Changes via CGST (fifth amendment) Rules

Table of Contents

- Introduction:Changes via CGST (fifth amendment) Rules

- Rule 12 of CGST rules:

- Changes in Rule 46:

- Changes in Rule 54:

- Insertion of rule 83B for GST practitioner:

- Rule 137:

- Rule 138E:

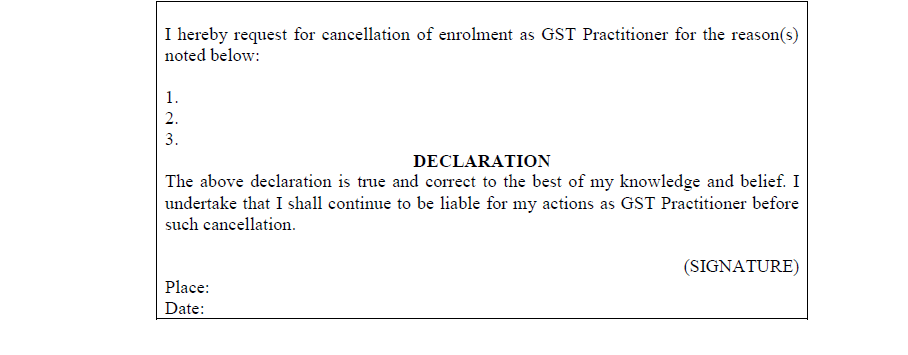

- FORM GST PCT –06: Application of Cancellation of Enrolment as GST Practitioner

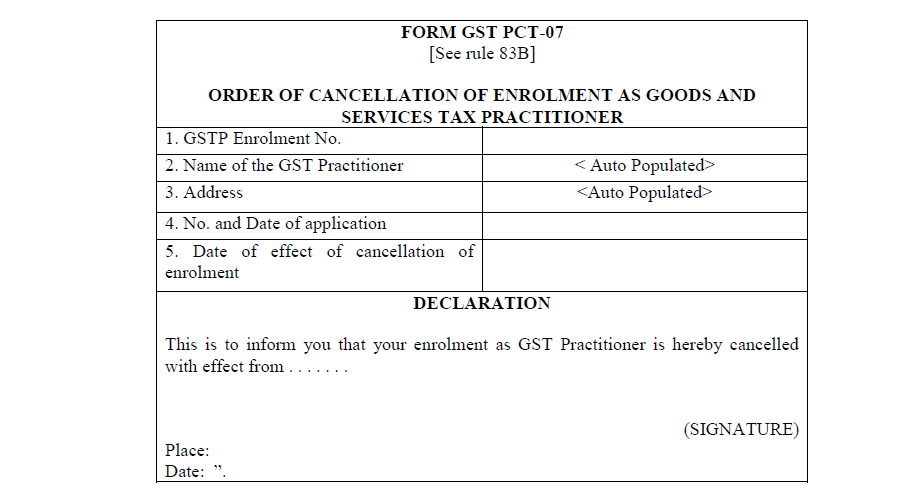

- Form GST PCT-07: Order of Cancellation of Enrolment as GST Practitioner

