from the date of receipt of application under subsection (1) of that section, interest at such rate not exceeding six per cent as may be specified in the notification issued by the Government on the recommendations of the Council shall be payable in respect of such refund from the date immediately after the expiry of sixty days from the date of receipt of application under the said subsection till the date of refund of such tax.

Provision after Amendment

If any tax ordered to be refunded under sub-section (5) of section 54 to any applicant is not refunded within sixty days from the date of receipt of application under subsection (1) of that section, interest at such rate not exceeding six per cent as may be specified in the notification issued by the Government on the recommendations of the Council shall be payable in respect of such refund for the period of delay beyond sixty days from the date of receipt of such application till the date of refund of such tax, to be computed in such manner and subject to such conditions and restrictions as may be prescribed.

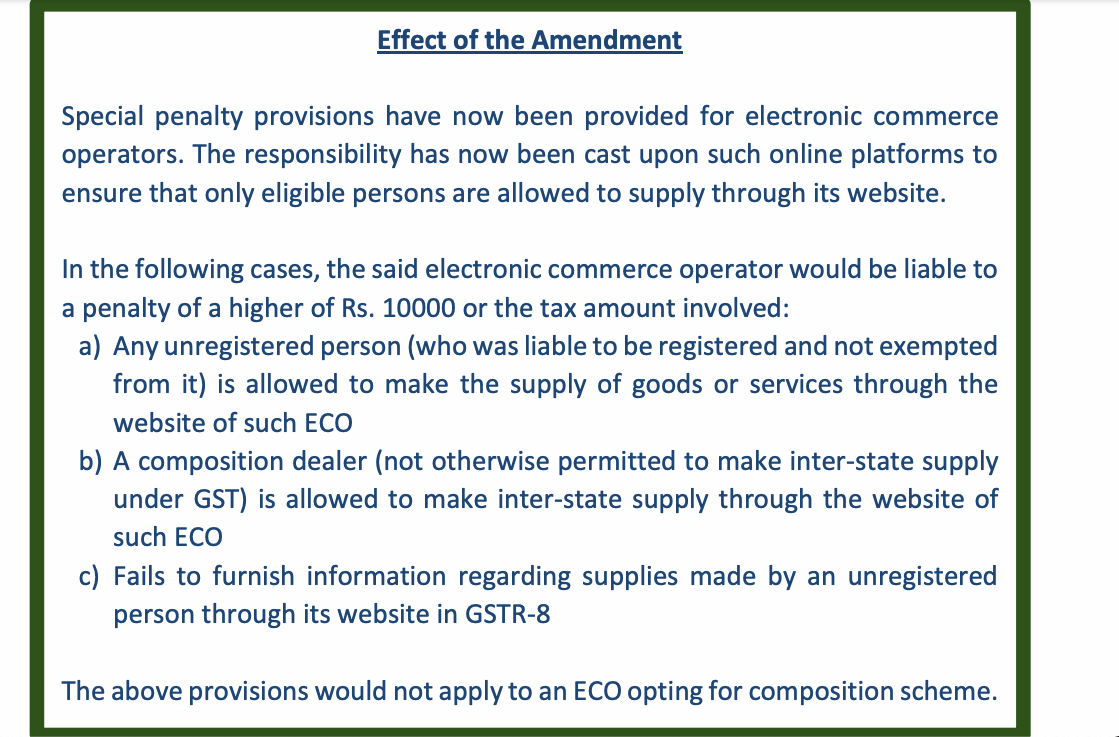

Penalty for ECO, if unregistered / composition persons wrongly supply through them

Source

Clause 138 of The Finance Bill, 2023

Effective Date

Prospectively from the date of the enactment.

Affected Provision

Section 122 of the CGST Act, 2017

New Clause

Sub-section (1B) has been inserted

Amendment

(1B) Any electronic commerce operator who––

1. allows a supply of goods or services or both through it by an unregistered person other than a person exempted from registration by a notification issued under this Act to make such supply;

2. allows an inter-State supply of goods or services or both through it by a person who is not eligible to make such inter-State supply; or

3. fails to furnish the correct details in the statement to be furnished under subsection (4) of section 52 of any outward supply of goods effected through it by a person exempted from obtaining registration under this Act,

shall be liable to pay a penalty of ten thousand rupees, or an amount equivalent to the amount of tax involved had such supply been made by a registered person other than a person paying tax under section 10, whichever is higher.