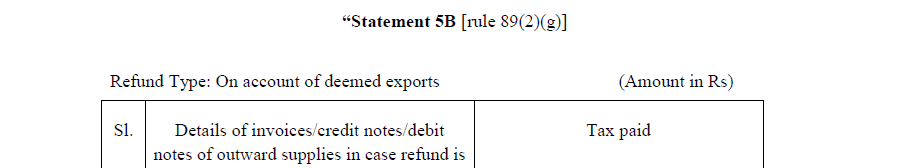

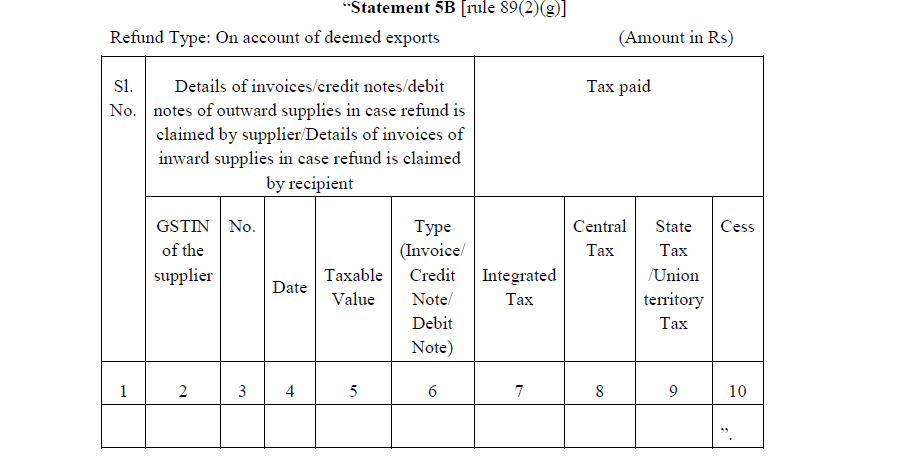

- Statement 5B: Statement for Deemed Export in FORM GST RFD-01

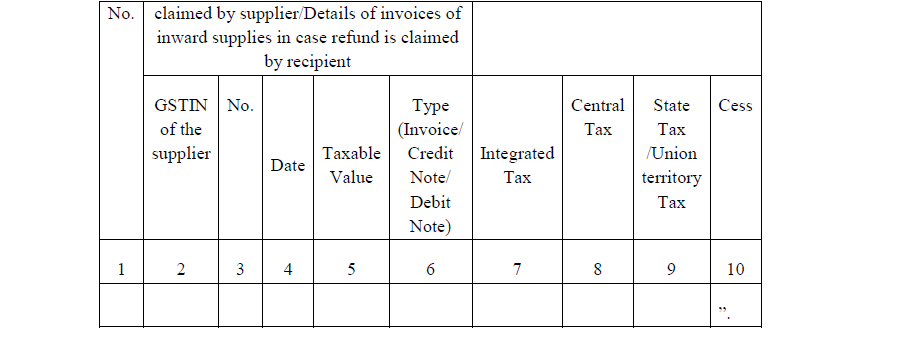

- Statement 5B: Statement for Deemed Export in FORM GST RFD-01A

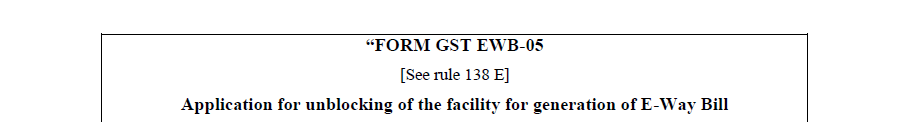

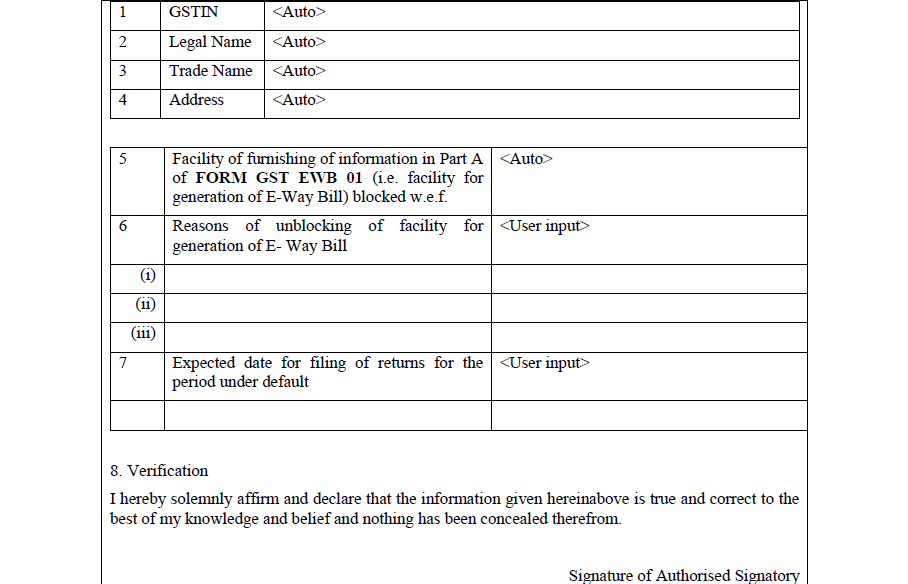

- FORM GST EWB-05: Application for unblocking of the facility for generation pf E-Way Bill