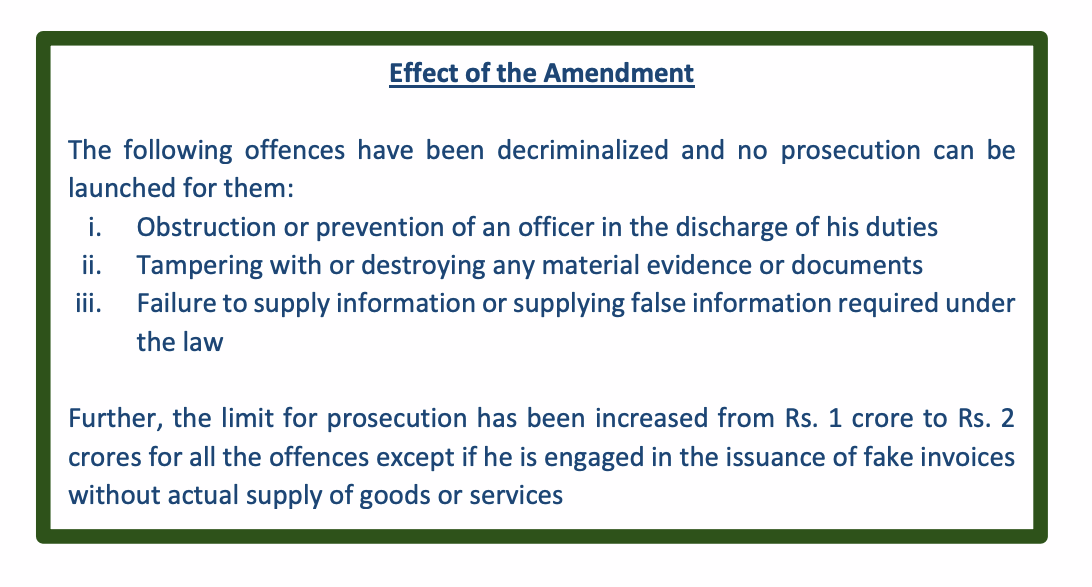

Decriminalization of some offences and increase of monetary limit for prosecution

Source

Clause 139 of The Finance Bill, 2023

Effective Date

Prospectively from the date of the enactment.

Affected Provision

Section 132 of the CGST Act, 2017

Provisions before Amendment:

(1) Whoever commits, or causes to commit and retain the benefits arising out of, any of the following offences, namely: –

(g) obstructs or prevents any officer in the discharge of his duties under this Act

(j) tampers with or destroys any material evidence or documents;

(k) fails to supply any information which he is required to supply under this Act or the rules made thereunder or (unless with a reasonable belief, the burden of proving which shall be upon him, that the information supplied by him is true) supplies false information; or

(l) attempts to commit, or abets the commission of any of the offences mentioned in clauses (a) to (k) of this section, shall be punishable- (i) in cases where the amount of tax evaded or the amount of input tax credit wrongly availed or utilised or the amount of refund wrongly taken exceeds five hundred lakh rupees, with imprisonment for a term which may extend to five years and with fine;

(ii) in cases where the amount of tax evaded or the amount of input tax credit wrongly availed or utilised or the amount of refund wrongly taken exceeds two hundred lakh rupees but does not exceed five hundred lakh rupees, with imprisonment for a term which may extend to three years and with fine;

(iii) in the case of any other offence where the amount of tax evaded or the amount of input tax credit wrongly availed or utilised or the amount of refund wrongly taken exceeds one hundred lakh rupees but does not exceed two hundred lakh rupees, with imprisonment for a term which may extend to one year and with fine;

(iv) in cases where he commits or abets the commission of an offence specified in clause (f) or clause (g) or clause (j), he shall be punishable with imprisonment for a term which may extend to six months or with fine or with both.

Provision After Amendment:

(1) Whoever commits, or causes to commit and retain the benefits arising out of, any of the following offences, namely: –

(l) attempts to commit, or abets the commission of any of the offences mentioned in clauses (a) to (f) and clauses (h) and (i) of this section, shall be punishable-

(i) in cases where the amount of tax evaded or the amount of input tax credit wrongly availed or utilised or the amount of refund wrongly taken exceeds five hundred lakh rupees, with imprisonment for a term which may extend to five years and with fine;

(ii) in cases where the amount of tax evaded or the amount of input tax credit wrongly availed or utilised or the amount of refund wrongly taken exceeds two hundred lakh rupees but does not exceed five hundred lakh rupees, with imprisonment for a term which may extend to three years and with fine;

(iii) in the case of an offence specified in clause (b), where the amount of tax evaded or the amount of input tax credit wrongly availed or utilised or the amount of refund wrongly taken exceeds one hundred lakh rupees but does not exceed two hundred lakh rupees, with imprisonment for a term which may extend to one year and with fine;

(iv) in cases where he commits or abets the commission of an offence specified in clause (f), he shall be punishable with imprisonment for a term which may extend to six months or with fine or with both.