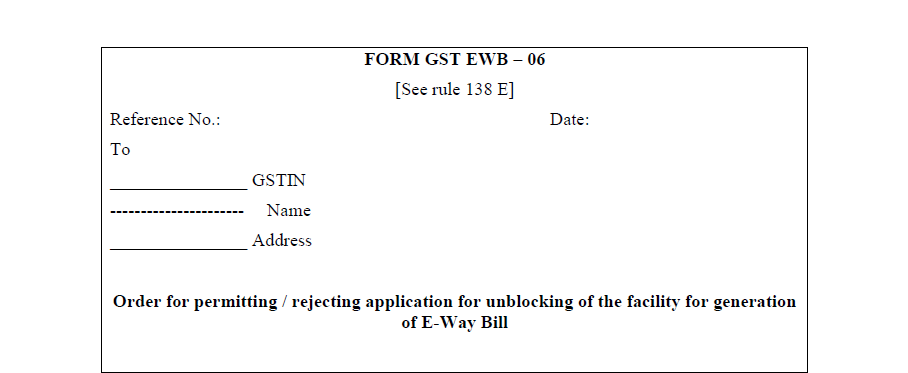

- FORM GST EWB-06: Order for unblocking of the facility for generation pf E-Way Bill

Introduction:Changes via CGST (fifth amendment) Rules

Notification no. 33/2019 – Central Tax has changed the CGST rules. Following changes are incorporated in CGST rules.Changes via CGST (fifth amendment) Rules are summarised below.

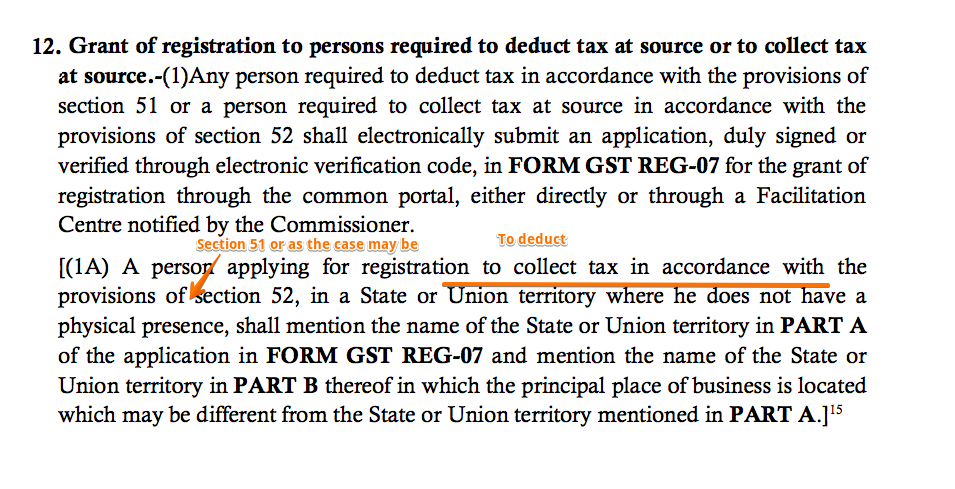

Rule 12 of CGST rules:

In clause 1A words “to deduct ” shall be inserted. It will look like following now.

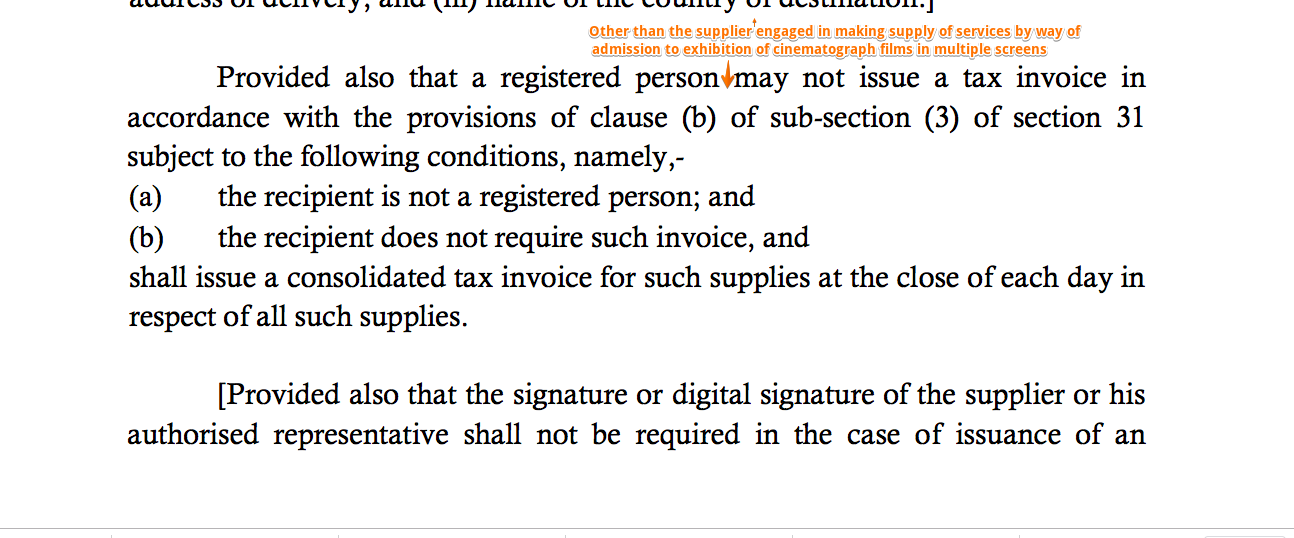

Changes in Rule 46:

Cinematograph film exhibition supplier is not allowed to issue a consolidated invoice.

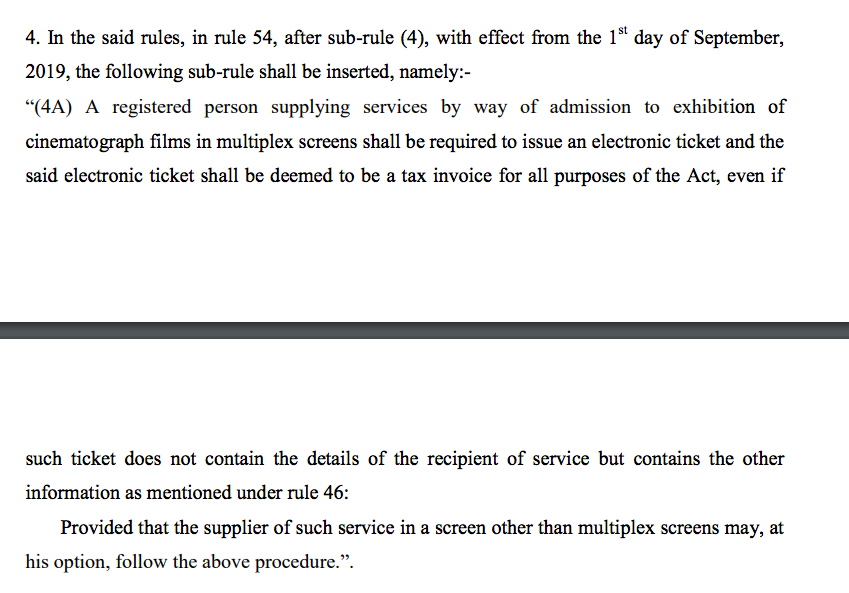

Changes in Rule 54:

The electronic ticket issued by the film halls will be deemed to be an invoice. This change is in accordance to the change in Rule 46. As now they are not allowed to issue a consolidated invoice but ticket itself will be taken as a GST invoice.