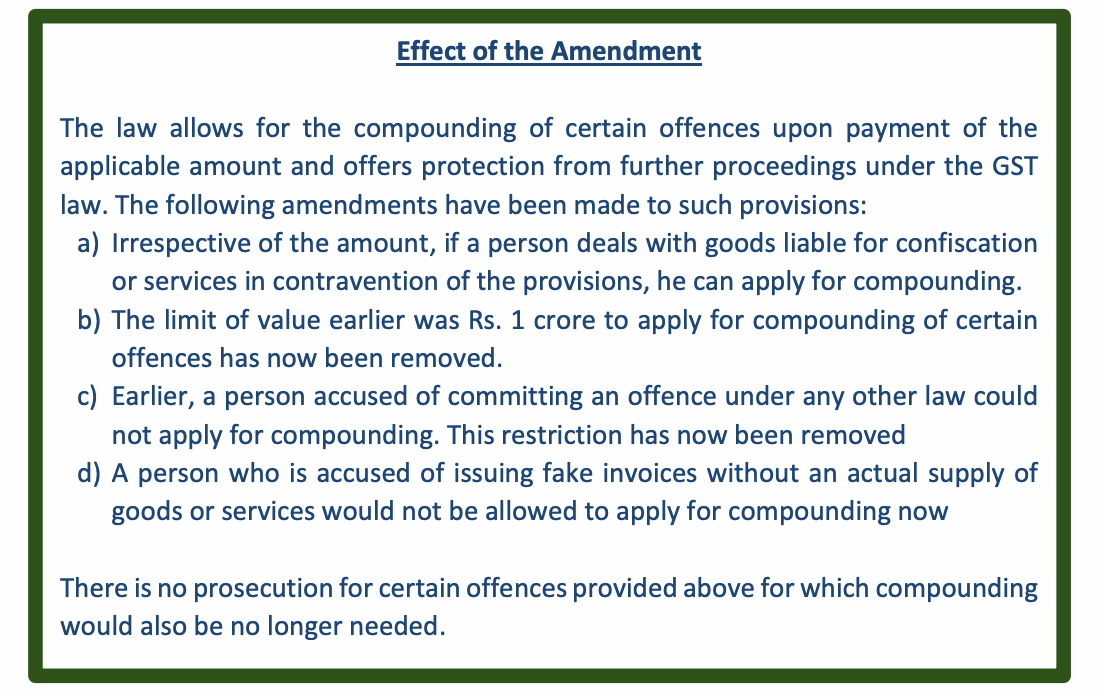

Changes in cases allowed for compounding of offences

Source

Clause 140(a)(i), (ii), (iii) and (iv) of the Finance Bill, 2023.

Effective Date-Prospectively from the date of the enactment.

Affected Provision

Section 138 (1) of the CGST Act, 2017

Provision before amendment

(1) Any offence under this Act may, either before or after the institution of prosecution, be compounded by the Commissioner on payment, by the person accused of the offence, to the Central Government or the State Government, as the case be, of such compounding amount in such manner as may be prescribed:

Provided that nothing contained in this section shall apply to-

(a) a person who has been allowed to compound once in respect of any of the offences specified in clauses (a) to (f) of sub-section (1) of section 132 and the offences specified in clause (l) which are relatable to offences specified in clauses (a) to (f) of the said sub-section;

(b) a person who has been allowed to compound once in respect of any offence, other than those in clause (a), under this Act or under the provisions of any State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act or the Integrated Goods and Services Tax Act in respect of supplies of value exceeding one crore rupees;

(c) a person who has been accused of committing an offence under this Act which is also an offence under any other law for the time being in force;

(d) a person who has been convicted for an offence under this Act by a court;

(e) a person who has been accused of committing an offence specified in clause (g) or clause (j) or clause (k) of subsection (1) of section 132; and

(f) any other class of persons or offences as may be prescribed:

Provision after amendment

(1) Any offence under this Act may, either before or after the institution of prosecution, be compounded by the Commissioner on payment, by the person accused of the offence, to the Central Government or the State Government, as the case be, of such compounding amount in such manner as may be prescribed:

Provided that nothing contained in this section shall apply to-

(a) a person who has been allowed to compound once in respect of any of the offences specified in clauses (a) to (f), (h), (i) and (l) of sub-section (1) of section 132;”

(b) Omitted

(c) a person who has been accused of committing an offence under clause (b) of sub-section (1) of section 132;

(d) a person who has been convicted for an offence under this Act by a court;

(e) Omitted

(f) any other class of persons or offences as may be prescribed:

Shubham Khaitan

Shubham Khaitan

Kolkata, India