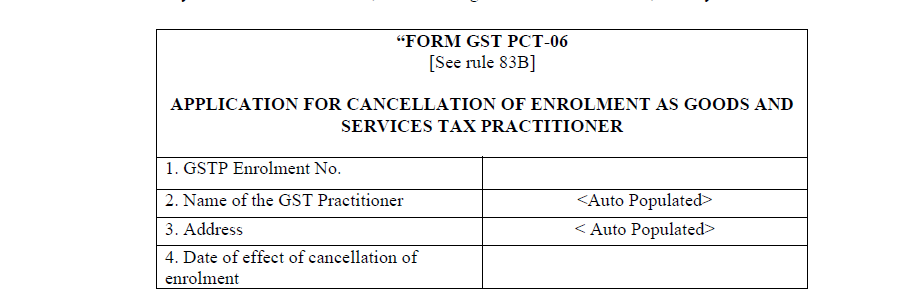

Insertion of rule 83B for GST practitioner:

83B. Surrender of enrolment of goods and services tax practitioner.-

(1) A goods and services tax practitioner seeking to surrender his enrolment shall electronically submit an application in FORM GST PCT-06, at the common portal, either directly or through a facilitation centre notified by the Commissioner.

(2) The Commissioner, or an officer authorised by him, may after causing such enquiry as deemed fit and by order in FORM GST PCT-07, cancel the enrolment of such practitioner.”.

Rule 137:

The time period in rule 137 is amended to four years from two years.

Rule 138E:

(a) after the words “Provided that the Commissioner may,” , the words, letters and figures “on receipt of an application from a registered person in FORM GST EWB-05,” shall be inserted;

(b) after the words “reasons to be recorded in writing, by order”, the words, letters and figures “in FORM GST EWB-06” shall be inserted.

FORM GST PCT –06: Application of Cancellation of Enrolment as GST Practitioner

Form GST PCT-07: Order of Cancellation of Enrolment as GST Practitioner

Statement 5B: Statement for Deemed Export in FORM GST RFD-01

Statement 5B: Statement for Deemed Export in FORM GST RFD-01A

FORM GST EWB-05: Application for unblocking of the facility for generation pf E-Way Bill

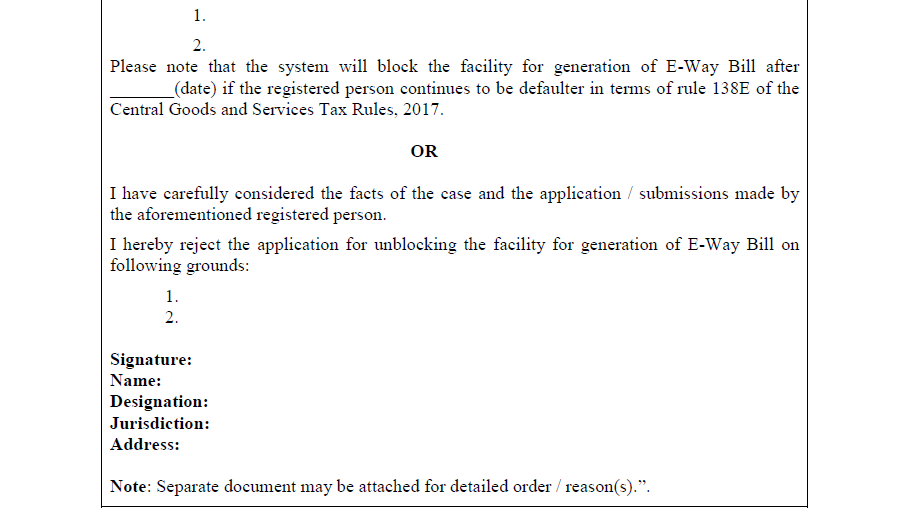

FORM GST EWB-06: Order for unblocking of the facility for generation pf E-Way Bill

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.